Https Titansecurity.icims.com Forms Form Il_withholding_stv&item 51138 – There are numerous reasons that a person may decide to submit an application for withholding. This includes the documentation requirements, withholding exclusions, and the requested withholding allowances. It is important to be aware of these aspects regardless of why you choose to fill out a form.

Withholding exemptions

Non-resident aliens have to file Form 1040 NR once per year. You may be eligible to file an exemption form for withholding tax in the event that you meet all requirements. This page you’ll see the exemptions that are that you can avail.

When submitting Form1040-NR, Attach Form 1042S. The form is used to declare the federal income tax. It provides the details of the withholding by the withholding agent. Make sure you enter the right information when you fill in the form. One individual may be treated if this information is not entered.

Non-resident aliens are subject to the 30% tax withholding rate. Your tax burden must not exceed 30% in order to be exempt from withholding. There are many exclusions. Some are for spouses and dependents, like children.

Generally, withholding under Chapter 4 allows you to claim an amount of money back. In accordance with Section 1471 through 1474, refunds are granted. These refunds are provided by the withholding agent (the person who collects tax at source).

Status of relationships

You and your spouse’s work is made simpler by a proper marriage-related status withholding document. You’ll be amazed by the amount that you can deposit at the bank. It is difficult to decide which one of the options you’ll pick. There are certain that you shouldn’t do. The wrong decision can cost you dearly. There’s no problem If you simply follow the directions and be attentive. If you’re lucky you might make new acquaintances on your trip. In the end, today is the date of your wedding anniversary. I’m sure you’ll utilize it against them to locate that perfect ring. In order to complete the job correctly it is necessary to seek the assistance of a certified tax expert. It’s worthwhile to accumulate wealth over the course of a lifetime. There are a myriad of websites that offer information. TaxSlayer is one of the most trusted and respected tax preparation companies.

There are many withholding allowances being made available

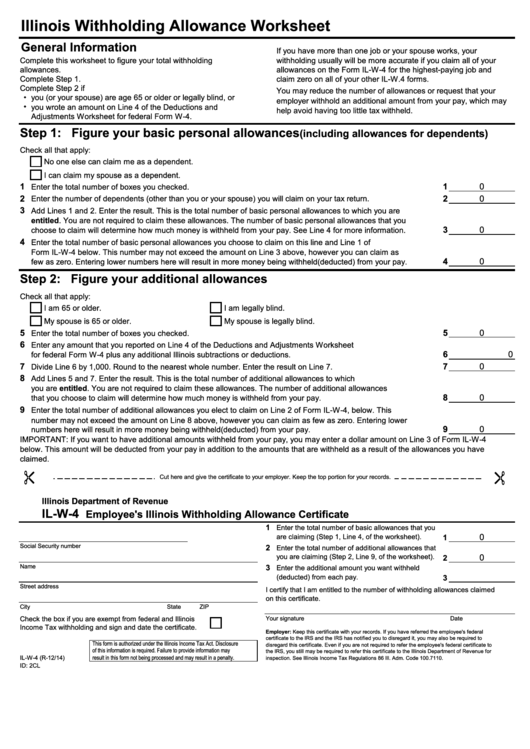

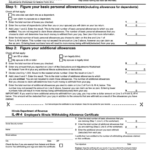

The form W-4 should be completed with the amount of withholding allowances that you wish to claim. This is important because the tax withheld will impact how much is taken from your paycheck.

Many factors influence the amount you qualify for allowances. The amount you earn will also impact the amount of allowances you’re qualified to receive. A larger allowance might be available if you earn lots of money.

Selecting the appropriate amount of tax deductions might allow you to avoid a significant tax payment. If you file your annual tax returns and you are eligible for a refund. However, you must choose your approach carefully.

Like every financial decision, you should be aware of the facts. Calculators can help determine how many withholding amounts should be claimed. It is also possible to speak with a specialist.

Filing specifications

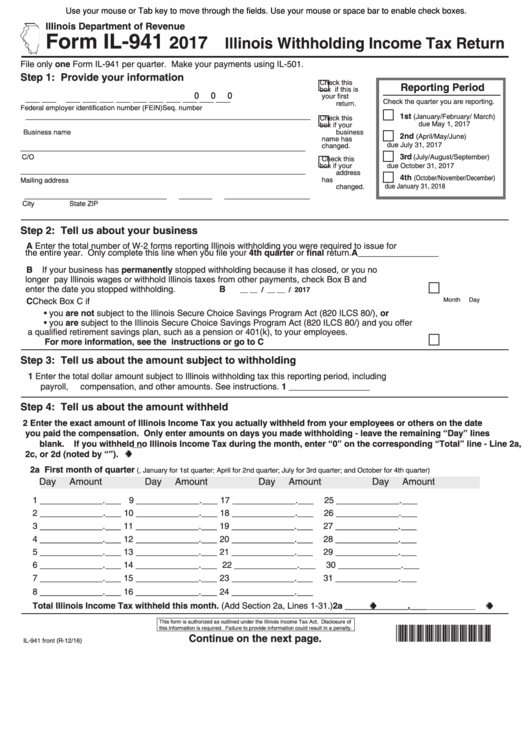

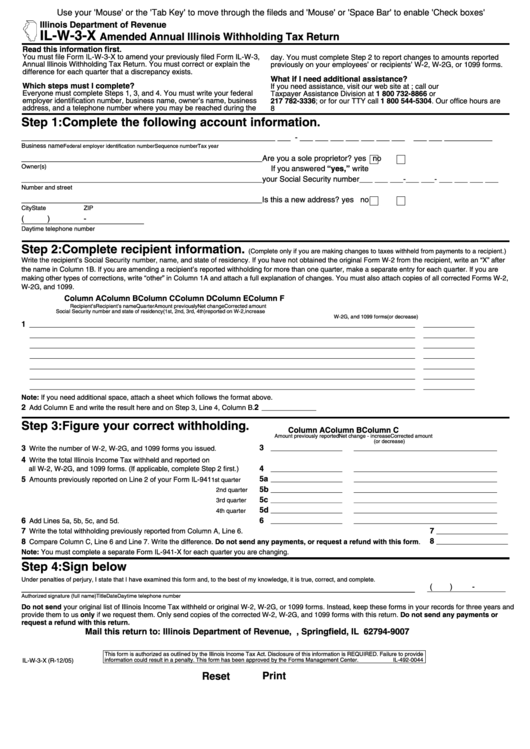

Employers should report the employer who withholds taxes from employees. Some of these taxes may be submitted to the IRS through the submission of paperwork. You might also need additional documentation , like a withholding tax reconciliation or a quarterly tax return. Here are some information on the different types of tax withholding forms and the deadlines for filing.

The bonuses, salary, commissions, and other earnings you earn from your employees may require you to file tax returns withholding. If you pay your employees promptly, you could be eligible for reimbursement of taxes withheld. It is important to note that certain taxes are also county taxes ought to be taken into consideration. There are specific withholding strategies that may be suitable in certain circumstances.

According to IRS regulations Electronic submissions of withholding forms are required. Your Federal Employer Identification Number must be listed when you submit your national revenue tax return. If you don’t, you risk facing consequences.