Idaho Income Tax Withholding Forms – There are many reasons that one could fill out a form for withholding. This includes the need for documentation, exemptions to withholding and the amount of withholding allowances. No matter the reason for the filing of an application there are certain aspects that you need to remember.

Withholding exemptions

Nonresident aliens are required to submit Form 1040-NR at least once per year. You could be eligible to apply for an exemption for withholding tax when you meet the conditions. There are exemptions available on this page.

For submitting Form 1040-NR include Form 1042-S. To report federal income tax purposes, this form provides the withholding process of the agency responsible for withholding. Fill out the form correctly. You may have to treat a single individual if you do not provide the correct information.

Nonresident aliens have a 30% withholding tax. An exemption from withholding may be available if you have a tax burden that is less than 30 percent. There are many exclusions. Certain exclusions are only for spouses or dependents like children.

Generally, a refund is accessible for Chapter 4 withholding. As per Sections 1471 to 1474, refunds are granted. The refunds are made by the withholding agents who is the person who withholds taxes at source.

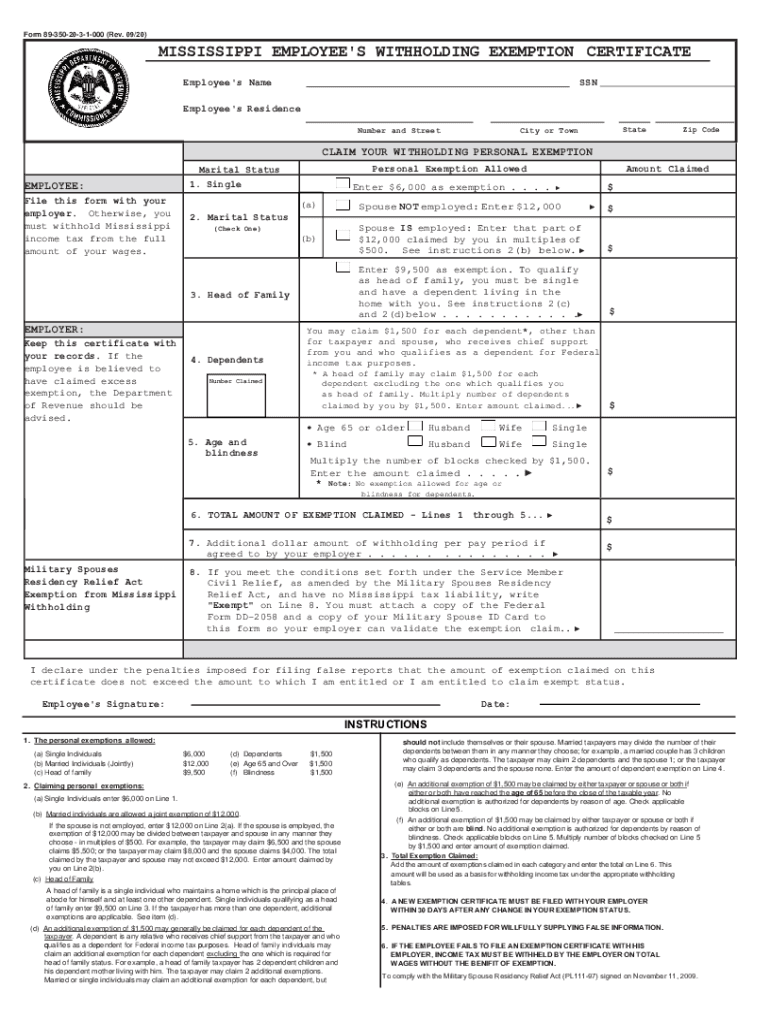

Relational status

The proper marital status and withholding forms will ease your work and that of your spouse. The bank could be shocked by the amount of money that you deposit. It is difficult to decide what option you will choose. You should be careful what you do. False decisions can lead to costly results. You won’t have any issues when you follow the directions and be attentive. If you’re lucky enough you’ll make new friends while on the road. Today marks the anniversary of your wedding. I’m sure you’ll be capable of using this against them to obtain the elusive wedding ring. It is best to seek the advice of a tax professional certified to ensure you’re doing it right. It’s worthwhile to create wealth over the course of a lifetime. There are tons of online resources that can provide you with information. TaxSlayer, a reputable tax preparation company is among the most helpful.

There are many withholding allowances being requested

It is important to specify the amount of withholding allowances which you want to claim in the form W-4. This is important as it will impact how much tax you receive from your wages.

You could be eligible to request an exemption for your head of household in the event that you are married. The amount you earn can affect the number of allowances accessible to you. If you have a high income, you could be eligible to request an increased allowance.

A tax deduction that is suitable for you can aid you in avoiding large tax payments. Even better, you might be eligible for a refund when your annual income tax return has been completed. You need to be careful when it comes to preparing this.

In every financial decision, you should be aware of the facts. To figure out the amount of tax withholding allowances to be claimed, you can utilize calculators. In addition, you may speak with an expert.

filing specifications

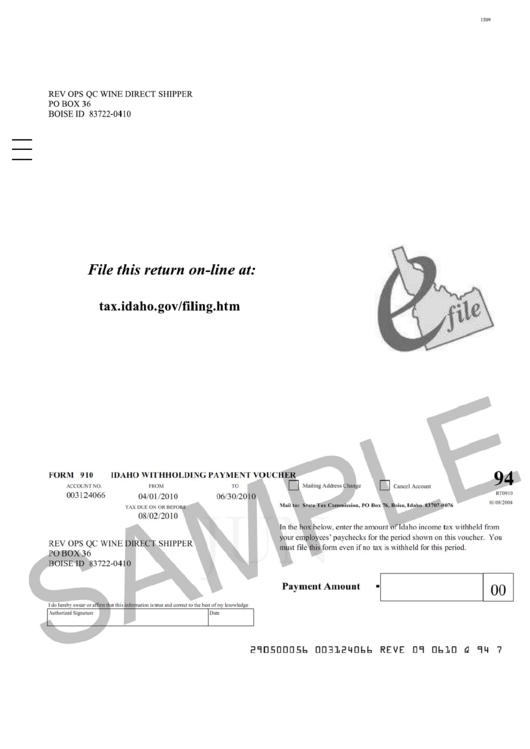

Withholding tax from your employees must be collected and reported when you’re an employer. For certain taxes you can submit paperwork to the IRS. It is possible that you will require additional documentation , like a withholding tax reconciliation or a quarterly tax return. Here’s some information about the different tax forms for withholding categories and the deadlines for filing them.

To be eligible for reimbursement of tax withholding on pay, bonuses, commissions or any other earnings that your employees receive, you may need to submit withholding tax return. You may also be eligible to be reimbursed for tax withholding if your employees received their wages in time. Remember that these taxes could also be considered local taxes. You may also find unique withholding procedures that can be used in specific situations.

In accordance with IRS regulations Electronic filing of forms for withholding are required. If you are filing your tax returns for the national income tax ensure that you provide your Federal Employee Identification Number. If you don’t, you risk facing consequences.