Ihss Tax Withholding Form – There are many reasons someone may decide to submit an application for withholding. The reasons include the need for documentation, withholding exemptions, and the quantity of requested withholding allowances. Whatever the motive someone has to fill out an Application There are a few aspects to keep in mind.

Exemptions from withholding

Non-resident aliens must submit Form 1040NR once per year. You could be eligible to submit an exemption form for withholding, if you meet all the criteria. There are exemptions accessible to you on this page.

For submitting Form 1040-NR add Form 1042-S. The form lists the amount that is withheld by the withholding agencies for federal income tax reporting for tax reporting purposes. Fill out the form correctly. It is possible for a individual to be treated in a manner that is not correct if the information is not given.

The withholding rate for nonresident aliens is 30 percent. Your tax burden is not to exceed 30% in order to be exempt from withholding. There are many exemptions. Certain of them apply to spouses, dependents, or children.

In general, you’re entitled to a reimbursement under chapter 4. Refunds may be granted in accordance with Sections 1400 through 1474. The refunds are made to the agent who withholds tax, the person who withholds taxes from the source.

Relational status

A proper marital status withholding can help you and your spouse to complete your tasks. The bank could be shocked by the amount of money that you have to deposit. It isn’t easy to determine which one of many choices is most appealing. There are certain that you shouldn’t do. It can be costly to make a wrong decision. If you stick to the instructions and keep your eyes open to any possible pitfalls, you won’t have problems. If you’re lucky enough you’ll make new acquaintances on the road. Today is your birthday. I’m hoping they can reverse the tide in order to assist you in getting that elusive engagement ring. To do this correctly, you’ll need the assistance of a qualified Tax Expert. It’s worthwhile to create wealth over a lifetime. There are a myriad of websites that offer details. TaxSlayer as well as other reliable tax preparation companies are some of the best.

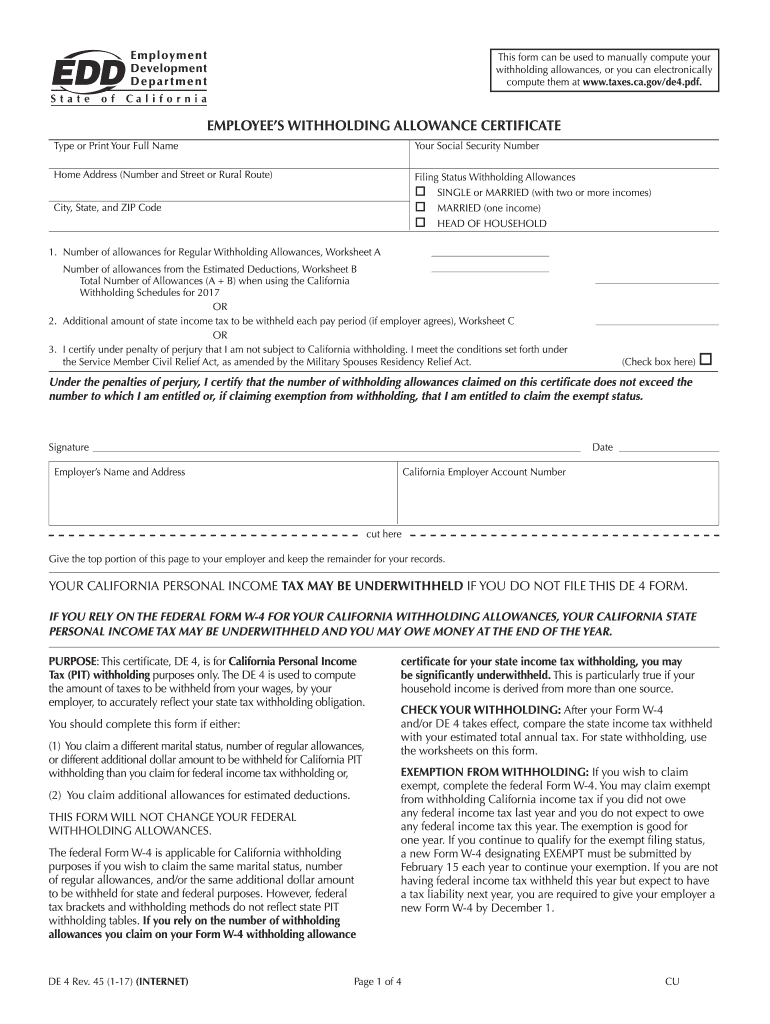

The amount of withholding allowances that were requested

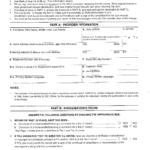

The form W-4 should be filled in with the amount of withholding allowances that you want to be able to claim. This is crucial since the withholdings can have an impact on how much tax is deducted from your paychecks.

The amount of allowances that you get will be contingent on various factors. For instance, if you are married, you may be entitled to an exemption for your household or head. The amount you can claim will depend on your income. If you have high income, you might be eligible to receive higher amounts.

Tax deductions that are suitable for you can help you avoid large tax bills. If you submit your annual income tax return, you could even receive a refund. However, be cautious about your approach.

Research as you would with any financial decision. To determine the amount of withholding allowances to be claimed, you can make use of calculators. In addition, you may speak with an expert.

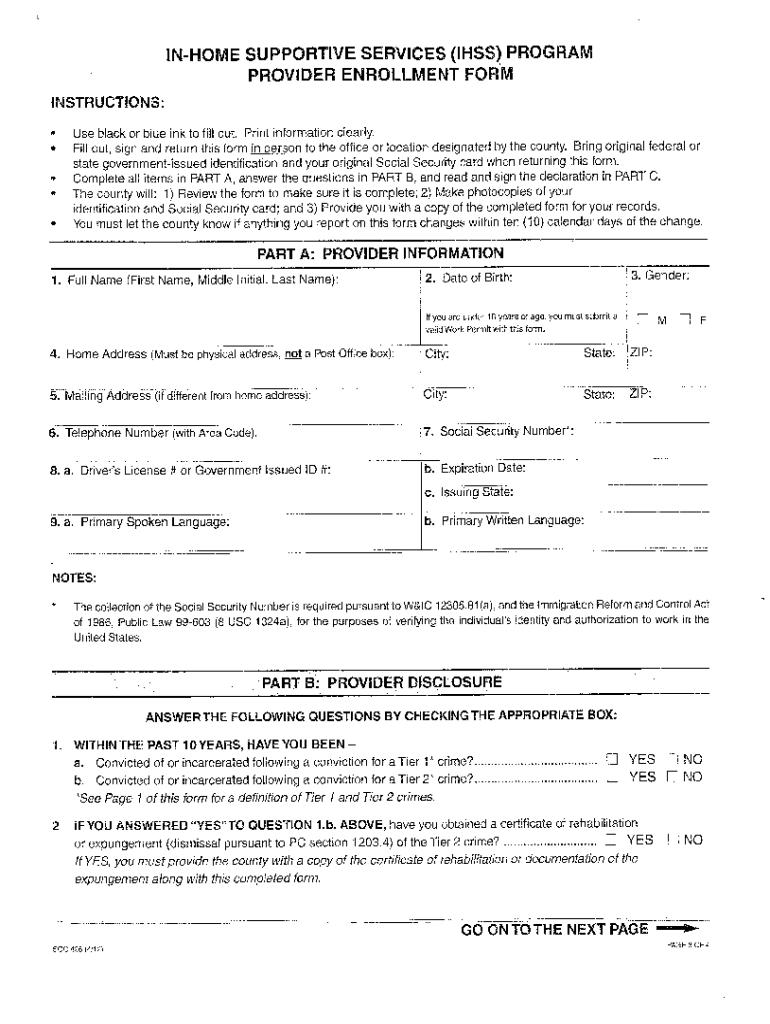

Submitting specifications

If you are an employer, you have to be able to collect and report withholding taxes from your employees. For certain taxes, you may submit paperwork to IRS. A tax reconciliation for withholding or an annual tax return for quarterly filing, as well as an annual tax return are all examples of additional documents you could be required to submit. Here’s some details about the different tax forms and when they must be filed.

Employees may need you to submit withholding taxes returns to be eligible for their bonuses, salary and commissions. If you make sure that your employees are paid on time, then you could be eligible for the reimbursement of taxes withheld. It is important to note that certain taxes are also county taxes ought to also be noted. There are also unique withholding methods that are applied in particular circumstances.

The IRS regulations require that you electronically file withholding documents. When you submit your national tax return, please include the Federal Employer Identification number. If you don’t, you risk facing consequences.