How To Register Form Sc Withholding Tax – There are many reasons someone could choose to submit an application for withholding. This includes documentation requirements and exemptions for withholding. Whatever the reasons someone is deciding to file the Form, there are several points to be aware of.

Exemptions from withholding

Non-resident aliens must complete Form 1040-NR once per year. If you meet the criteria, you could be eligible for an exemption to withholding. The following page lists all exemptions.

The attachment of Form 1042-S is the first step in submitting Form 1040-NR. This form is used to declare the federal income tax. It outlines the amount of withholding that is imposed by the tax withholding agent. When you fill out the form, ensure that you provide the exact details. One individual may be treated if the information is not supplied.

The non-resident alien withholding rate is 30 percent. An exemption from withholding may be available if you have an income tax burden of lower than 30%. There are numerous exemptions. Some are for spouses and dependents, such as children.

Generally, withholding under Chapter 4 allows you to claim the right to a refund. Refunds are granted according to Sections 1471-1474. Refunds are to be given by the tax withholding agents, which is the person who collects taxes at the source.

Relational status

A valid marital status and withholding forms can simplify the job of both you and your spouse. Additionally, the quantity of money that you can deposit at the bank can be awestruck. It can be difficult to choose what option you will choose. There are certain items you must avoid. Unwise decisions could lead to costly consequences. If you stick to the instructions and keep your eyes open for any potential pitfalls You won’t face any issues. If you’re lucky to meet some new acquaintances on the road. Today marks the anniversary. I’m hoping they turn it against you to get you the elusive engagement ring. It’s a complex job that requires the knowledge of an expert in taxation. This small payment is well worth the lifetime of wealth. You can find tons of information online. TaxSlayer is a reputable tax preparation firm.

There are many withholding allowances that are being claimed

You need to indicate how many withholding allowances to claim on the Form W-4 that you file. This is crucial since the withholdings can have an impact on how much tax is taken out of your paychecks.

You may be able to apply for an exemption on behalf of the head of your household if you are married. Your income also determines how many allowances you are entitled to. If you earn a high amount it could be possible to receive higher amounts.

You may be able to reduce the amount of your tax bill by selecting the right amount of tax deductions. If you file your annual income tax return, you could even get a refund. However, you must choose the right method.

As with any financial decision, you must be aware of the facts. Calculators are available to assist you in determining how much withholding allowances you can claim. A better option is to consult with a specialist.

Specifications to be filed

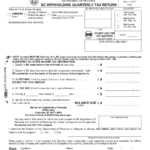

Withholding taxes on employees need to be reported and collected when you’re an employer. If you are unable to collect these taxes, you may provide documentation to the IRS. Additional paperwork that you may require to submit includes an withholding tax reconciliation and quarterly tax returns and an annual tax return. Below is information about the different types of withholding taxes as well as the deadlines to file them.

Withholding tax returns may be required to prove income such as salary, bonuses or commissions as well as other earnings. You could also be eligible to receive reimbursement for tax withholding if your employees received their wages on time. The fact that certain taxes are county taxes should be considered. In certain circumstances there are rules regarding withholding that can be unique.

As per IRS regulations Electronic filings of tax withholding forms are required. When you file your national revenue tax return, please include your Federal Employer Identification number. If you don’t, you risk facing consequences.