Indiana State Wage Withholding Form – There are many explanations why somebody could decide to fill out a form for withholding. These include documentation requirements, withholding exclusions as well as the withholding allowances. Whatever the reason behind an individual to file an application it is important to remember certain points you must keep in mind.

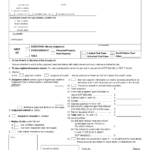

Withholding exemptions

Non-resident aliens must submit Form 1040-NR at a minimum every year. You could be eligible to file an exemption form for withholding tax when you meet the criteria. This page you will discover the exemptions that you can avail.

To complete Form 1040-NR, attach Form 1042-S. This document is required to declare the federal income tax. It details the withholding by the withholding agent. Fill out the form correctly. This information may not be disclosed and result in one person being treated differently.

Non-resident aliens have to pay the 30% tax withholding rate. The tax burden of your business must not exceed 30% in order to be eligible for exemption from withholding. There are many different exemptions. Some are only for spouses, dependents, or children.

You are entitled to refunds if you have violated the rules of chapter 4. Refunds can be claimed in accordance with Sections 1401, 1474 and 1475. The withholding agent or the individual who withholds the tax at source is the one responsible for distributing these refunds.

Status of the relationship

The work of your spouse and you is made simpler by the proper marriage status withholding form. The bank might be shocked by the amount that you have to deposit. Choosing which of the options you’re likely to choose is the challenge. Certain aspects should be avoided. It will be costly to make a wrong choice. If you stick to the directions and adhere to them, there won’t be any problems. If you’re fortunate you could even meet some new friends when you travel. In the end, today is the date of your wedding anniversary. I’m hoping you’ll utilize it to secure that elusive diamond. If you want to do this correctly, you’ll need the guidance of a certified Tax Expert. The little amount is worthwhile for the life-long wealth. There are a myriad of websites that offer details. Tax preparation firms that are reputable, such as TaxSlayer are among the most efficient.

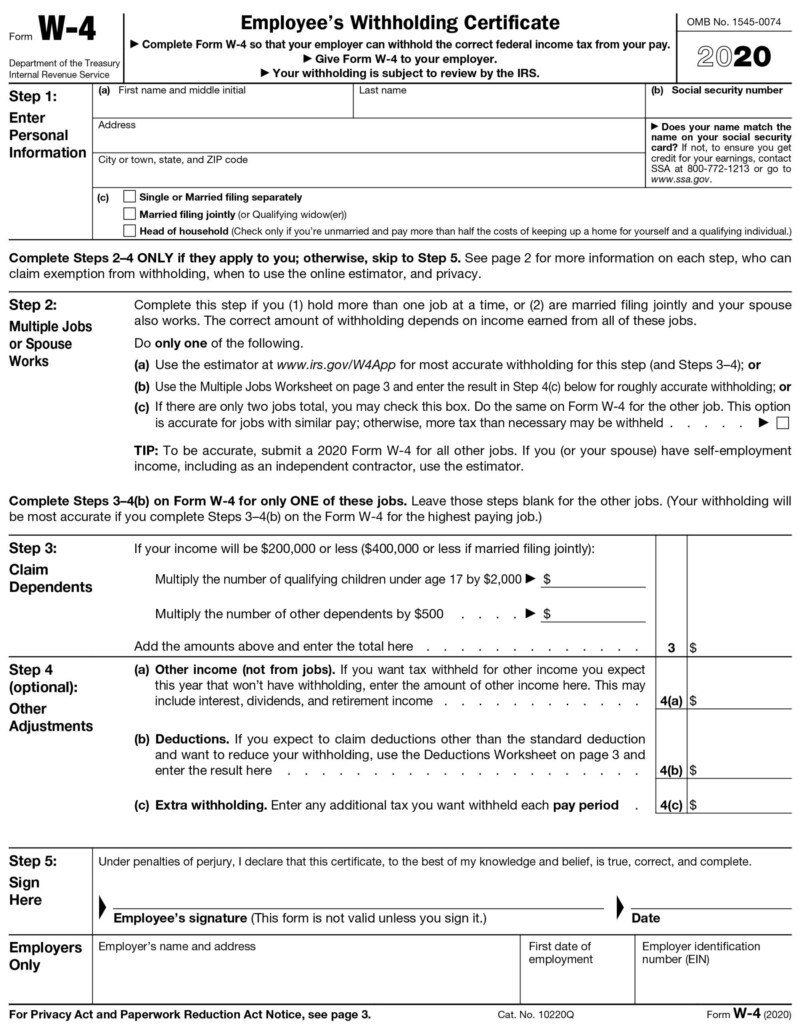

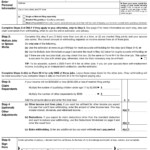

Number of withholding allowances claimed

On the Form W-4 that you fill out, you need to specify the amount of withholding allowances you requesting. This is vital because it affects the amount of tax you get from your wages.

You may be able to request an exemption for the head of your household when you’re married. Your income level also affects how much allowances you’re entitled to. An additional allowance could be granted if you make an excessive amount.

Tax deductions that are appropriate for you could help you avoid large tax payments. If you submit your annual tax returns You could be entitled to a refund. But you need to pick your strategy carefully.

Just like with any financial decision it is essential to conduct your research. Calculators can be utilized to determine how many withholding allowances are required to be claimed. Alternative options include speaking with an expert.

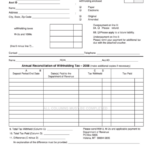

Specifications that must be filed

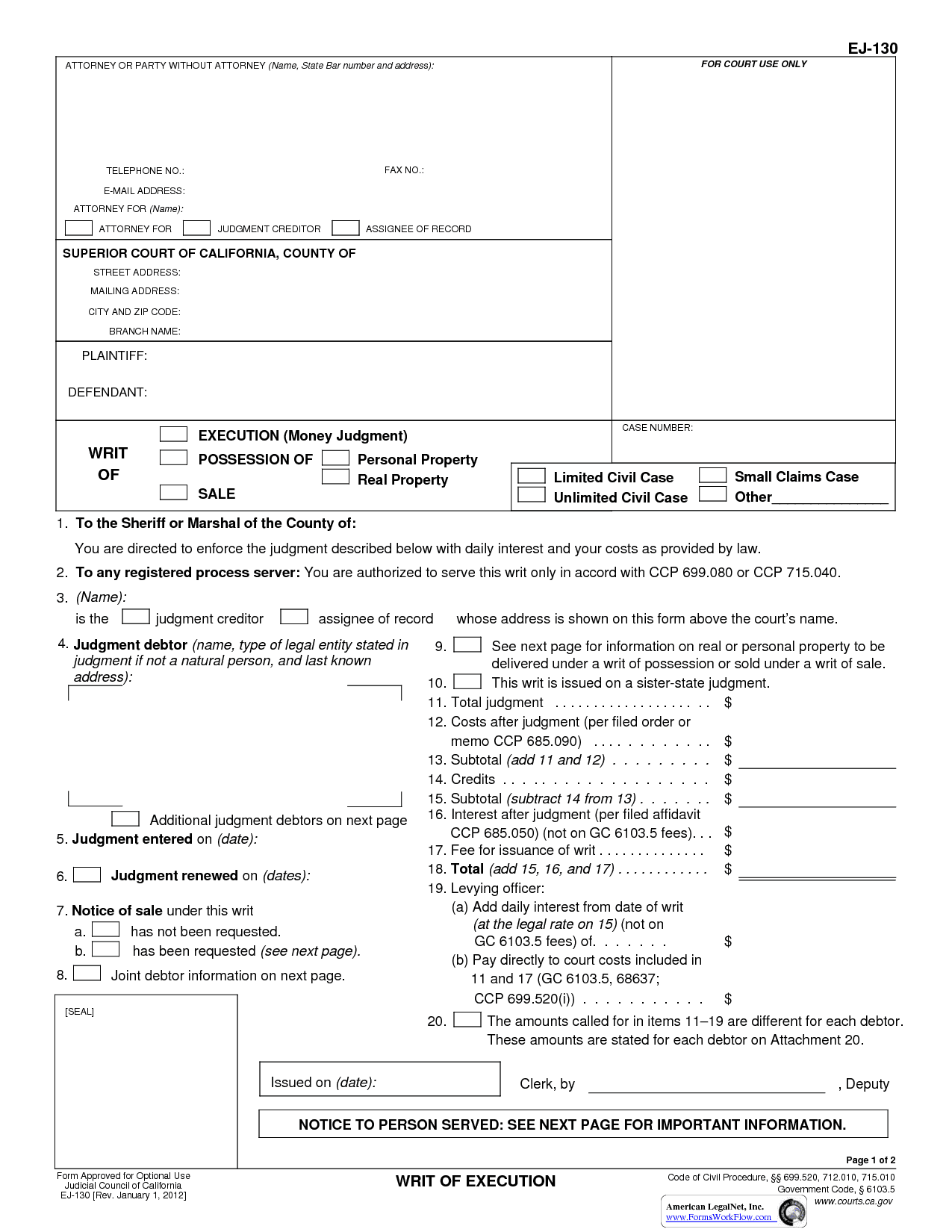

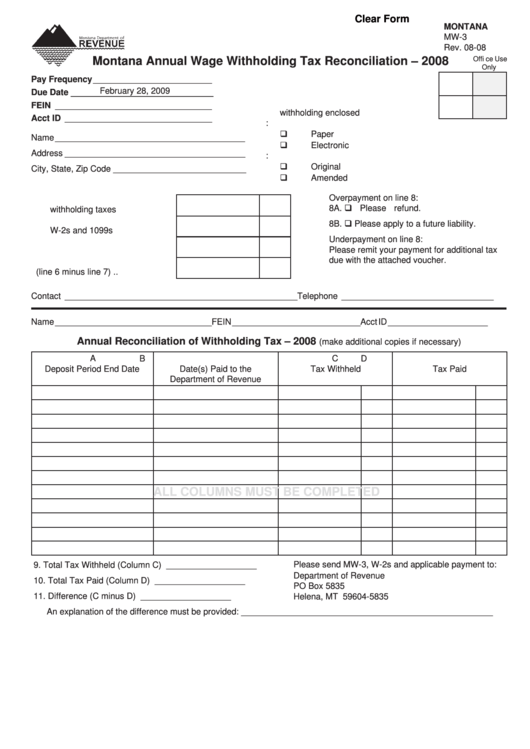

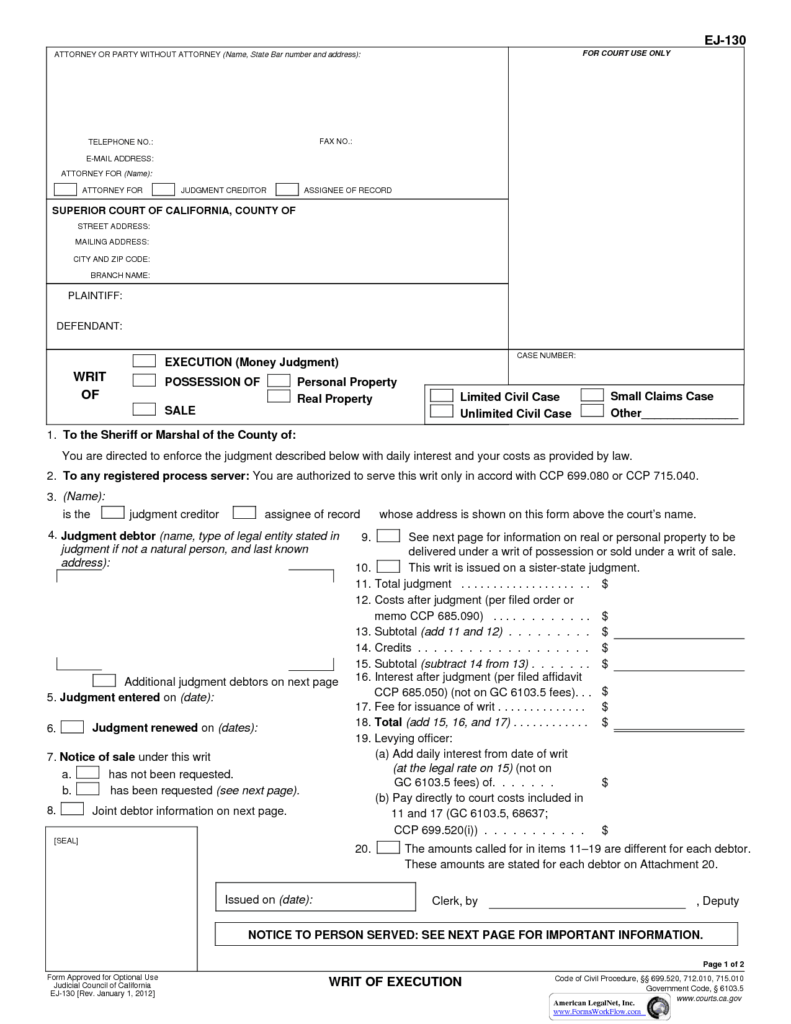

Employers are required to report the company who withholds taxes from employees. In the case of a small amount of these taxes, you may submit paperwork to IRS. A withholding tax reconciliation or an annual tax return for quarterly filing, as well as an annual tax return are some examples of other paperwork you may have to file. Below are details on the different forms of withholding taxes as well as the deadlines for filing them.

Withholding tax returns may be required for income such as salary, bonuses and commissions, as well as other income. If you pay your employees promptly, you could be eligible for reimbursement of taxes withheld. Noting that certain of these taxes are county taxes, is also important. In certain situations the rules for withholding can be unique.

In accordance with IRS regulations Electronic filing of forms for withholding are required. You must include your Federal Employer Identification Number when you point your national income tax return. If you don’t, you risk facing consequences.