Https Heartland.icims.com Forms Form In_withholding_2023_template&item 251170 – There are a variety of reasons one might decide to fill out a form for withholding form. These factors include documentation requirements as well as exemptions from withholding, as well as the amount of withholding allowances. Whatever the motive someone has to fill out the Form, there are several aspects to keep in mind.

Exemptions from withholding

Nonresident aliens are required to complete Form 1040-NR every year. If you meet these conditions, you could be eligible for an exemption from the form for withholding. The exclusions are that you can access on this page.

To submit Form 1040-NR the first step is to attach Form 1042S. This form is a record of the withholdings that are made by the agency. When you fill out the form, ensure that you provide the accurate details. One individual may be treated if this information is not entered.

The non-resident alien withholding rate is 30%. Exemption from withholding could be granted if you have a an income tax burden of less than 30%. There are many exemptions. Some are specifically for spouses, or dependents, for example, children.

In general, withholding under Chapter 4 gives you the right to a return. Refunds are available under sections 1401, 1474 and 1475. Refunds are provided by the withholding agent. This is the individual responsible for withholding the tax at the source.

Status of the relationship

An official marriage status withholding form will help your spouse and you both get the most out of your time. You’ll be amazed by the amount you can deposit to the bank. The challenge is choosing the right option from the multitude of options. There are certain things to avoid. A bad decision could cause you to pay a steep price. If you stick to it and pay attention to the directions, you shouldn’t have any issues. If you’re fortunate you could even meet a few new pals while traveling. Today is the day you celebrate your wedding. I’m hoping that they will reverse the tide to help you get that elusive engagement ring. In order to complete the job correctly it is necessary to obtain the assistance from a qualified tax professional. The small amount is well enough for a lifetime of wealth. There is a wealth of details online. TaxSlayer is a well-known tax preparation business is among the most useful.

There are a lot of withholding allowances being made available

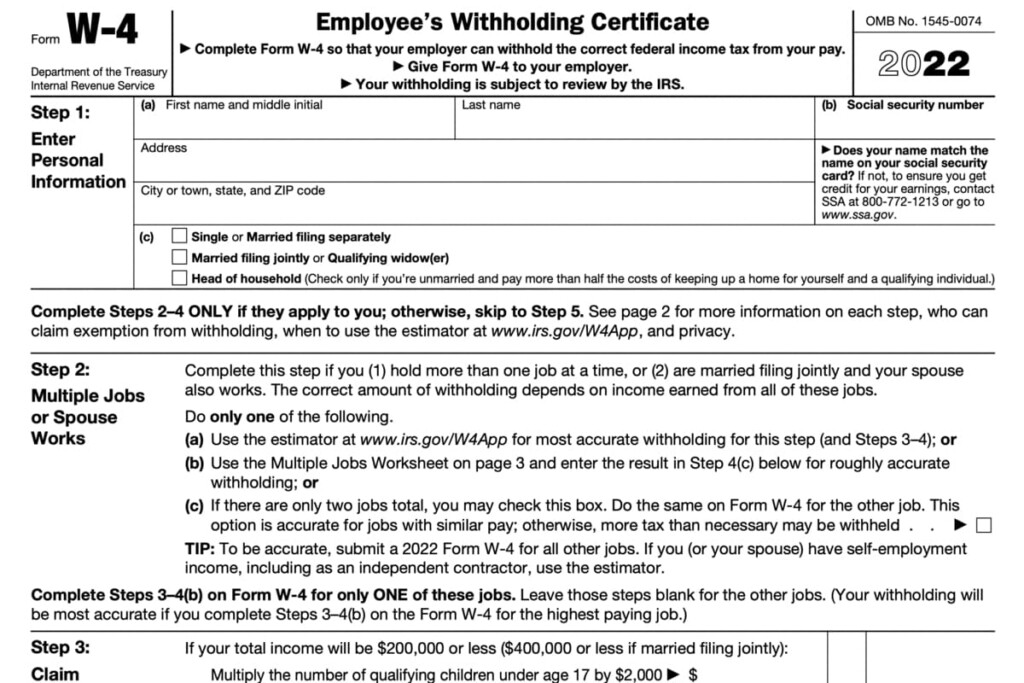

When submitting Form W-4, you must specify how many withholdings allowances you would like to claim. This is important because the tax withheld can affect the amount taken out of your pay check.

The amount of allowances you are entitled to will be determined by a variety of factors. For example If you’re married, you could be qualified for an exemption for the head of household or for the household. The amount of allowances you are eligible for will be contingent on your income. If you earn a high amount, you might be eligible to receive more allowances.

A tax deduction that is appropriate for your situation could help you avoid large tax payments. Refunds could be possible if you submit your tax return on income for the current year. But you need to pick your approach wisely.

Research as you would with any other financial decision. Calculators can assist you in determining the amount of withholding that should be demanded. Another option is to talk with a professional.

Filing requirements

Employers should report the employer who withholds taxes from employees. It is possible to submit documents to the IRS for some of these taxes. A tax reconciliation for withholding or the quarterly tax return as well as an annual tax return are examples of additional documents you could be required to submit. Here’s a brief overview of the different tax forms and when they must be filed.

You may have to file tax returns for withholding to claim the earnings you earn from employees, including bonuses, commissions, or salary. Additionally, if employees are paid in time, you could be eligible for tax refunds for withheld taxes. It is crucial to remember that there are a variety of taxes that are local taxes. Furthermore, there are special methods of withholding that are applied under particular situations.

You have to submit electronically withholding forms according to IRS regulations. Your Federal Employer Identification Number should be listed on to your national tax return. If you don’t, you risk facing consequences.