Https Cvph.icims.com Forms Form Ny_withholding_it_2104_stv&item 38991 – There are a variety of reasons an individual might decide to fill out forms for withholding. The reasons include the need for documentation, withholding exemptions, and the quantity of requested withholding allowances. It doesn’t matter what motive someone has to fill out a Form, there are several points to be aware of.

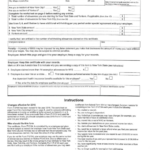

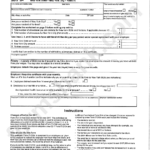

Exemptions from withholding

Nonresident aliens are required once a year to submit Form1040-NR. If you meet the requirements you could be eligible for an exemption to withholding. The exemptions listed on this page are yours.

The first step to submitting Form 1040 – NR is attaching Form 1042 S. The form contains information on the withholding done by the tax agency that handles withholding for federal income tax reporting to be used for reporting purposes. When filling out the form ensure that you provide the correct information. If this information is not given, a person could be taken into custody.

The non-resident alien withholding rate is 30 percent. If your tax burden is less than 30 percent of your withholding you may be eligible to receive an exemption from withholding. There are numerous exemptions. Some are specifically for spouses, and dependents, like children.

You may be entitled to refunds if you have violated the provisions of chapter 4. As per Sections 1471 to 1474, refunds are given. The withholding agent or the individual who is responsible for withholding the tax at source is responsible for the refunds.

Relational status

Your and your spouse’s job can be made easier with a valid marital status withholding form. You’ll be amazed by the amount you can deposit to the bank. The difficulty lies in choosing the right option from the multitude of choices. There are certain things you must be aware of. You will pay a lot when you make a bad decision. You won’t have any issues if you just adhere to the instructions and be attentive. You might make some new acquaintances if you’re fortunate. Today is your birthday. I’m hoping they can reverse the tide to help you get the elusive engagement ring. If you want to get it right, you will need the aid of a qualified accountant. It’s worthwhile to create wealth over the course of a lifetime. There is a wealth of details online. TaxSlayer is among the most trusted and respected tax preparation firms.

Number of withholding allowances requested

It is important to specify the number of withholding allowances you wish to claim on the form W-4 that you file. This is important because your pay will depend on the tax amount that you pay.

A variety of factors influence the amount of allowances requested.If you’re married, as an example, you could be eligible to claim a head of household exemption. You can also claim more allowances depending on how much you earn. If you earn a higher income, you can request an increase in your allowance.

You might be able to reduce the amount of your tax bill by deciding on the right amount of tax deductions. If you file your annual income tax return, you might even receive a refund. Be cautious regarding how you go about this.

Similar to any financial decision, it is important that you should do your homework. Calculators can be used for determining how many withholding allowances are required to be made. Another option is to talk to a professional.

Formulating specifications

Withholding taxes from employees need to be collected and reported if you’re an employer. Certain of these taxes can be submitted to the IRS through the submission of paperwork. A tax reconciliation for withholding or the quarterly tax return or an annual tax return are all examples of additional documents you could have to file. Here’s some details on the various withholding tax form categories, as well as the deadlines to filing them.

To be eligible for reimbursement of withholding tax on the salary, bonus, commissions or any other earnings earned by your employees it is possible to submit a tax return withholding. It is also possible to receive reimbursement for tax withholding if your employees received their wages promptly. Noting that certain of these taxes may be taxes imposed by the county, is crucial. Additionally, there are unique tax withholding procedures that can be applied under particular conditions.

Electronic filing of withholding forms is required under IRS regulations. When you submit your tax return for national revenue, please provide your Federal Employer Identification number. If you don’t, you risk facing consequences.