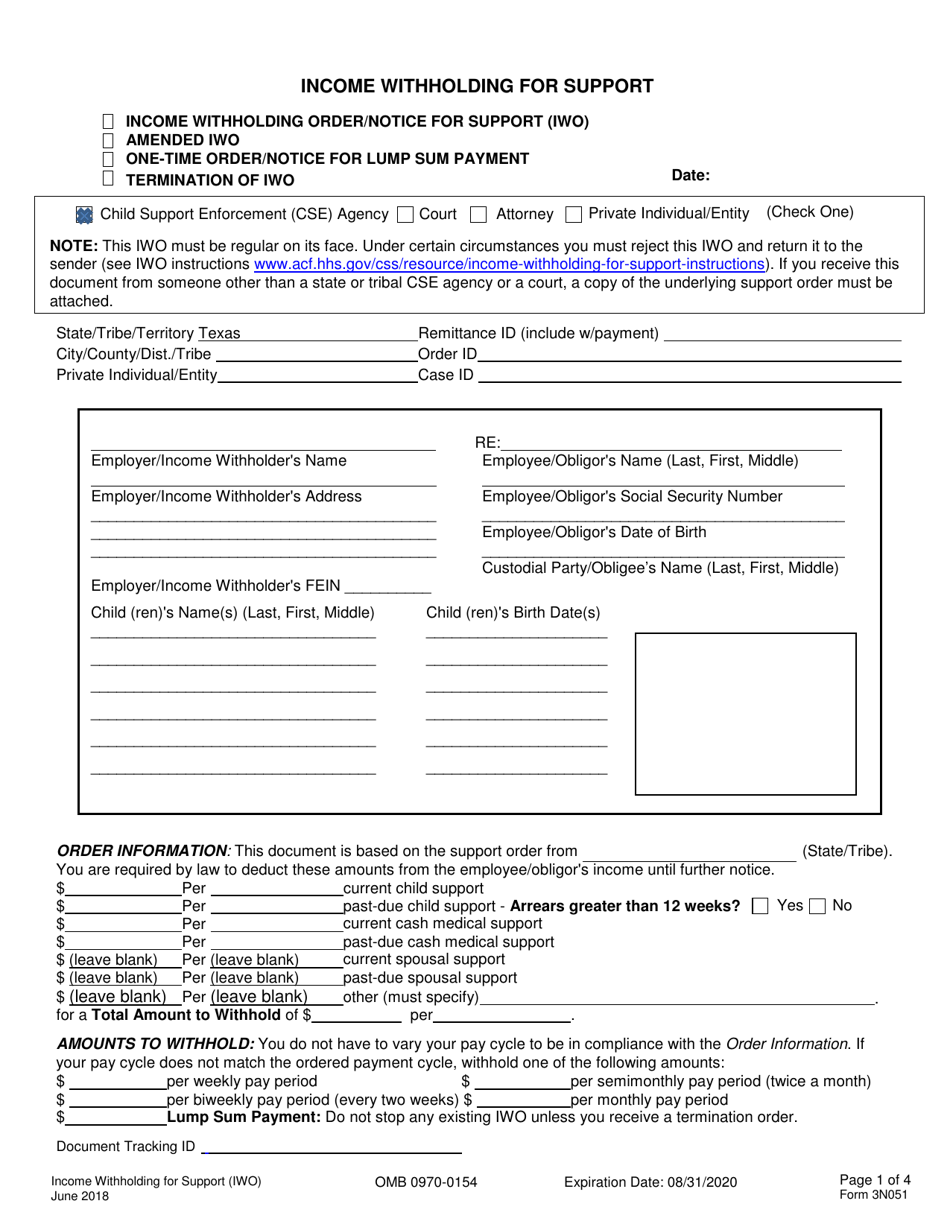

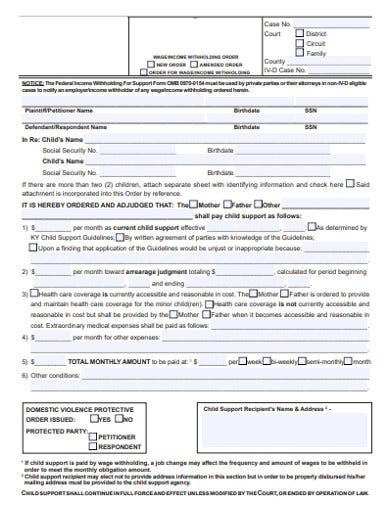

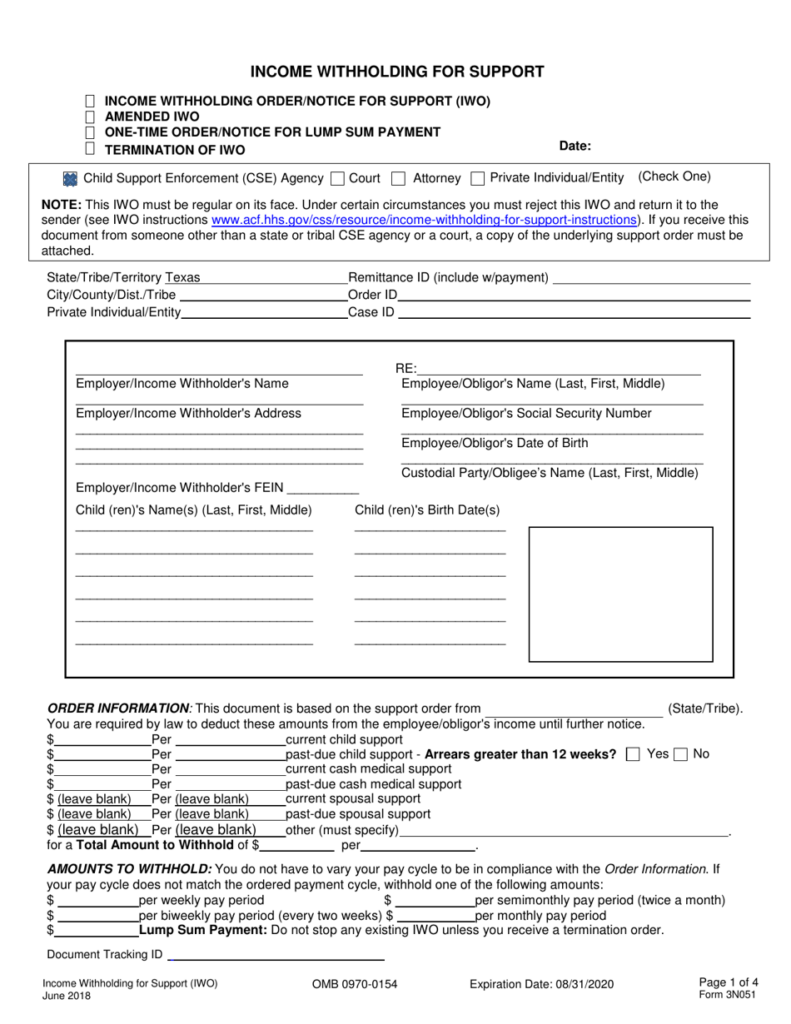

Income Withholding Form Nc Child Support – There are numerous reasons that a person might decide to file an application for withholding. This includes the documents required, the exclusion of withholding as well as the withholding allowances. Whatever the reason a person chooses to file the form there are some aspects to consider.

Withholding exemptions

Non-resident aliens must submit Form 1040-NR at a minimum once a year. You may be eligible to submit an exemption form for withholding tax in the event that you meet all criteria. The exemptions you will find here are yours.

The first step in submitting Form 1040 – NR is attaching Form 1042 S. The form lists the amount withheld by the tax withholding authorities to report federal income tax to be used for reporting purposes. When filling out the form make sure you fill in the exact details. A person could be treated if the information is not provided.

The 30% non-resident alien tax withholding tax rate is 30. You may be eligible to be exempted from withholding tax if your tax burden is higher than 30%. There are many exemptions. Some are specifically for spouses, and dependents, like children.

In general, chapter 4 withholding entitles you to an amount of money. Refunds can be made in accordance with Sections 471 to 474. The refunds are made by the withholding agents who is the person who is responsible for withholding taxes at the source.

Relationship status

Your and your spouse’s job is made simpler with a valid marital status withholding form. You’ll be amazed by the amount you can deposit to the bank. Choosing which of the options you’re likely to choose is the challenge. There are certain things that you should not do. It will be costly to make a wrong choice. If you follow the instructions and follow them, there shouldn’t be any problems. If you’re lucky you’ll make new friends while driving. Today marks the anniversary of your wedding. I’m sure you’ll utilize it against them to search for that one-of-a-kind wedding ring. It will be a complicated job that requires the knowledge of an expert in taxation. A little amount can create a lifetime of wealth. It is a good thing that you can access plenty of information on the internet. Trustworthy tax preparation companies like TaxSlayer are among the most helpful.

There are numerous withholding allowances that are being requested

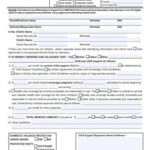

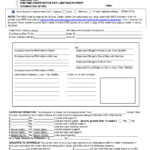

It is important to specify the number of withholding allowances you want to claim on the form W-4 that you file. This is essential because the tax amount taken from your pay will depend on how you withhold.

A number of factors can affect the amount you are eligible for allowances. The amount you earn will also impact how many allowances you are entitled to. If you have a high income, you may be eligible for an increased allowance.

A tax deduction appropriate for your situation could aid you in avoiding large tax bills. You could actually receive the amount you owe if you submit your annual income tax return. But , you have to choose your strategy carefully.

It is essential to do your homework as you would with any other financial choice. To figure out the amount of tax withholding allowances to be claimed, you can utilize calculators. An expert might be a viable alternative.

filing specifications

Employers are required to report the company who withholds taxes from employees. If you are taxed on a specific amount, you may submit paperwork to IRS. A withholding tax reconciliation or an annual tax return for quarterly filing, as well as an annual tax return are all examples of additional paperwork you might need to submit. Below are details about the various tax forms for withholding and their deadlines.

The bonuses, salary, commissions, and other earnings you earn from your employees may require you to submit withholding tax returns. Also, if your employees receive their wages on time, you may be eligible to get reimbursement of withheld taxes. You should also remember that certain taxes could be considered to be local taxes. There are also special withholding methods that are applicable under certain conditions.

You have to submit electronically withholding forms in accordance with IRS regulations. Your Federal Employer Identification Number needs to be listed when you submit your national revenue tax return. If you don’t, you risk facing consequences.