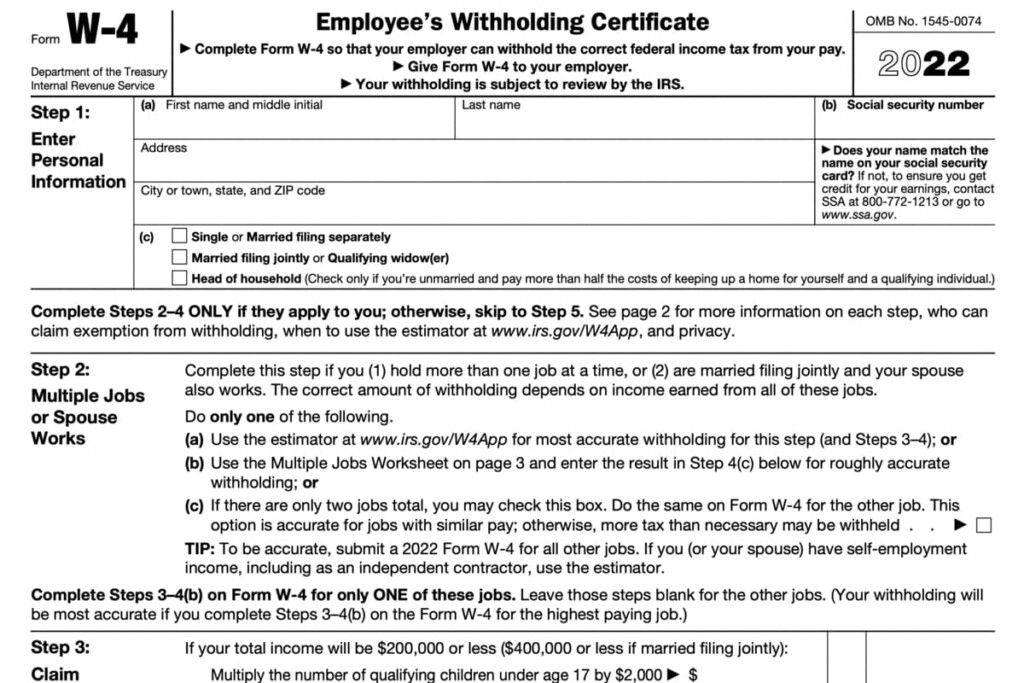

Https Irobot.icims.com Forms Form Ca_withholding_2023_template&item 63722 – There are a variety of reasons why a person could choose to submit a withholding application. The requirements for documentation, exemptions from withholding as well as the quantity of withholding allowances requested are all factors. You should be aware of these factors regardless of the reason you decide to submit a request form.

Exemptions from withholding

Non-resident aliens must submit Form 1040–NR every calendar year. If you meet these conditions, you could be eligible for an exemption from the form for withholding. You will discover the exclusions accessible to you on this page.

The first step to submitting Form 1040 – NR is to attach Form 1042 S. This form is a record of the withholdings that the agency makes. Make sure you fill out the form correctly. One individual may be treated differently if this information is not entered.

The non-resident alien withholding tax is 30 percent. Your tax burden is not to exceed 30% to be exempt from withholding. There are many different exemptions. Some are specifically for spouses, and dependents, like children.

Generallyspeaking, withholding in Chapter 4 allows you to claim the right to a refund. Refunds can be claimed under sections 1401, 1474 and 1475. These refunds are provided by the agent who withholds tax (the person who is responsible for withholding tax at source).

Status of relationships

The proper marital status and withholding forms can simplify your work and that of your spouse. You’ll be surprised at how much money you can put in the bank. The problem is deciding what option to choose. You must be cautious in with what you choose to do. It will be expensive to make the wrong choice. But if you follow it and pay attention to the instructions, you won’t have any issues. It is possible to make new friends if you are fortunate. Today is the anniversary day of your wedding. I hope you are able to use this against them in order to acquire the elusive wedding ring. It’s a complex job that requires the knowledge of an accountant. A small amount of money can make a lifetime of wealth. There is a wealth of information on the internet. TaxSlayer as well as other reliable tax preparation firms are some of the most reliable.

The amount of withholding allowances claimed

It is important to specify the amount of the withholding allowance you want to claim in the W-4 form. This is critical since your wages could be affected by the amount of tax that you pay.

You may be able to claim an exemption for the head of your household in the event that you are married. The amount you earn will also impact the amount of allowances you’re entitled to. An additional allowance could be granted if you make an excessive amount.

The right amount of tax deductions can save you from a large tax cost. If you submit your annual income tax returns, you may even be entitled to a refund. But you need to pick the right method.

It is essential to do your homework, just like you would with any other financial decision. Calculators can be used for determining how many withholding allowances must be made. You can also speak to an expert.

Submission of specifications

Employers must report the employer who withholds taxes from their employees. The IRS may accept forms to pay certain taxes. Additional paperwork that you may be required to file include an withholding tax reconciliation and quarterly tax returns and the annual tax return. Below are details on the different forms of withholding taxes as well as the deadlines to file them.

The bonuses, salary commissions, other income you get from your employees could require you to file tax returns withholding. You could also be eligible to get reimbursements of taxes withheld if you’re employees received their wages promptly. Be aware that certain taxes may be county taxes. There are also unique withholding rules that can be used in specific circumstances.

Electronic submission of forms for withholding is mandatory according to IRS regulations. When you file your tax returns for national revenue ensure that you provide the Federal Employee Identification Number. If you don’t, you risk facing consequences.