How To Reduce North Carolina State Withholdings On Tax Form – There stand a digit of explanations why somebody could decide to fill out a tax form. This includes the need for documentation, withholding exemptions and also the amount of required withholding allowances. No matter the reasons someone is deciding to file an Application There are a few points to be aware of.

Withholding exemptions

Non-resident aliens are required to file Form 1040-NR at least once per year. If your requirements are met, you may be eligible to apply for an exemption from withholding. You will discover the exclusions that you can access on this page.

The application of Form 1042-S to Form 1042-S is a first step in submitting Form 1040-NR. This form is used to report the federal income tax. It provides the details of the withholding of the withholding agent. Make sure you enter the right information when filling in this form. If this information is not supplied, one person may be diagnosed with a medical condition.

Nonresident aliens have 30 percent withholding tax. An exemption from withholding may be granted if you have a an income tax burden of less than 30 percent. There are many exclusions. Certain of them apply to spouses or dependents like children.

In general, the withholding section of chapter 4 gives you the right to an amount of money. Refunds are permitted under Sections 1471-1474. Refunds are provided by the tax agent. This is the person responsible for withholding the tax at the source.

Relationship status

The marital withholding form is a good way to make your life easier and aid your spouse. You’ll be amazed at how much money you can put in the bank. Choosing which of the possibilities you’re likely pick is the tough part. There are certain things you must avoid. Making the wrong choice could cause you to pay a steep price. If you stick to the directions and watch out for any pitfalls You won’t face any issues. If you’re fortunate you may even meet a few new pals when you travel. Today is your birthday. I’m hoping that you can leverage it to secure that dream ring. It will be a complicated task that requires the expertise of an expert in taxation. It’s worthwhile to accumulate wealth over the course of your life. It is a good thing that you can access many sources of information online. TaxSlayer as well as other reliable tax preparation companies are some of the most reliable.

Number of claimed withholding allowances

When submitting Form W-4, you need to specify how many withholdings allowances you would like to claim. This is crucial because the amount of tax withdrawn from your paycheck will be affected by the you withhold.

You could be eligible to request an exemption for your spouse in the event that you are married. The amount you are eligible for will be contingent on the income you earn. If you have a high income, you may be eligible for a higher allowance.

Making the right choice of tax deductions could help you avoid a hefty tax payment. You could actually receive an income tax refund when you file your annual income tax return. But it is important to select the correct method.

Do your research, like you would with any other financial decision. Calculators can be utilized to determine the amount of withholding allowances you should claim. A better option is to consult to a professional.

Specifications that must be filed

Employers are required to report any withholding taxes being paid by employees. For a limited number of the taxes, you are able to submit paperwork to IRS. You might also need additional documents, such as a withholding tax reconciliation or a quarterly tax return. Below are information on the different tax forms that you can use for withholding as well as the deadlines for each.

Your employees may require the submission of withholding tax returns in order to receive their salary, bonuses and commissions. If your employees receive their wages in time, you could be eligible for the tax deductions you withheld. It is important to note that certain taxes are county taxes must be considered. You may also find unique withholding methods that are used in specific situations.

The IRS regulations require that you electronically file withholding documents. The Federal Employer Identification number must be listed when you point to your tax return for the nation. If you don’t, you risk facing consequences.

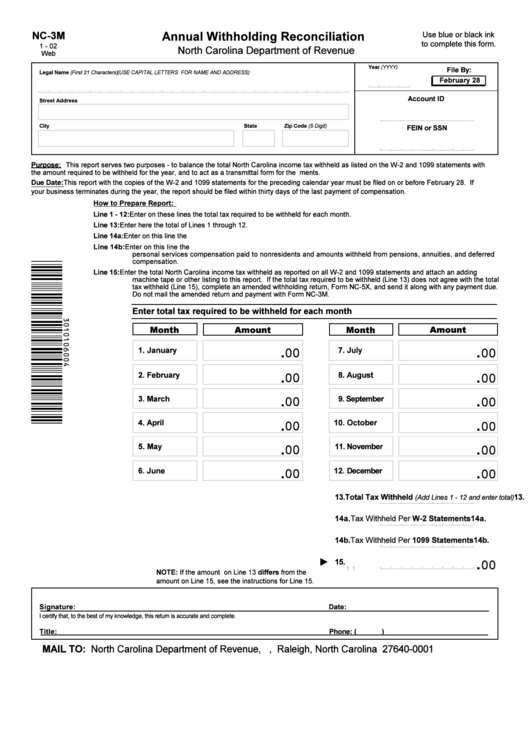

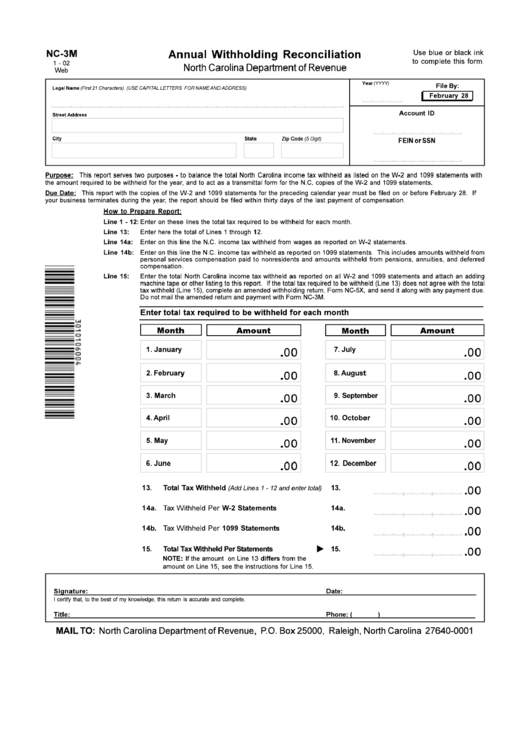

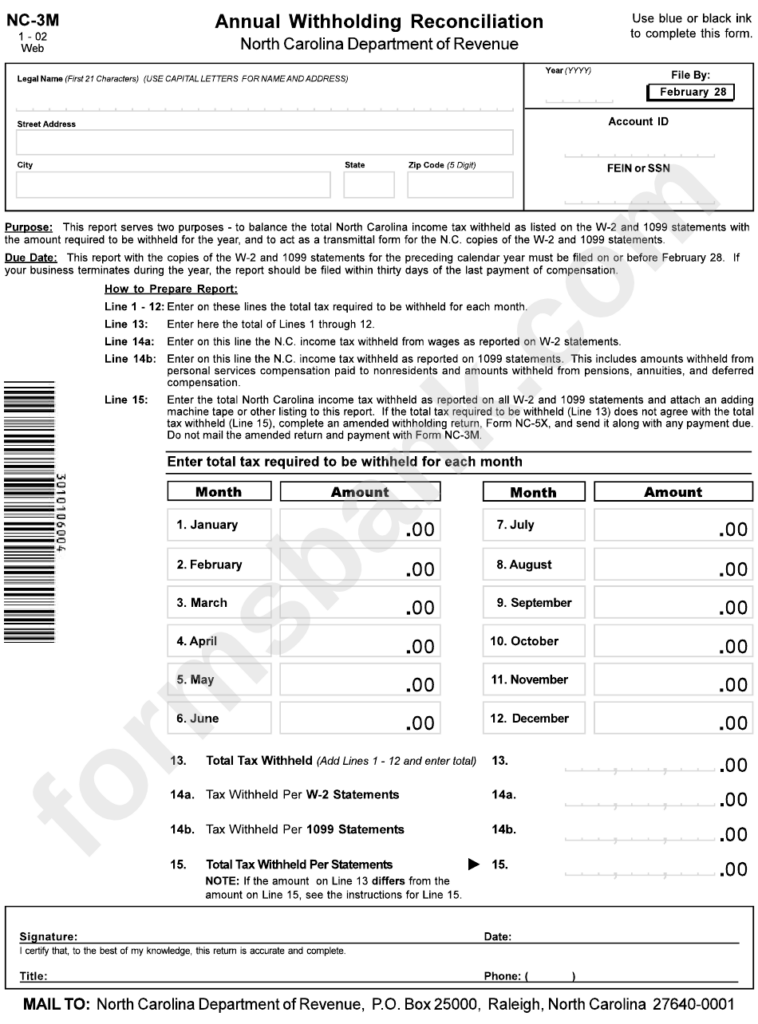

Gallery of How To Reduce North Carolina State Withholdings On Tax Form

Form Nc 3m Annual Withholding Reconciliation North Carolina