Il Tax Withholding Form 2024 – There are numerous reasons one could fill out a form for withholding. Withholding exemptions, documentation requirements as well as the quantity of allowances for withholding demanded are all elements. There are a few points to be aware of regardless of the reason the person fills out an application.

Withholding exemptions

Non-resident aliens must submit Form 1040-NR at least once per year. If you meet these requirements, you could be eligible to receive an exemption from the withholding forms. This page you’ll discover the exemptions that you can avail.

Attaching Form 1042-S is the first step to file Form 1040-NR. The form contains information on the withholding that is performed by the agency responsible for withholding to report federal income tax for tax reporting purposes. It is crucial to enter correct information when you complete the form. One individual may be treated if this information is not supplied.

Non-resident aliens are subjected to a 30% withholding rate. Nonresident aliens could be qualified for an exemption. This is the case if your tax burden less than 30%. There are many different exemptions. Some are for spouses or dependents, for example, children.

In general, chapter 4 withholding allows you to receive a refund. Refunds are made under Sections 471 through 474. Refunds will be made to the withholding agent that is the person who collects the tax from the source.

relational status

An official marriage status withholding form can help both of you to make the most of your time. In addition, the amount of money you can put in the bank will pleasantly be awestruck. It can be difficult to choose which of the many options you will choose. There are certain things you should avoid doing. There are a lot of costs when you make a bad choice. If you follow the guidelines and follow them, there shouldn’t be any problems. If you’re lucky, you might find some new friends while driving. Today is the anniversary. I’m sure you’ll be capable of using this against them in order to acquire that wedding ring you’ve been looking for. For this to be done correctly, you’ll need the advice of a tax expert who is certified. It’s worthwhile to create wealth over the course of a lifetime. There is a wealth of details online. TaxSlayer is a trusted tax preparation firm.

There are numerous withholding allowances that are being made available

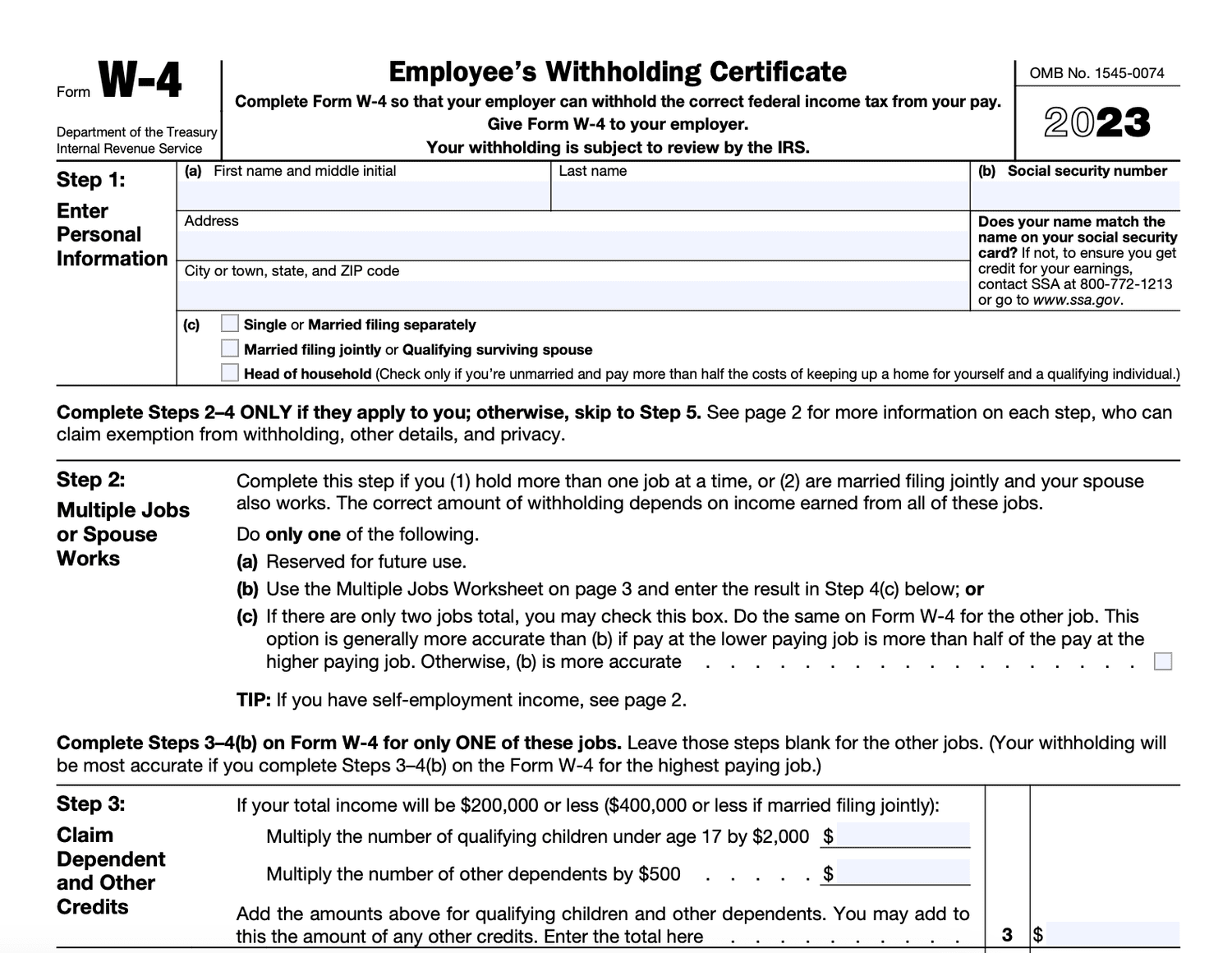

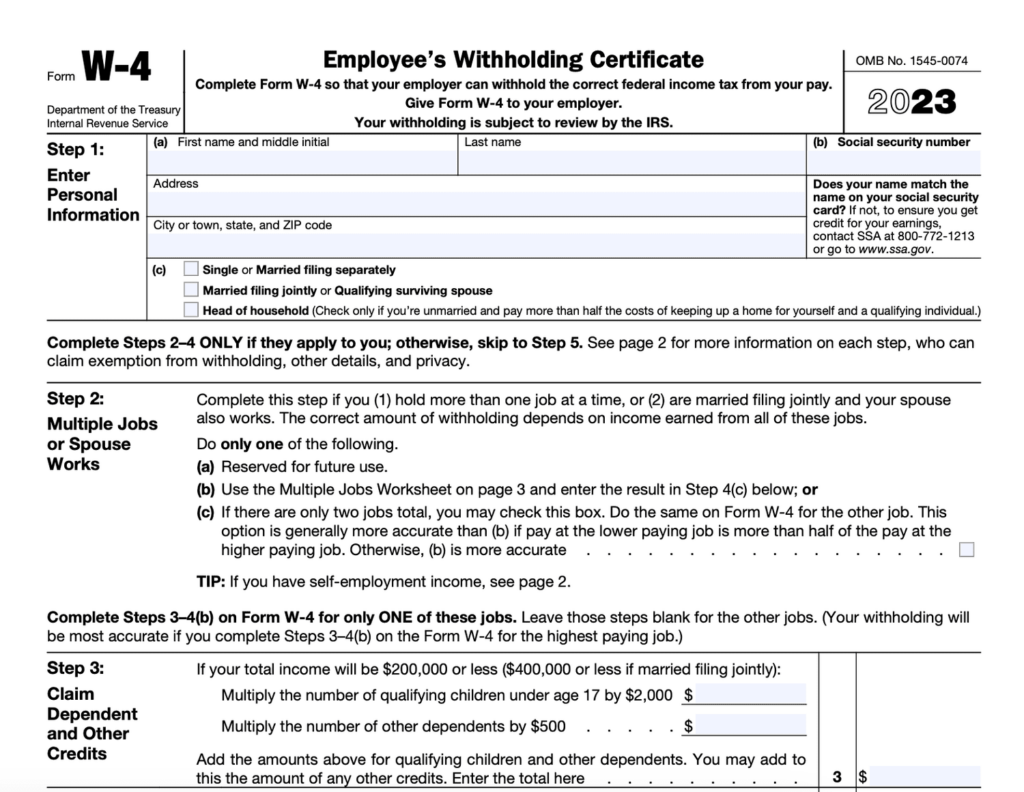

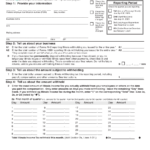

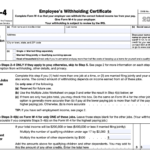

You need to indicate how many withholding allowances you wish to claim on the W-4 you submit. This is essential as the tax withheld will affect the amount taken out of your paycheck.

You could be eligible to apply for an exemption on behalf of the head of your household in the event that you are married. Your income level also affects how many allowances you are entitled to. If you earn a significant amount of money, you might get a bigger allowance.

Choosing the proper amount of tax deductions could save you from a large tax payment. If you submit the annual tax return for income and you are eligible for a refund. But it is important to select the correct method.

As with any financial decision, it is important that you must do your research. Calculators are useful to determine how many withholding allowances need to be requested. An expert may be an alternative.

Specifications for filing

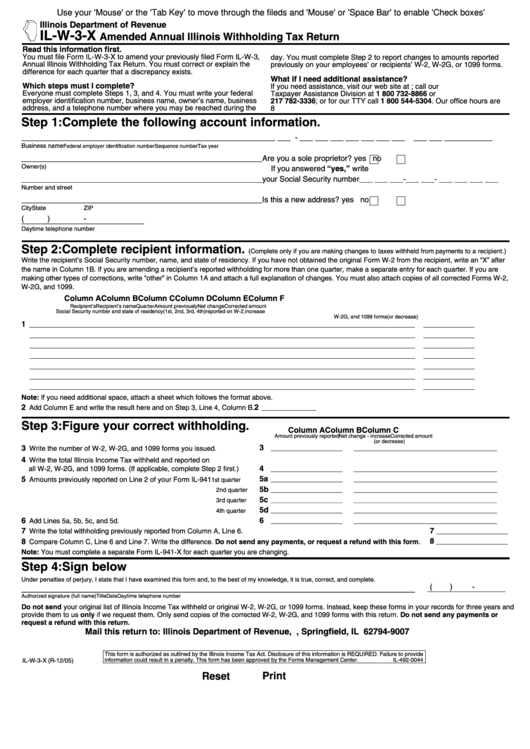

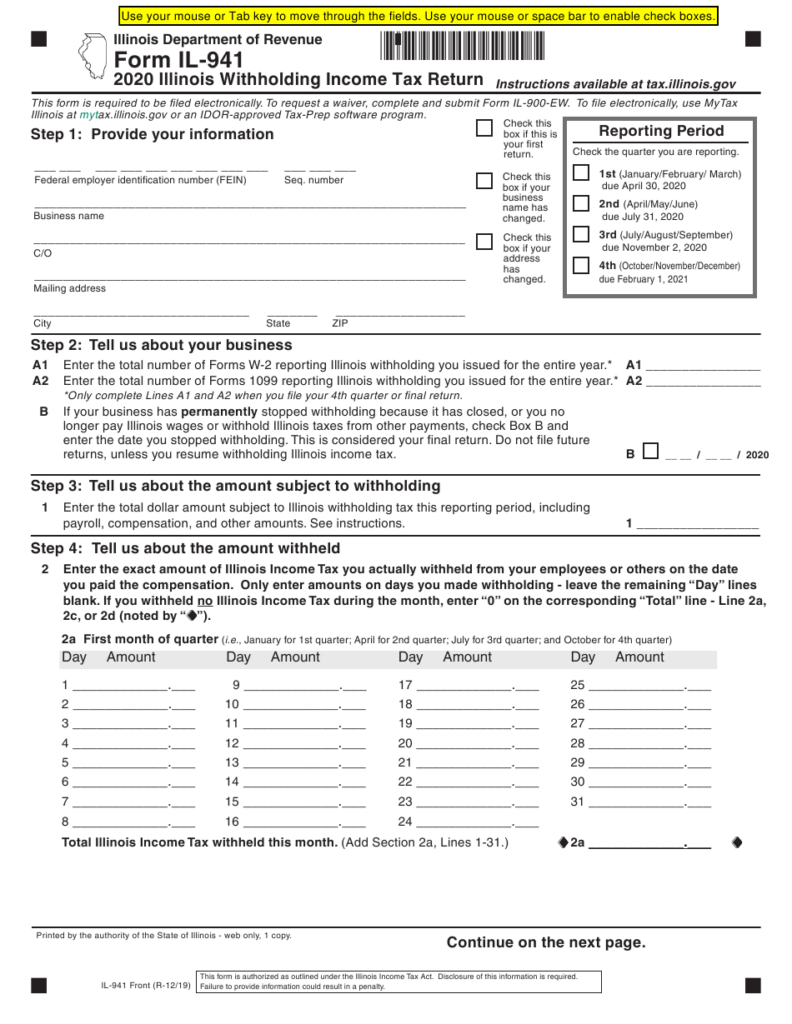

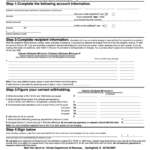

If you’re an employer, you must collect and report withholding taxes on your employees. The IRS may accept forms to pay certain taxes. You may also need additional forms that you could require, such as an annual tax return, or a withholding reconciliation. Here’s a brief overview of the various tax forms and the time when they should be submitted.

In order to be eligible for reimbursement of withholding taxes on the compensation, bonuses, salary or other revenue that your employees receive You may be required to submit a tax return withholding. You could also be eligible to be reimbursed for tax withholding if your employees were paid in time. The fact that certain taxes are also county taxes should be taken into consideration. In addition, there are specific tax withholding procedures that can be applied under particular conditions.

In accordance with IRS rules, you are required to electronically submit withholding forms. When you file your tax returns for national revenue make sure you include the Federal Employee Identification Number. If you don’t, you risk facing consequences.