Illinois State Income Tax Withholding Form – There are a variety of reasons why an individual could submit a form for withholding. These factors include documentation requirements and exemptions from withholding. You should be aware of these factors regardless of why you choose to file a request form.

Exemptions from withholding

Nonresident aliens need to submit Form 1040–NR every calendar year. If you fulfill the criteria, you may be able to submit an exemption from the withholding form. This page you will discover the exemptions available to you.

The attachment of Form 1042-S is the first step to submit Form 1040-NR. The form outlines the withholdings that are made by the agency. Be sure to enter the correct information when filling in this form. One person may be treated if the information is not entered.

Non-resident aliens are subject to the option of paying a 30% tax on withholding. The tax burden of your business must not exceed 30% to be exempt from withholding. There are many exemptions. Some of them are intended for spouses, while others are meant to be used by dependents such as children.

Generally, a refund is offered for the chapter 4 withholding. Refunds are allowed according to Sections 1471-1474. Refunds are given to the tax agent withholding the person who withholds the tax from the source.

Relational status

The marital withholding form is a good way to simplify your life and help your spouse. You will be pleasantly surprised by the amount of money you can put in the bank. It is difficult to decide what option you will choose. There are certain aspects to avoid. It will be costly to make the wrong choice. However, if you adhere to the guidelines and be alert for any potential pitfalls You won’t face any issues. If you’re lucky enough to meet some new acquaintances on the road. Today is your anniversary. I’m hoping that you can leverage it to find that perfect wedding ring. In order to complete the job correctly, you will need to seek the assistance of a tax professional who is certified. The small amount of money you pay is worth the time and money. There is a wealth of details online. TaxSlayer and other trusted tax preparation companies are some of the best.

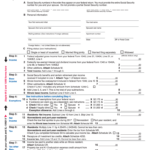

The amount of withholding allowances that were claimed

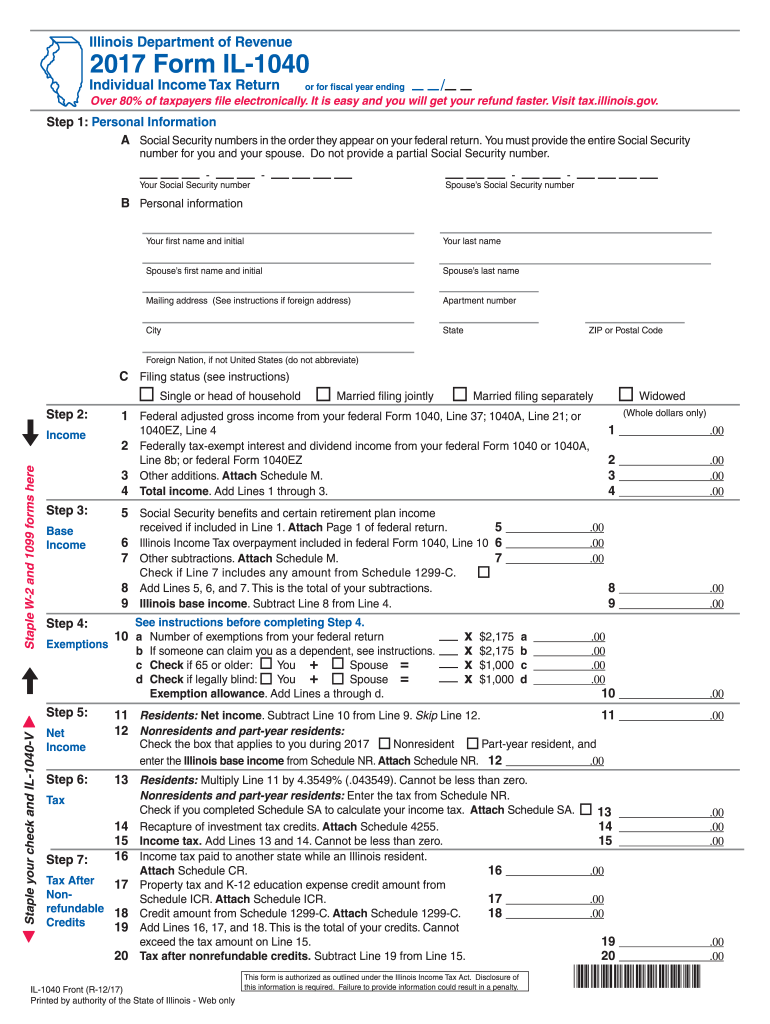

In submitting Form W-4 you need to specify how many withholdings allowances you would like to claim. This is crucial because the tax amount you are able to deduct from your paycheck will depend on how you withhold.

The amount of allowances you are entitled to will be determined by the various aspects. For example, if you are married, you could be eligible for an exemption for the head of household or for the household. The amount of allowances you can claim will depend on your income. If you earn a higher income, you could be eligible to request a higher allowance.

Tax deductions that are appropriate for you could help you avoid large tax obligations. You could actually receive the amount you owe if you submit the annual tax return. But , you have to choose your approach wisely.

You must do your homework, just like you would for any financial option. Calculators will help you determine the number of withholdings that need to be demanded. You can also speak to an expert.

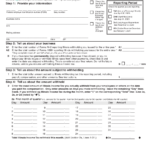

filing specifications

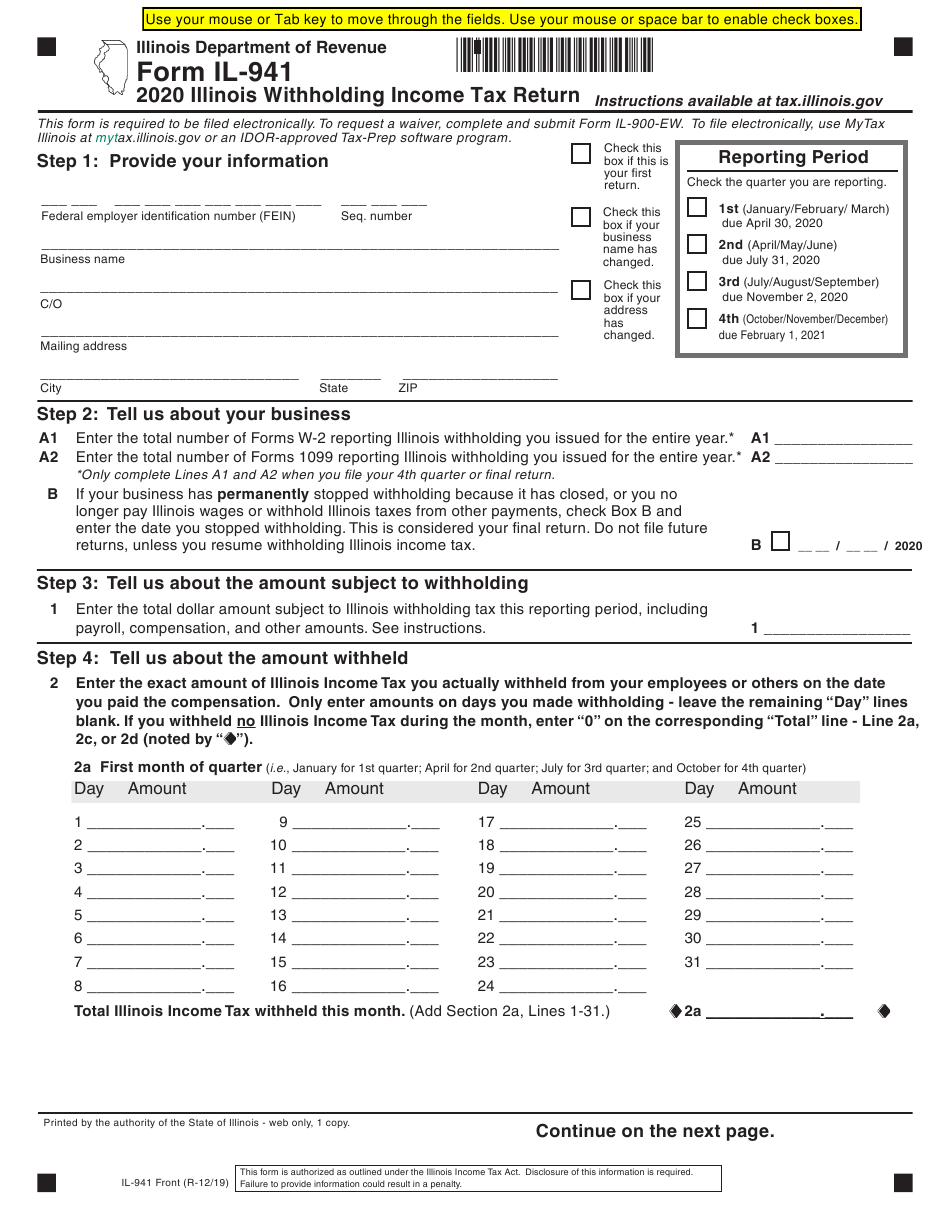

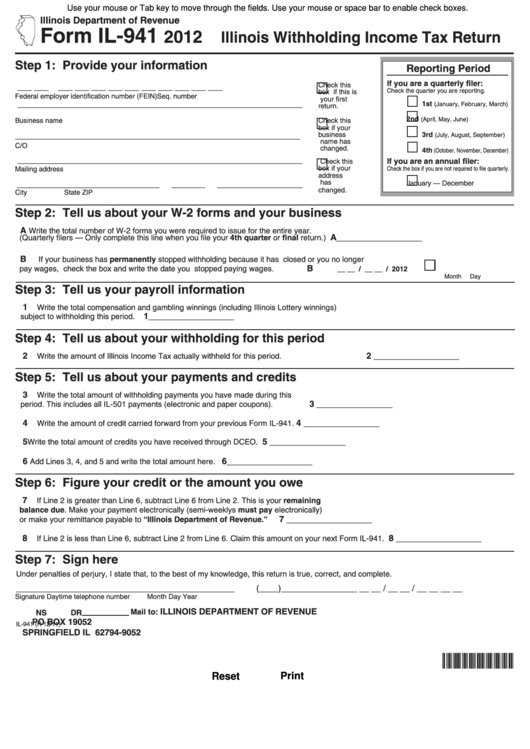

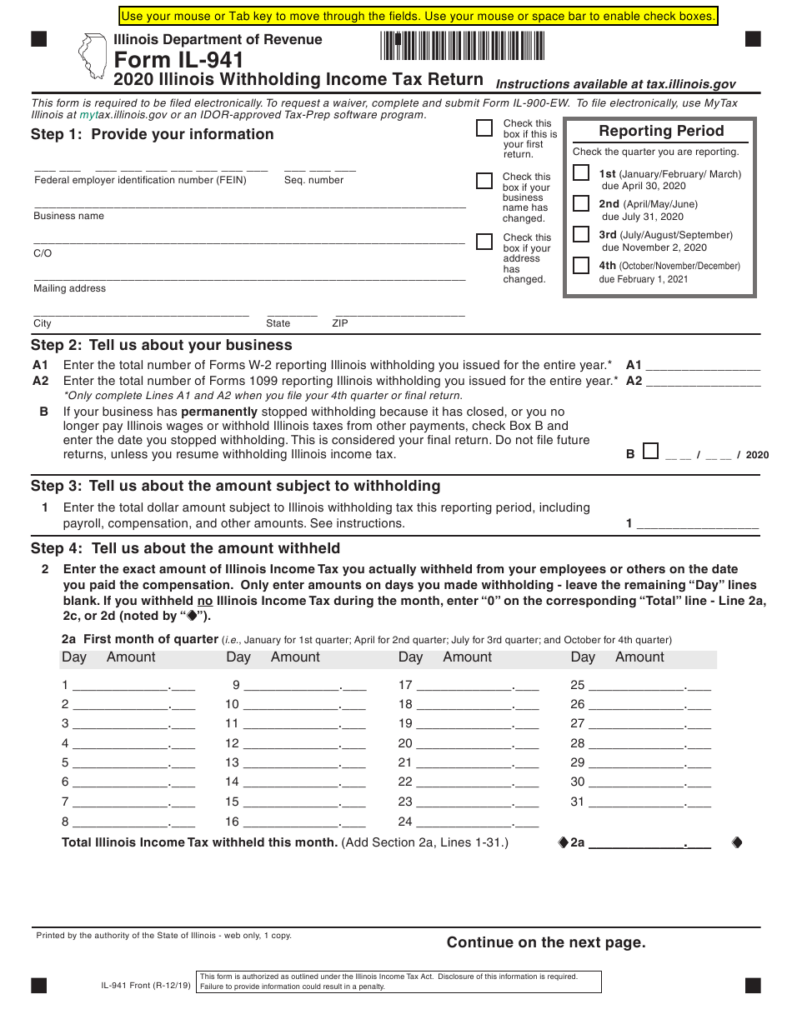

Employers are required to pay withholding taxes to their employees and report it. For a limited number of these taxes, you can send paperwork to IRS. There may be additional documentation , like a withholding tax reconciliation or a quarterly return. Here’s a brief overview of the different tax forms and when they must be filed.

Employees may need you to file withholding tax returns to be eligible for their wages, bonuses and commissions. In addition, if you pay your employees promptly, you could be eligible for reimbursement of taxes withheld. Be aware that certain taxes could be considered to be county taxes, is also important. You may also find unique withholding rules that can be used in specific situations.

You have to submit electronically tax withholding forms as per IRS regulations. You must include your Federal Employer ID Number when you point your national income tax return. If you don’t, you risk facing consequences.