Idaho State Withholding Form 2024 – There are many reasons one might choose to fill out forms for withholding. This includes the need for documentation, exemptions to withholding and the amount of the required withholding allowances. It doesn’t matter what reason someone chooses to file an Application, there are several aspects to keep in mind.

Exemptions from withholding

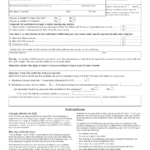

Non-resident aliens must complete Form 1040-NR once per year. However, if your requirements are met, you could be eligible to apply for an exemption from withholding. The exemptions listed on this page are yours.

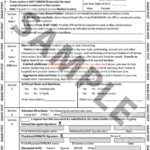

For submitting Form 1040-NR attach Form 1042-S. For federal income tax reporting reasons, this form details the withholdings made by the withholding agency. Fill out the form correctly. It is possible that you will have to treat one person for not providing the correct information.

The tax withholding rate for non-resident aliens is 30. If the tax you pay is less than 30 percent of your withholding you may qualify to receive an exemption from withholding. There are many exemptions. Some are for spouses and dependents, like children.

In general, withholding under Chapter 4 gives you the right to a return. According to Sections 1471 through 1474, refunds are given. The person who is the withholding agent, or the individual who is responsible for withholding the tax at source, is the one responsible for distributing these refunds.

Status of relationships

The marital withholding form is a good way to make your life easier and assist your spouse. You will be pleasantly surprised at how much money you can deposit to the bank. It isn’t easy to choose which of the many options is the most attractive. There are certain that you shouldn’t do. Making the wrong choice could cost you a lot. But if you follow it and follow the instructions, you won’t encounter any issues. You may make new acquaintances if fortunate. Today is the anniversary of your wedding. I’m sure you’ll be able to make use of it to secure that dream ring. It is best to seek the advice of a certified tax expert to complete it correctly. This small payment is well enough to last the life of your wealth. You can get a lot of information on the internet. TaxSlayer, a reputable tax preparation company is among the most helpful.

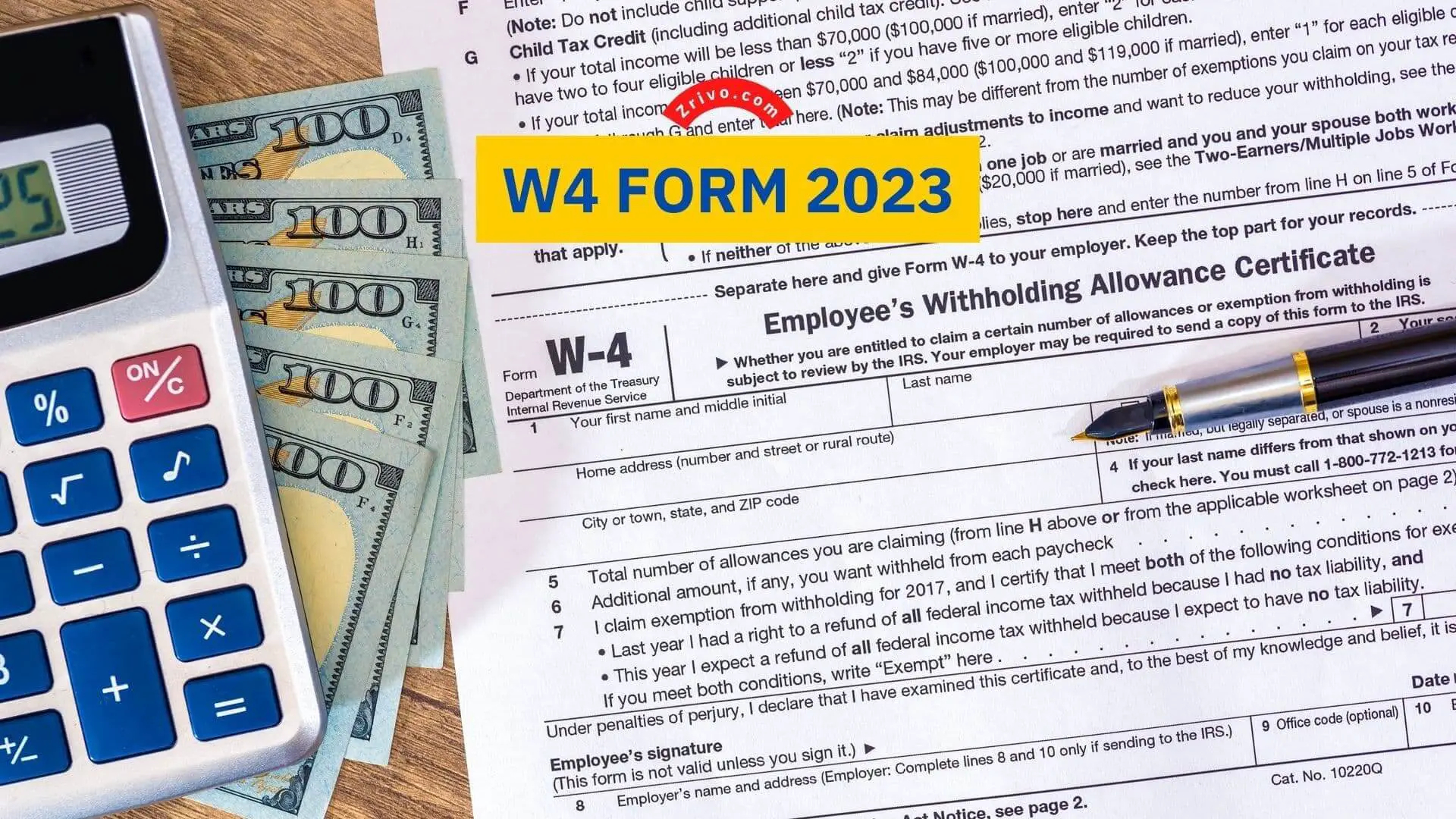

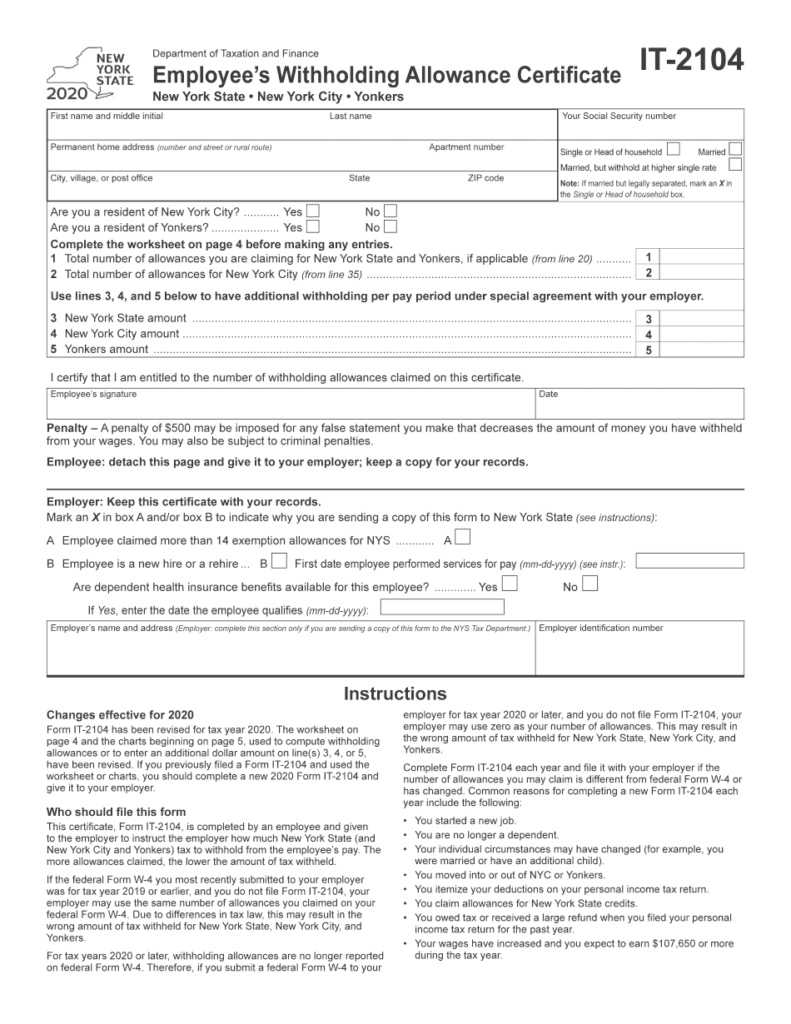

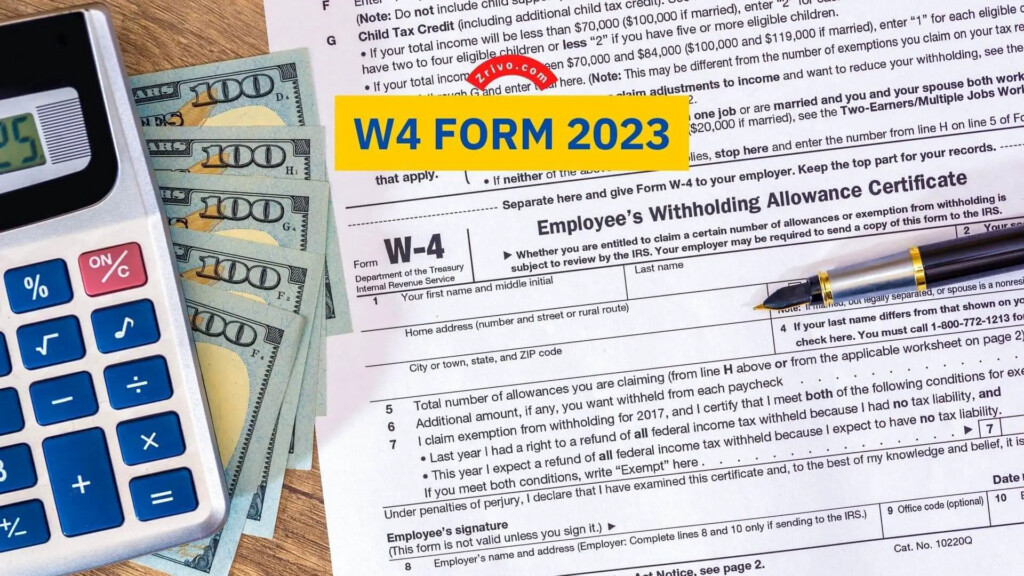

The amount of withholding allowances that were requested

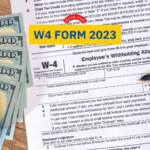

You must specify how many withholding allowances you wish to claim on the Form W-4 you fill out. This is important because the tax withheld will affect the amount taken out of your paycheck.

There are many variables that influence the amount of allowances you can apply for. If you’re married you may be eligible for a head-of-household exemption. Your income level can also affect the number of allowances available to you. You could be eligible to claim more allowances if make a lot of money.

It could save you a lot of money by choosing the correct amount of tax deductions. Even better, you might even receive a tax refund if your annual income tax return has been completed. But, you should be careful about how you approach the tax return.

Do your research, as you would in any financial decision. Calculators will help you determine the number of withholdings that need to be claimed. You may also talk to a specialist.

Specifications to be filed

Employers are required to report any withholding tax that is being collected from employees. The IRS may accept forms to pay certain taxes. A tax reconciliation for withholding, an annual tax return for quarterly filing, or an annual tax return are some examples of additional paperwork you might have to file. Here’s some details about the different tax forms and when they need to be filed.

You may have to file tax returns for withholding for the income you receive from employees, like bonuses or commissions. You may also have to file for salary. If you make sure that your employees are paid on time, then you could be eligible for the refund of taxes that you withheld. Be aware that certain taxes could be considered to be county taxes, is also vital. There are certain methods of withholding that are suitable in certain situations.

Electronic submission of withholding forms is required under IRS regulations. Your Federal Employer Identification Number should be listed on your national revenue tax return. If you don’t, you risk facing consequences.