Illinois Income Withholding Remittance Form – There are many reasons why one might decide to fill out a withholding form. This includes documentation requirements as well as exemptions from withholding, as well as the amount of withholding allowances. There are some things you should remember regardless of the reason the person fills out a form.

Exemptions from withholding

Nonresident aliens are required at least once a year to submit Form1040-NR. If you meet the requirements, you could be able to claim an exemption from the withholding forms. This page will list all exclusions.

The attachment of Form 1042-S is the first step to submit Form 1040-NR. For federal income tax reporting reasons, this form provides the withholding made by the tax agency that handles withholding. When filling out the form, make sure you fill in the accurate details. This information might not be provided and could result in one person being treated.

The 30% non-resident alien tax withholding tax rate is 30. Your tax burden should not exceed 30% in order to be eligible for exemption from withholding. There are several different exclusions that are available. Some are specifically designed to be used by spouses, while some are designed to be used by dependents such as children.

Generally, you are eligible for a reimbursement in accordance with chapter 4. Refunds can be made under Sections 471 through 474. The refunds are made by the withholding agents that is, the person who is responsible for withholding taxes at source.

Status of the relationship

The marital withholding form is a good way to simplify your life and assist your spouse. You’ll be surprised at how much money you can transfer to the bank. The trick is to decide which of the numerous options to select. Certain things are best avoided. The wrong decision can cause you to pay a steep price. If you adhere to the rules and pay attention to directions, you shouldn’t run into any problems. If you’re lucky, you may meet some new friends on your journey. Today is your birthday. I’m sure you’ll be in a position to leverage this against them in order to acquire that wedding ring you’ve been looking for. To do it right you’ll require the assistance of a certified accountant. This small payment is well worth the time and money. There are tons of online resources that provide information. TaxSlayer, a reputable tax preparation company, is one of the most effective.

The amount of withholding allowances that are claimed

In submitting Form W-4 you must specify how many withholdings allowances you would like to claim. This is vital as it will impact the amount of tax you get from your pay checks.

There are many factors that influence the amount of allowances that you can request. If you’re married you might be eligible for a head-of-household exemption. The amount of allowances you are eligible for will be contingent on your income. If you earn a significant amount of money, you might be eligible for a larger allowance.

A tax deduction appropriate for your situation could help you avoid large tax payments. It is possible to receive a refund if you file the annual tax return. It is important to be cautious when it comes to preparing this.

Like any financial decision, it is important that you should conduct your homework. Calculators are readily available to help you determine how much withholding allowances must be claimed. Another option is to talk with a professional.

filing specifications

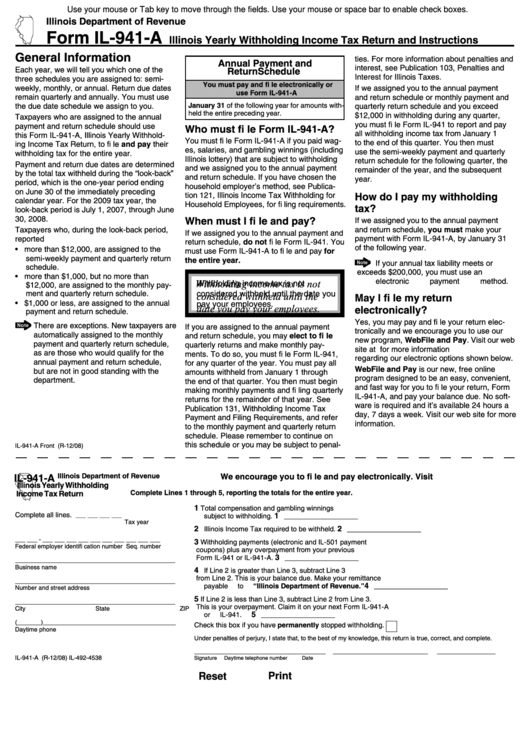

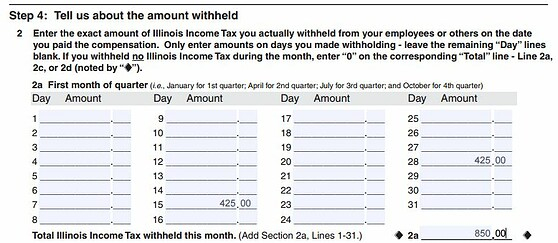

Withholding taxes from employees need to be reported and collected if you’re an employer. The IRS may accept forms for some of these taxes. A tax return that is annually filed, quarterly tax returns or the reconciliation of withholding tax are all types of documents you could require. Below are details on the different forms of withholding taxes as well as the deadlines for filing them.

In order to be eligible to receive reimbursement for tax withholding on compensation, bonuses, salary or any other earnings earned by your employees You may be required to file a tax return for withholding. Additionally, if you pay your employees on-time, you might be eligible for reimbursement for any taxes withheld. Be aware that certain taxes may be county taxes, is also crucial. There are specific withholding strategies that may be applicable in specific situations.

You have to submit electronically withholding forms according to IRS regulations. The Federal Employer Identification Number must be listed on to your national tax return. If you don’t, you risk facing consequences.