How To Change Your Social Security Voluntary Withholding Form – There are numerous reasons an individual could submit the form to request withholding. These factors include documentation requirements and exemptions for withholding. There are some things you should remember regardless of the reason that a person has to fill out an application.

Withholding exemptions

Nonresident aliens need to submit Form 1040–NR once a calendar year. If you satisfy the requirements, you might be qualified for exemption from withholding. This page lists all exemptions.

The first step to filling out Form 1040-NR is to attach Form 1042 S. To report federal income tax purposes, this form details the withholding process of the tax agency that handles withholding. It is essential to fill in correct information when you complete the form. This information may not be given and result in one individual being treated differently.

Non-resident aliens are subjected to the 30% tax withholding rate. The tax burden of your business must not exceed 30% in order to be exempt from withholding. There are numerous exemptions. Certain of them are designed to be used by spouses, while some are meant to be used by dependents, such as children.

The majority of the time, a refund is offered for the chapter 4 withholding. Refunds are granted under Sections 1400 to 1474. The refunds are made to the withholding agent that is the person who collects taxes from the source.

Relational status

The marital withholding form is an excellent way to simplify your life and help your spouse. You’ll be amazed by the amount of money you can put in the bank. The problem is selecting the best option out of the many choices. There are certain items you must avoid. There are a lot of costs if you make a wrong choice. If you stick to the instructions and adhere to them, there won’t be any problems. If you’re lucky you could even meet some new friends while traveling. After all, today marks the anniversary of your wedding. I’m hoping you’re capable of using this against them to obtain that elusive wedding ring. It’s a complex task that requires the expertise of an expert in taxation. The small amount is well enough for a life-long wealth. It is a good thing that you can access plenty of information on the internet. TaxSlayer is a trusted tax preparation firm.

Amount of withholding allowances claimed

You must specify how many withholding allowances to claim on the form W-4 you fill out. This is crucial as your paychecks may be affected by the amount of tax you have to pay.

There are many factors that affect the amount of allowances you are able to apply for. If you’re married you could be qualified for an exemption for head of household. Your income will affect the amount of allowances you can receive. You could be eligible to claim more allowances if make a lot of money.

It can save you thousands of dollars by selecting the appropriate amount of tax deductions. If you submit your annual tax returns, you may even be entitled to a refund. However, you must be careful about how you approach the tax return.

As with any other financial decision, you must do your research. Calculators can help determine how many withholding amounts should be requested. Alternative options include speaking with a specialist.

Filing requirements

Withholding taxes from your employees have to be reported and collected when you are an employer. The IRS can accept paperwork for certain taxes. There may be additional documentation such as the reconciliation of your withholding tax or a quarterly return. Here are the details on various tax forms for withholding and their deadlines.

The bonuses, salary, commissions, and other income you get from employees might necessitate you to file withholding tax returns. It is also possible to be reimbursed for taxes withheld if your employees were paid in time. Be aware that certain taxes could be considered to be local taxes. In certain situations, withholding rules can also be unique.

The IRS regulations require that you electronically file withholding documents. Your Federal Employer Identification Number should be included when you point your national revenue tax return. If you don’t, you risk facing consequences.

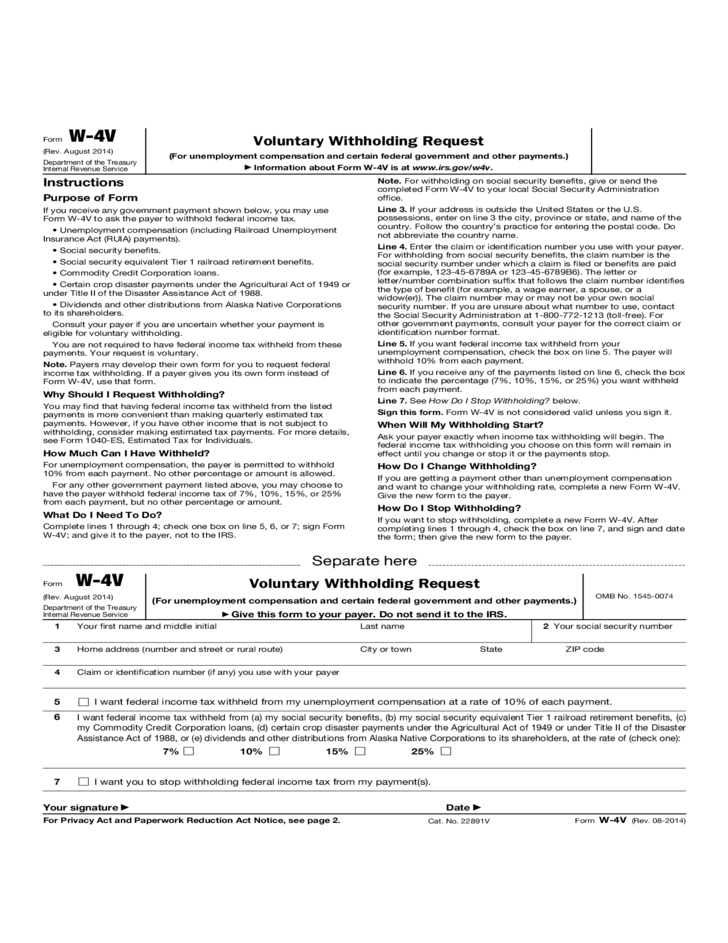

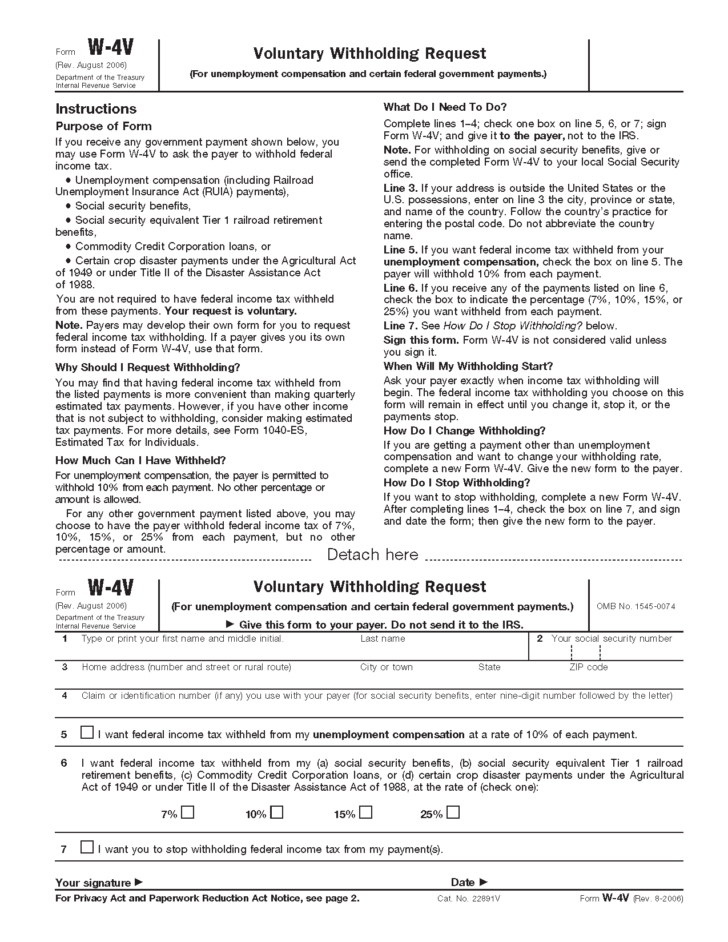

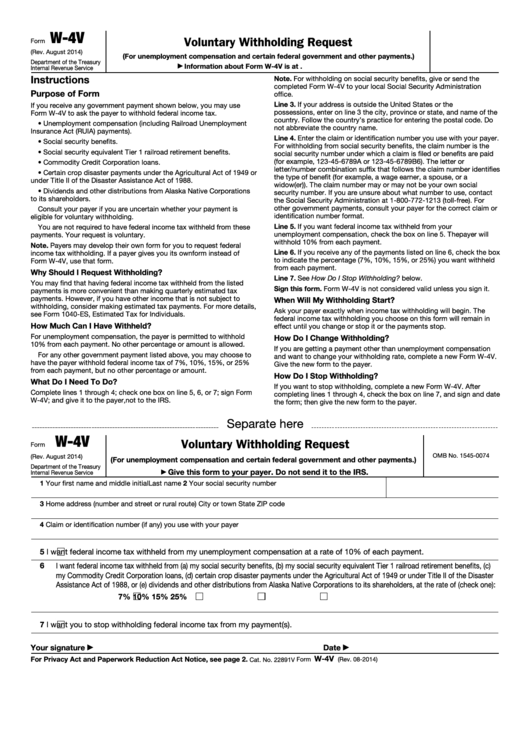

Gallery of How To Change Your Social Security Voluntary Withholding Form

Fillable Form W 4v Voluntary Withholding Request Printable Pdf Download