How To File An Ohio Withholding Form – There are many reasons that one could fill out the form to request withholding. This includes documentation requirements and exemptions from withholding. No matter the reason for an individual to file an application, there are certain things to keep in mind.

Exemptions from withholding

Nonresident aliens need to submit Form 1040–NR every calendar year. You could be eligible to submit an exemption form for withholding, when you meet the criteria. This page you will find the exclusions that you can avail.

To submit Form 1040-NR, attach Form 1042-S. This form provides details about the withholding that is performed by the agency responsible for withholding for federal tax reporting for tax reporting purposes. Fill out the form correctly. You could be required to treat a specific person for not providing the correct information.

The tax withholding rate for non-resident aliens is 30%. If your tax burden is lower than 30 percent of your withholding, you may be eligible to receive an exemption from withholding. There are many exemptions. Some are specifically for spouses, and dependents, like children.

Generally, you are entitled to a reimbursement in accordance with chapter 4. Refunds are granted according to Sections 1471-1474. Refunds will be made to the agent who withholds tax that is the person who collects taxes from the source.

relational status

The work of your spouse and you is made simpler by the proper marriage status withholding form. You’ll be amazed by the amount that you can deposit at the bank. The trick is to decide what option to select. You should be careful with what you choose to do. Making the wrong decision will cost you dearly. However, if you adhere to the guidelines and watch out for any potential pitfalls You won’t face any issues. If you’re lucky you might be able to make new friends during your journey. Today is the anniversary day of your wedding. I’m hoping that you can leverage it to get that elusive ring. It is best to seek the advice of a certified tax expert to finish it properly. It’s worth it to build wealth over the course of your life. There is a wealth of details online. TaxSlayer is among the most trusted and reputable tax preparation companies.

The amount of withholding allowances claimed

When filling out the form W-4 you fill out, you need to declare the amount of withholding allowances you requesting. This is crucial because the amount of tax you are able to deduct from your paychecks will depend on how much you withhold.

The amount of allowances that you receive will depend on a variety of factors. For instance, if you are married, you could be eligible for an exemption for the head of household or for the household. Additionally, you can claim additional allowances, based on how much you earn. If you earn a substantial income, you could be eligible to request a higher allowance.

Choosing the proper amount of tax deductions can help you avoid a hefty tax payment. In addition, you could even receive a tax refund if your tax return for income has been completed. You need to be careful when it comes to preparing this.

Do your research, like you would with any financial decision. Calculators can be used for determining how many withholding allowances must be made. An expert may be an option.

Formulating specifications

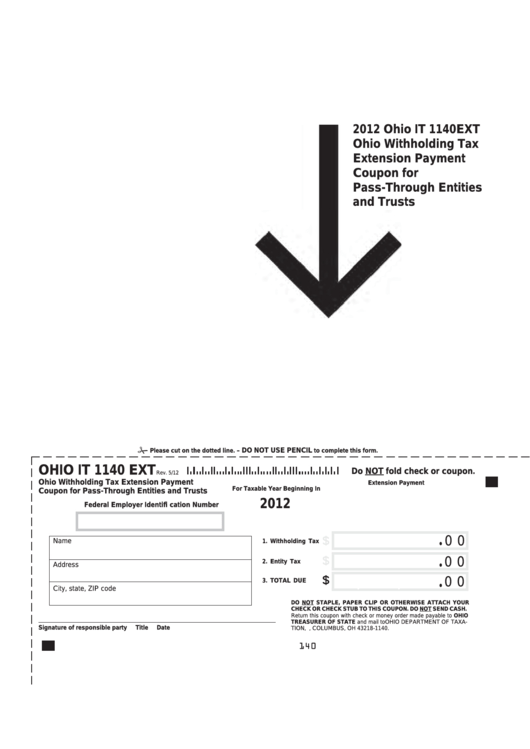

If you’re an employer, you are required to collect and report withholding taxes from your employees. If you are unable to collect these taxes, you can submit paperwork to IRS. There are other forms you might need for example, an annual tax return, or a withholding reconciliation. Below are details about the various tax forms for withholding and the deadlines for each.

Employees may need you to file withholding tax return forms to get their bonuses, salary and commissions. If you paid your employees in time, you may be eligible for reimbursement of taxes that were withheld. It is crucial to remember that there are a variety of taxes that are local taxes. There are also unique withholding techniques which can be utilized under certain conditions.

According to IRS regulations, you must electronically submit withholding forms. If you are submitting your tax return for national revenue, please include your Federal Employer Identification number. If you don’t, you risk facing consequences.