Il State Tax Withholding Form – There are many reasons for a person to decide to complete a withholding form. These include the need for documentation and exemptions for withholding. Whatever the reason behind a person to file an application, there are certain things to keep in mind.

Withholding exemptions

Non-resident aliens are required to submit Form1040-NR once every year to file Form1040-NR. It is possible to file an exemption form for withholding, if you meet all the requirements. This page lists all exemptions.

To file Form 1040-NR the first step is attaching Form 1042S. This form details the withholdings that are made by the agency. It is crucial to enter exact information when you fill out the form. It is possible that you will have to treat one person for not providing this information.

The withholding rate for nonresident aliens is 30 percent. The tax burden of your business should not exceed 30% in order to be eligible for exemption from withholding. There are many different exemptions. Certain of them are designed for spouses, while others are designed for use by dependents such as children.

Generally, a refund is offered for the chapter 4 withholding. Refunds are granted according to Sections 1400 through 1474. These refunds must be made by the agents who withhold taxes, which is the person who withholds taxes at source.

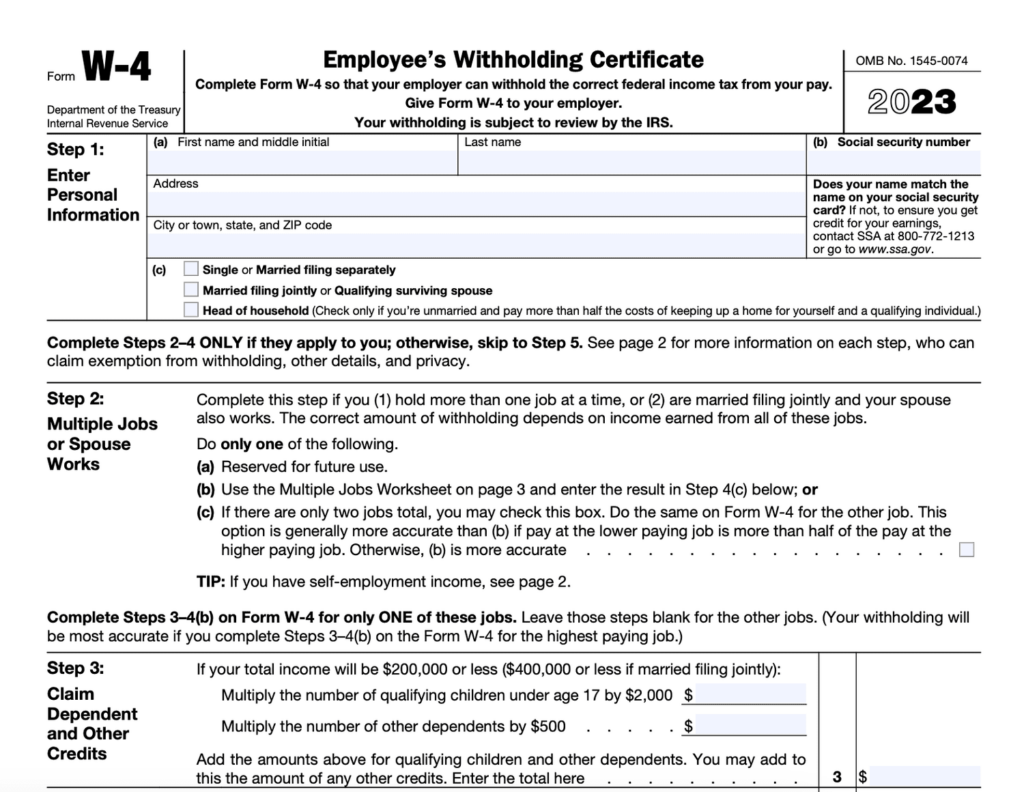

Relational status

A valid marital status and withholding forms can simplify your work and that of your spouse. You’ll be amazed at the amount you can deposit to the bank. The problem is selecting the best option among the numerous possibilities. There are certain things you must be aware of. Making a mistake can have costly negative consequences. You won’t have any issues when you adhere to the instructions and pay attention. If you’re lucky, you could be able to make new friends during your journey. Today marks the day you celebrate your marriage. I hope you are in a position to leverage this to get that elusive wedding ring. To complete the task correctly, you will need to get the help of a tax professional who is certified. The small amount is well worth it for a life-long wealth. Information on the internet is easy to find. TaxSlayer as well as other reliable tax preparation firms are some of the best.

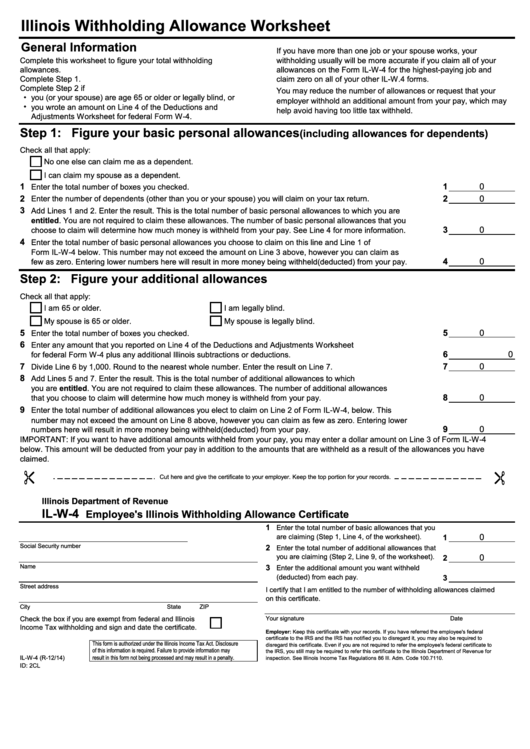

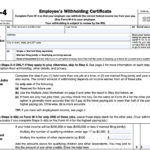

Number of claimed withholding allowances

It is essential to state the amount of withholding allowances you wish to claim on the Form W-4. This is important as your paychecks may depend on the tax amount you pay.

There are a variety of factors that affect the amount of allowances you can apply for. If you’re married, you might be eligible for a head-of-household exemption. Your income level can also affect the number of allowances accessible to you. If you earn a substantial income, you could be eligible to request an increased allowance.

Selecting the appropriate amount of tax deductions might help you avoid a hefty tax payment. It is possible to receive a refund if you file the annual tax return. However, you must choose your approach wisely.

In any financial decision, you must conduct your own research. Calculators will help you determine the number of withholdings that need to be demanded. You may also talk to an expert.

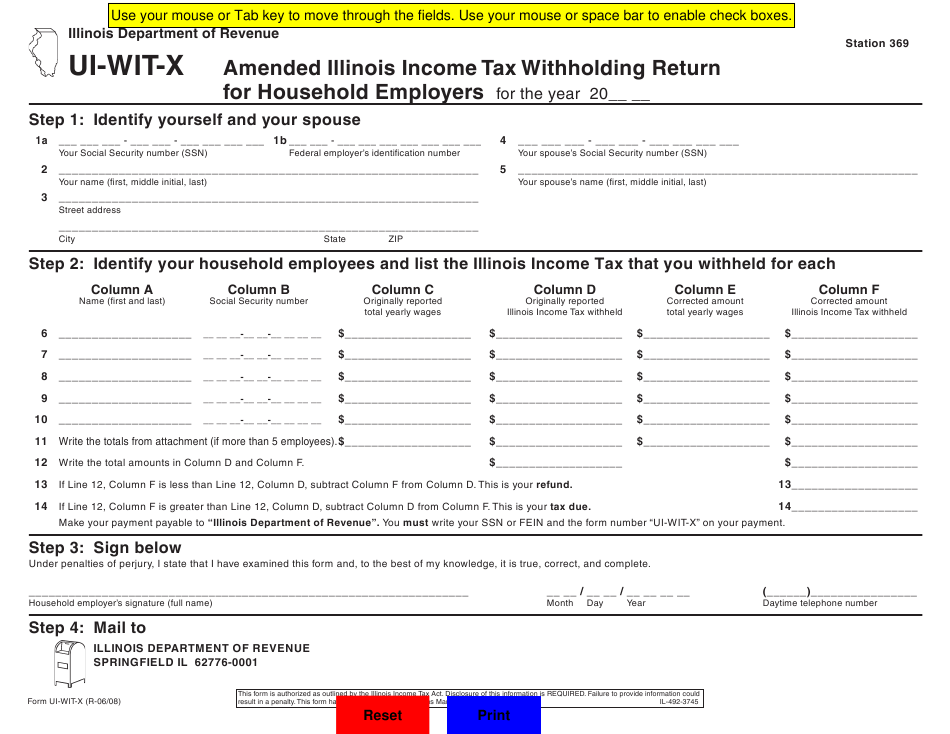

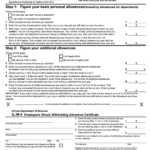

Formulating specifications

Employers must report any withholding taxes being taken from employees. A few of these taxes can be reported to the IRS through the submission of paperwork. An annual tax return, quarterly tax returns or tax withholding reconciliations are just a few types of documents you could require. Here is some information on the different forms of withholding tax categories and the deadlines for filing them.

You might have to file tax returns for withholding for the income you receive from employees, such as bonuses, commissions, or salary. If you also pay your employees on-time it could be possible to qualify to receive reimbursement for taxes not withheld. It is important to note that some of these taxes are taxes imposed by the county, is crucial. In addition, there are specific withholding practices that can be applied under particular conditions.

Electronic filing of withholding forms is mandatory according to IRS regulations. Your Federal Employer Identification number must be included when you submit to your tax return for the nation. If you don’t, you risk facing consequences.