Https Te.icims.com Forms Form Nc_withholding_stv&item 945847 – There stand a digit of reasons why someone might choose to complete a withholding form. This is due to the requirement for documentation, exemptions to withholding and the amount of withholding allowances. There are a few points to be aware of, regardless of the reason a person files an application.

Exemptions from withholding

Nonresident aliens are required once a year to submit Form1040-NR. If the requirements are met, you could be eligible for an exemption from withholding. There are exemptions accessible to you on this page.

To file Form 1040-NR the first step is attaching Form 1042S. This form provides details about the withholding that is performed by the tax agency that handles withholding for federal income tax reporting to be used for reporting purposes. Make sure you enter the correct information when you fill in the form. This information might not be disclosed and result in one person being treated differently.

The tax withholding rate for non-resident aliens is 30 percent. Your tax burden is not to exceed 30% in order to be eligible for exemption from withholding. There are several different exclusions that are available. Some of them are intended for spouses, while others are designed to be used by dependents like children.

Generally, withholding under Chapter 4 entitles you for an amount of money back. Refunds may be granted in accordance with Sections 1400 through 1474. The withholding agent or the individual who withholds the tax at source is the one responsible for distributing these refunds.

Status of the relationship

You and your spouse’s work can be made easier by a proper marriage status withholding form. Furthermore, the amount of money you may deposit in the bank will pleasantly delight you. The problem is deciding what option to select. You must be cautious in what you do. A bad decision could result in a costly loss. However, if you adhere to the directions and be alert to any possible pitfalls, you won’t have problems. If you’re lucky, you might find some new acquaintances while driving. Today is your birthday. I’m hoping they turn it against you to get you the elusive engagement ring. To do it right you’ll need the assistance of a certified accountant. The little amount is enough for a lifetime of wealth. Online information is easily accessible. Reputable tax preparation firms like TaxSlayer are one of the most useful.

There are numerous withholding allowances that are being requested

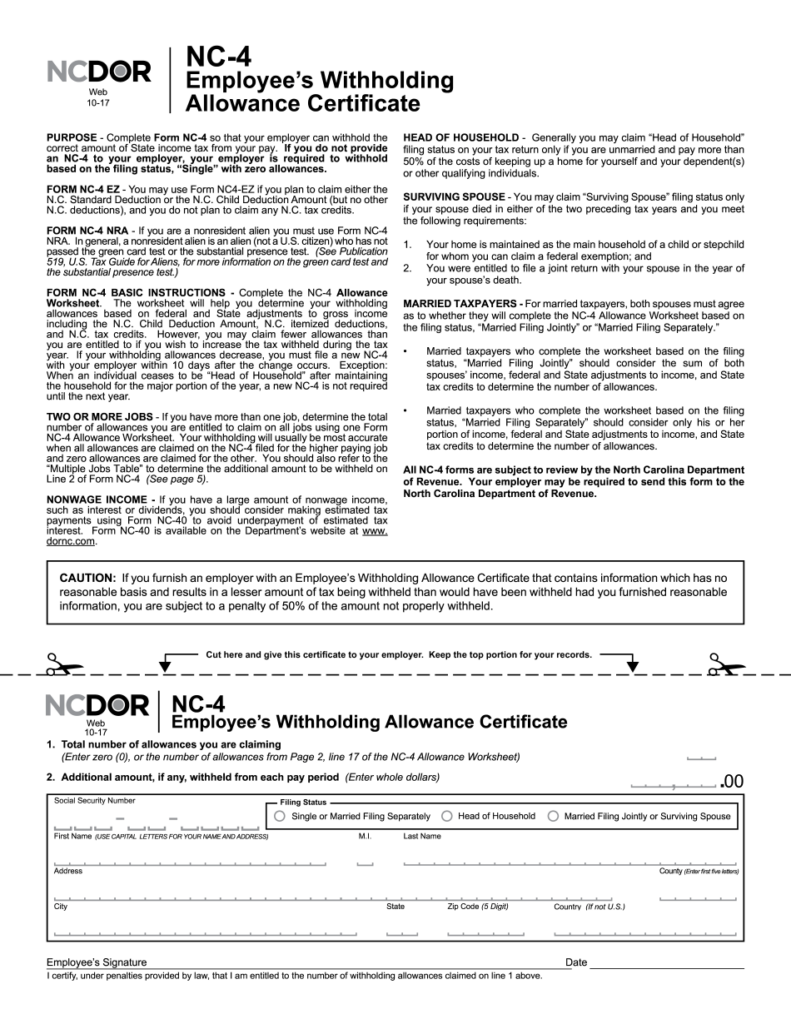

The Form W-4 must be filled in with the amount of withholding allowances that you want to take advantage of. This is important since the tax amount taken from your paychecks will be affected by the much you withhold.

The amount of allowances you receive will depend on various factors. For example when you’re married, you may be qualified for a head or household exemption. Your income will affect the amount of allowances you are eligible for. If you earn a high amount, you might be eligible to receive higher amounts.

It is possible to reduce the amount of your tax bill by deciding on the correct amount of tax deductions. In fact, if you file your annual income tax return, you may even get a refund. But you need to pick the right method.

Do your research, as you would with any other financial decision. To figure out the amount of tax withholding allowances that need to be claimed, you can utilize calculators. You can also speak to an expert.

Formulating specifications

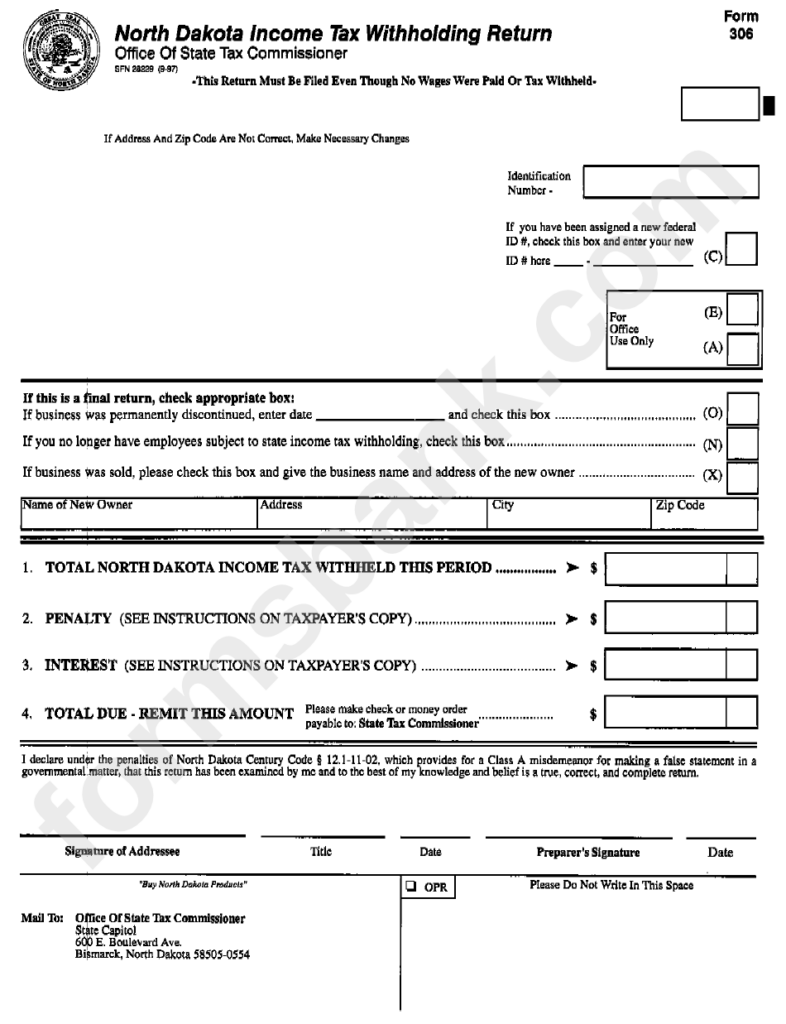

Employers are required to report any withholding tax that is being collected from employees. If you are taxed on a specific amount, you may submit paperwork to IRS. An annual tax return, quarterly tax returns or withholding tax reconciliation are all examples of paperwork you might require. Here’s some details about the different tax forms, and when they need to be submitted.

You might have to file tax returns for withholding to claim the earnings you earn from your employees, including bonuses and commissions or salaries. Additionally, if you pay your employees in time, you may be eligible for reimbursement of taxes withheld. Remember that these taxes can be considered as local taxes. You may also find unique withholding rules that can be used in specific situations.

Electronic filing of withholding forms is required under IRS regulations. The Federal Employer Identification Number should be listed when you submit your national revenue tax return. If you don’t, you risk facing consequences.

Gallery of Https Te.icims.com Forms Form Nc_withholding_stv&item 945847

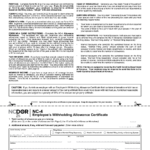

North Carolina Employee Withholding Form 2022 WithholdingForm