Illinois Withholding Registration Form – There are many reasons why one might choose to fill out withholding forms. Withholding exemptions, documentation requirements and the amount of allowances for withholding demanded are all elements. You must be aware of these aspects regardless of your reason for choosing to fill out a form.

Exemptions from withholding

Non-resident aliens are required to submit Form 1040 NR at least once each year. However, if you meet the requirements, you might be eligible to submit an exemption from withholding form. The exemptions listed here are yours.

The first step for submitting Form 1040 – NR is to attach Form 1042 S. This form is a record of the withholdings made by the agency. When filling out the form make sure you fill in the exact information. There is a possibility for a individual to be treated in a manner that is not correct if the correct information is not provided.

The non-resident alien tax withholding tax rate is 30. The tax burden of your business must not exceed 30% in order to be exempt from withholding. There are many exemptions. Certain are only for spouses and dependents, such as children.

In general, you’re entitled to a reimbursement in accordance with chapter 4. Refunds can be granted in accordance with Sections 471 to 474. The refunds are made by the agents who withhold taxes, which is the person who withholds taxes at the source.

Status of relationships

A marital withholding form can simplify your life and help your spouse. Additionally, the quantity of money you may deposit at the bank can surprise you. Knowing which of the many possibilities you’re most likely to pick is the tough part. You should be careful when you make a decision. The wrong decision can cause you to pay a steep price. But if you follow it and pay attention to the directions, you shouldn’t have any issues. If you’re fortunate, you might even make acquaintances on your travels. Since today is the date of your wedding anniversary. I’m hoping you’ll utilize it in order to find the sought-after diamond. To complete the task correctly, you will need to get the help from a qualified tax professional. This tiny amount is worth the time and money. You can find tons of information on the internet. TaxSlayer is a trusted tax preparation firm.

the number of claims for withholding allowances

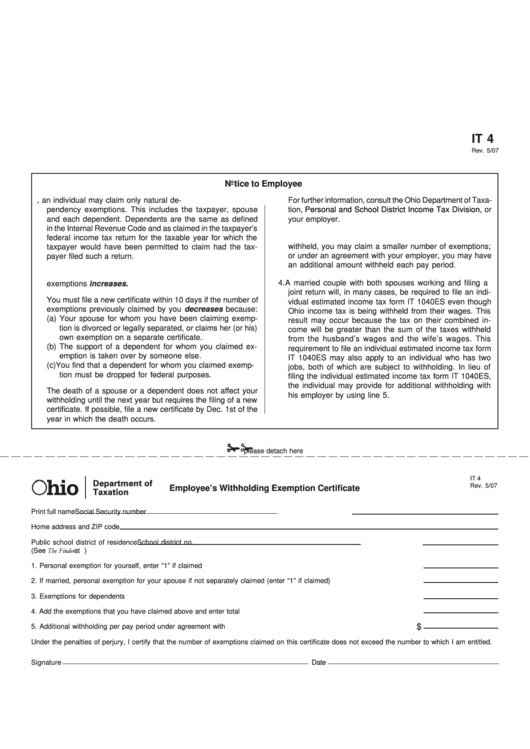

It is important to specify the amount of withholding allowances which you want to claim in the Form W-4. This is crucial since the tax amount you are able to deduct from your pay will be affected by the you withhold.

A number of factors can influence the amount you qualify for allowances. Your income level can also impact how many allowances are available to you. A higher allowance may be granted if you make a lot.

A tax deduction that is appropriate for you could help you avoid large tax payments. You could actually receive a refund if you file the annual tax return. But , you have to choose the right method.

It is essential to do your homework, just like you would with any financial decision. Calculators are available to assist you in determining how much withholding allowances must be claimed. Other options include talking to a specialist.

Filing specifications

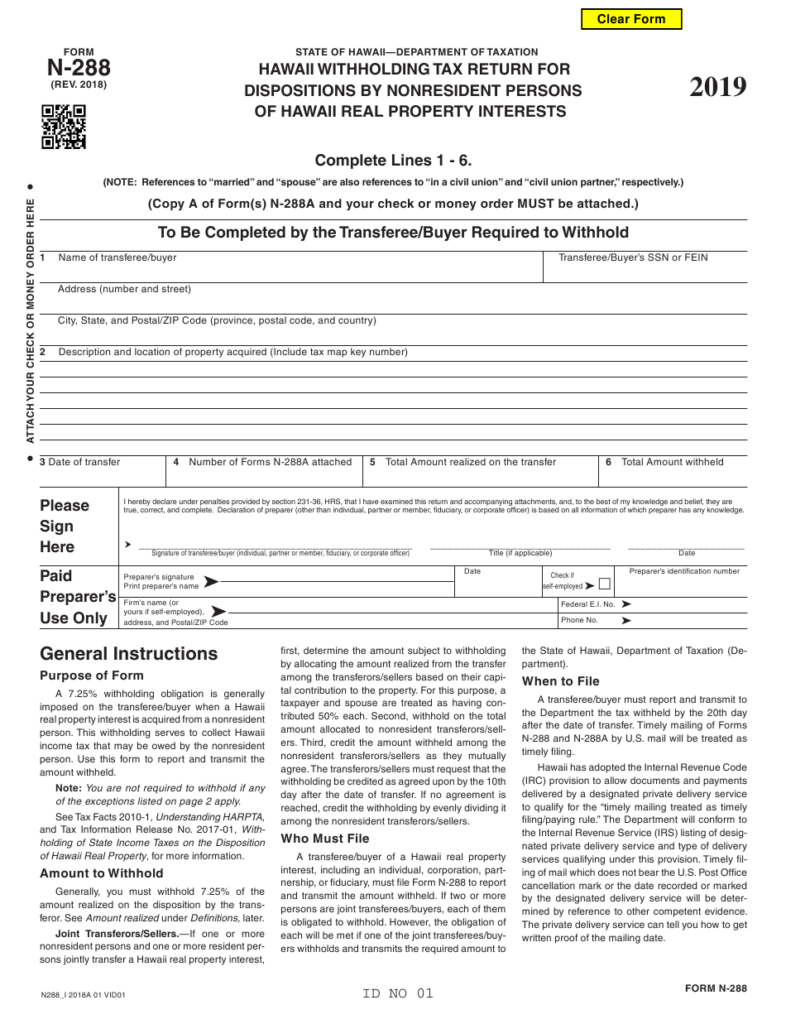

Employers should report the employer who withholds taxes from employees. If you are unable to collect the taxes, you are able to send paperwork to IRS. An annual tax return and quarterly tax returns as well as the reconciliation of withholding tax are all types of documents you could require. Here are some details about the various types of withholding tax forms along with the deadlines for filing.

To be eligible to receive reimbursement for tax withholding on salary, bonus, commissions or other income earned by your employees You may be required to submit a tax return withholding. If your employees are paid punctually, you might be eligible to get reimbursement of withheld taxes. It is crucial to remember that not all of these taxes are local taxes. There are also unique withholding methods that can be used in specific situations.

According to IRS regulations Electronic submissions of withholding forms are required. Your Federal Employer Identification Number needs to be listed when you submit your national revenue tax return. If you don’t, you risk facing consequences.

Gallery of Illinois Withholding Registration Form

Hawaii State Tax Withholding Form 2022 WithholdingForm