How To Fill Out State Withholding Election Form – There are a variety of reasons for a person to decide to fill out a form for withholding. These factors include documentation requirements and exemptions for withholding. There are certain points to be aware of regardless of why a person files an application.

Exemptions from withholding

Non-resident aliens must submit Form 1040–NR every calendar year. If you satisfy the requirements, you might be eligible to be exempt from withholding. The exemptions listed on this page are yours.

To complete Form 1040-NR, add Form 1042-S. The form lists the amount withheld by the tax authorities for federal income tax reporting for tax reporting purposes. Fill out the form correctly. There is a possibility for one person to be treated differently if the information isn’t provided.

Non-resident aliens are subjected to a 30% withholding rate. An exemption from withholding may be possible if you’ve got a the tax burden less than 30%. There are many exemptions. Some of them are intended for spouses, while others are meant for use by dependents, such as children.

Generally, you are eligible for a reimbursement under chapter 4. According to Sections 1471 through 1474, refunds are granted. These refunds must be made by the withholding agents, which is the person who collects taxes at source.

Status of relationships

An official marriage status withholding form will help your spouse and you both to make the most of your time. You’ll also be surprised by how much money you could make a deposit to the bank. The challenge is in deciding which of the numerous options to choose. There are certain things that you should not do. There are a lot of costs if you make a wrong decision. However, if you adhere to the guidelines and be alert for any pitfalls and pitfalls, you’ll be fine. If you’re lucky, you could make new acquaintances on your trip. Today marks the anniversary of your wedding. I’m sure you’ll use it against them to find that elusive ring. To do this correctly, you’ll need the guidance of a qualified Tax Expert. The accumulation of wealth over time is more than the modest payment. You can get a ton of information online. TaxSlayer is a reputable tax preparation company.

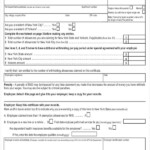

number of claimed withholding allowances

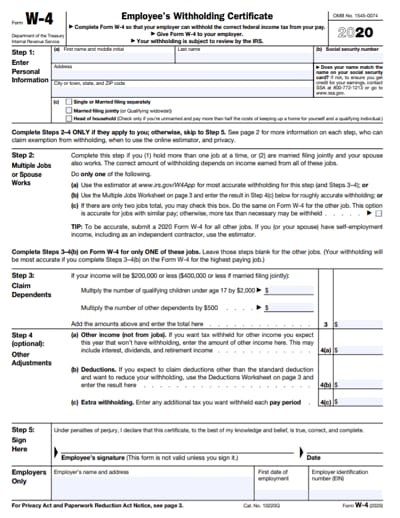

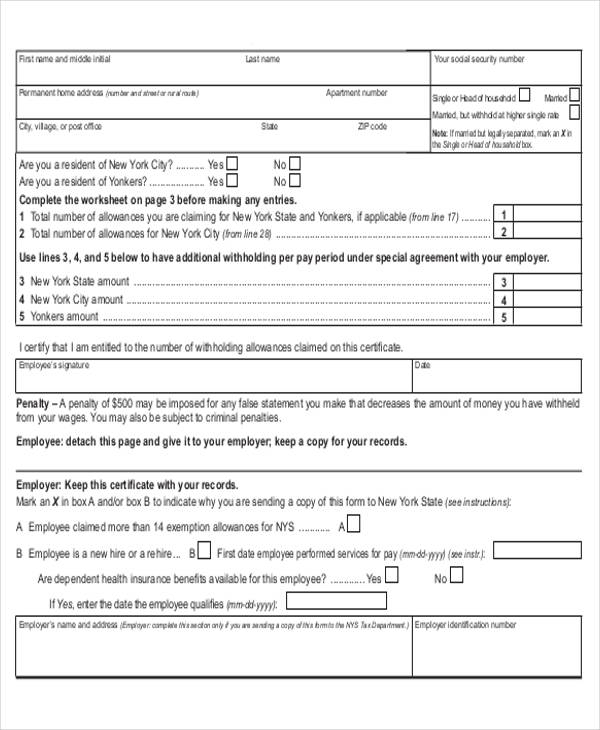

The Form W-4 must be filled out with the number of withholding allowances that you wish to claim. This is crucial since the withholdings will have an impact on how much tax is taken from your paychecks.

There are many factors which affect the amount of allowances you are able to claim. If you’re married, you might be eligible for a head-of-household exemption. You can also claim more allowances, based on how much you earn. If you earn a significant amount of income, you may be eligible for a larger allowance.

Making the right choice of tax deductions might save you from a large tax payment. If you complete your yearly income tax return, you may even receive a refund. It is essential to choose the right approach.

As with any financial decision you make it is crucial to do your homework. Calculators can assist you in determining how much withholding allowances you can claim. A professional could be a good option.

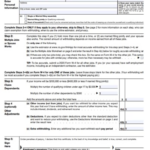

Specifications for filing

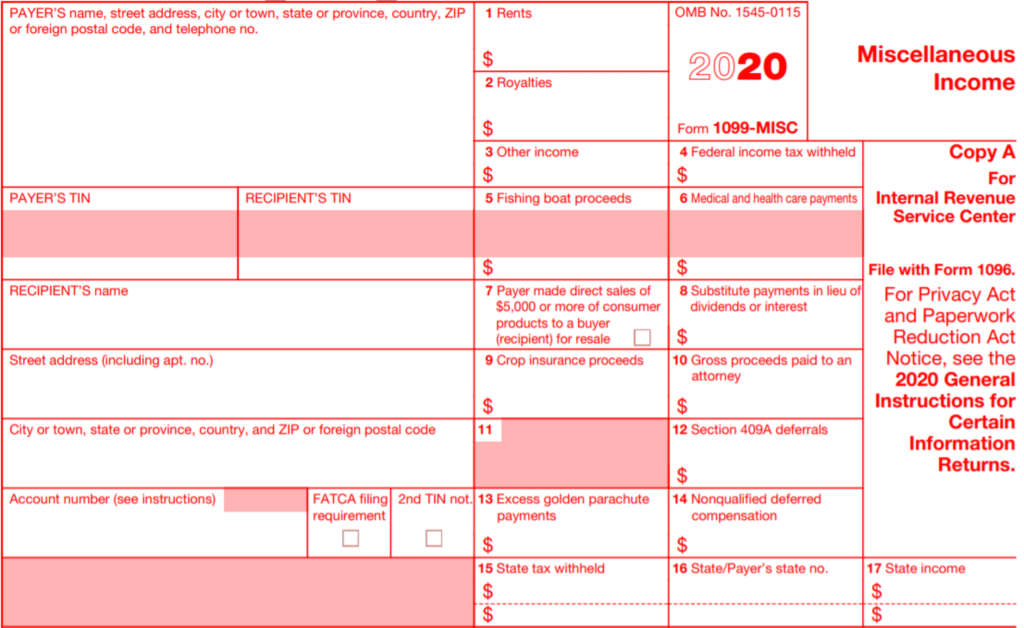

Employers are required to pay withholding taxes to their employees and then report the amount. Some of these taxes can be submitted to the IRS through the submission of paperwork. An annual tax return, quarterly tax returns or the reconciliation of withholding tax are all kinds of documentation you may require. Here’s some details about the different tax forms, and when they must be filed.

The salary, bonuses commissions, other earnings you earn from your employees could necessitate you to file withholding tax returns. If you pay your employees on time, you could be eligible for reimbursement of taxes that you withheld. It is important to note that some of these taxes are also county taxes must also be noted. In certain situations the rules for withholding can be different.

The IRS regulations require that you electronically file withholding documents. Your Federal Employer identification number should be included when you submit your national tax return. If you don’t, you risk facing consequences.