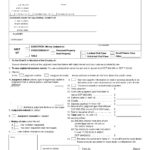

Indiana Child Support Withholding Form Payoff Arrears – There are numerous reasons someone could complete an application for withholding. These include the need for documentation and withholding exemptions. No matter what the reason is for the filing of documents, there are certain things to keep in mind.

Withholding exemptions

Non-resident aliens are required to submit Form1040-NR once each year to fill out Form1040-NR. If the requirements are met, you could be eligible for an exemption from withholding. There are exemptions available on this page.

To complete Form 1040-NR, include Form 1042-S. This document lists the amount withheld by the tax authorities for federal tax reporting for tax reporting purposes. Be sure to enter the right information when filling out this form. It is possible that you will have to treat one person if you don’t provide this information.

Nonresident aliens have a 30% withholding tax. An exemption from withholding may be available if you have the tax burden less than 30%. There are many exemptions. Some are for spouses and dependents, such as children.

You may be entitled to a refund if you violate the rules of chapter 4. Refunds are made in accordance with Sections 471 to 474. Refunds will be made to the tax agent withholding that is the person who collects the tax at the source.

Status of relationships

An official marital status form withholding forms will assist you and your spouse to make the most of your time. Furthermore, the amount of money that you can deposit at the bank can surprise you. The problem is deciding what option to choose. Undoubtedly, there are some that you shouldn’t do. A bad decision could cost you dearly. However, if you adhere to the instructions and watch out for any pitfalls and pitfalls, you’ll be fine. If you’re lucky, you might even make acquaintances on your travels. Today is the anniversary. I’m hoping that you can utilize it in order to find that elusive diamond. To complete the task correctly it is necessary to obtain the assistance of a tax professional who is certified. The small amount of money you pay is worth the lifetime of wealth. Online information is easy to find. Tax preparation firms that are reputable, such as TaxSlayer are one of the most useful.

number of claimed withholding allowances

The form W-4 should be filled in with the amount of withholding allowances that you wish to take advantage of. This is crucial since the amount of tax taken from your pay will be affected by the much you withhold.

There are a variety of factors that can determine the amount that you can claim for allowances. Your income level also affects how much allowances you’re entitled to. An additional allowance could be available if you earn a lot.

A proper amount of tax deductions will save you from a large tax bill. Refunds could be possible if you submit your income tax return for the year. It is essential to pick the right method.

You must do your homework the same way you would with any other financial choice. Calculators can be used to determine how many allowances for withholding must be claimed. As an alternative to a consultation with an expert.

Submitting specifications

Withholding taxes from your employees must be collected and reported if you are an employer. For some taxes you might need to submit documentation to the IRS. Additional paperwork that you may be required to file include a withholding tax reconciliation, quarterly tax returns, as well as the annual tax return. Here are some specifics about the various types of tax forms for withholding and the deadlines for filing.

Withholding tax returns may be required for certain incomes like bonuses, salary or commissions as well as other earnings. If you pay your employees on time, you could be eligible for the refund of taxes that you withheld. You should also remember that some of these taxes might be county taxes. Furthermore, there are special withholding practices that can be used in certain conditions.

According to IRS rules, you have to electronically submit forms for withholding. Your Federal Employer Identification number must be noted when you file at your national tax return. If you don’t, you risk facing consequences.