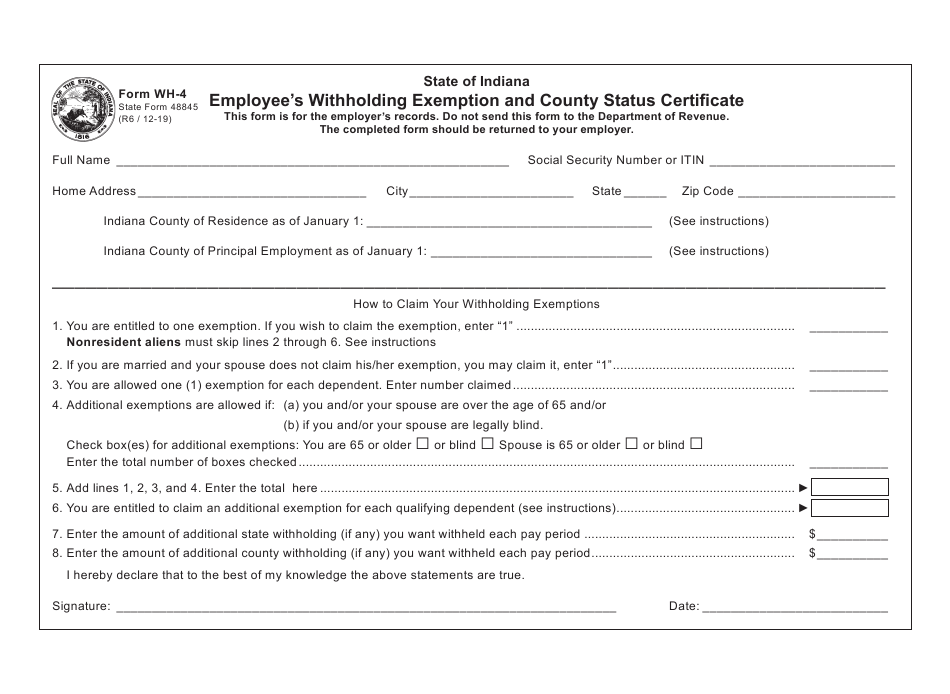

Indiana Wh-4 Withholding Form – There are many reasons why someone may choose to fill out forms withholding. This includes documentation requirements and withholding exemptions. You must be aware of these aspects regardless of your reason for choosing to submit a request form.

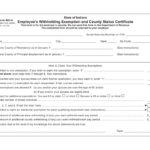

Exemptions from withholding

Non-resident aliens are required to submit Form 1040 NR at least once per year. However, if you meet the criteria, you may be eligible for an exemption from withholding form. This page will provide all exemptions.

The first step in submit Form 1040 – NR is to attach Form 1042 S. The form provides information about the withholding that is performed by the agency responsible for withholding to report federal income tax to be used for reporting purposes. Make sure you enter the right information when you fill out the form. There is a possibility for a person to be treated if the correct information is not provided.

The tax withholding rate for non-resident aliens is 30. You may be eligible to receive an exemption from withholding if the tax burden is greater than 30%. There are a variety of exclusions. Some are specifically designed for spouses, whereas others are intended to be used by dependents, such as children.

In general, chapter 4 withholding entitles you to the possibility of a refund. As per Sections 1471 to 1474, refunds are given. Refunds are to be given by the agents who withhold taxes that is, the person who collects taxes at source.

Status of relationships

A valid marital status and withholding form will simplify your work and that of your spouse. You’ll be surprised by the amount of money you can put in the bank. Knowing which of the several options you’re likely to choose is the challenge. Certain issues should be avoided. Unwise decisions could lead to costly negative consequences. You won’t have any issues If you simply follow the directions and be attentive. You might make some new friends if you are lucky. Today marks the anniversary. I’m hoping they reverse the tide in order to assist you in getting the perfect engagement ring. To do this correctly, you’ll need the assistance of a qualified Tax Expert. This tiny amount is enough to last the life of your wealth. You can get a ton of information online. TaxSlayer is a well-known tax preparation firm is one of the most useful.

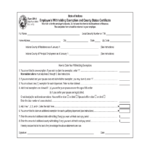

The number of withholding allowances requested

The Form W-4 must be filled out with the number of withholding allowances that you want to take advantage of. This is essential since the amount of tax taken from your paychecks will be affected by the much you withhold.

A number of factors can determine the amount that you can claim for allowances. The amount you’re eligible to claim will depend on your income. If you earn a high amount it could be possible to receive higher amounts.

Making the right choice of tax deductions could allow you to avoid a significant tax payment. You could actually receive the amount you owe if you submit your annual tax return. But, you should be careful about how you approach the tax return.

It is essential to do your homework the same way you would with any other financial choice. Calculators can help determine the number of withholdings that need to be requested. A specialist could be a good alternative.

Formulating specifications

If you’re an employer, you are required to pay and report withholding tax on your employees. The IRS will accept documents for some of these taxes. Other documents you might be required to file include a withholding tax reconciliation, quarterly tax returns, as well as the annual tax return. Here’s a brief overview of the different tax forms, and when they need to be filed.

The bonuses, salary commissions, bonuses, and other income you get from your employees may require you to file withholding tax returns. If employees are paid punctually, you might be eligible to get the tax deductions you withheld. It is important to note that some of these taxes could be considered to be county taxes, is also important. There are specific methods of withholding that are suitable in certain situations.

The IRS regulations require that you electronically submit withholding documents. When you file your tax returns for national revenue make sure you include your Federal Employee Identification Number. If you don’t, you risk facing consequences.