How Do You Fill Out A Tax Withholding Form – There stand a digit of reasons why someone might choose to fill out a tax form. These include documentation requirements, withholding exclusions, and the requested withholding allowances. No matter why one chooses to submit a form it is important to remember a few things to keep in mind.

Withholding exemptions

Non-resident aliens are required to file Form 1040–NR once a calendar year. If you meet the criteria, you may be eligible for an exemption to withholding. The following page lists all exclusions.

For submitting Form 1040-NR attach Form 1042-S. This form lists the amount withheld by the withholding agencies for federal income tax reporting to be used for reporting purposes. Complete the form in a timely manner. If this information is not supplied, one person may be treated.

The rate of withholding for non-resident aliens is 30 percent. It is possible to be exempted from withholding if the tax burden is greater than 30 percent. There are many exemptions available. Some of them apply to spouses or dependents, like children.

In general, the chapter 4 withholding gives you the right to an amount of money. As per Sections 1471 to 1474, refunds are given. The refunds are made by the withholding agents who is the person who collects taxes at source.

Status of relationships

A valid marital status withholding can help both you and your spouse to accomplish your job. You’ll be amazed by how much you can transfer to the bank. The problem is deciding which of the numerous options to pick. There are some things you should be aware of. Making the wrong choice could result in a costly loss. But if you follow it and follow the instructions, you won’t encounter any issues. If you’re lucky, you may even make new acquaintances while you travel. Today is the anniversary of your marriage. I’m hoping that they will turn it against you to get you the perfect engagement ring. To do this properly, you’ll require guidance of a qualified Tax Expert. A lifetime of wealth is worth the tiny amount. You can find tons of details online. Reputable tax preparation firms like TaxSlayer are one of the most useful.

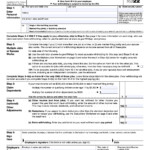

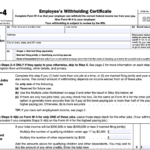

The number of withholding allowances claimed

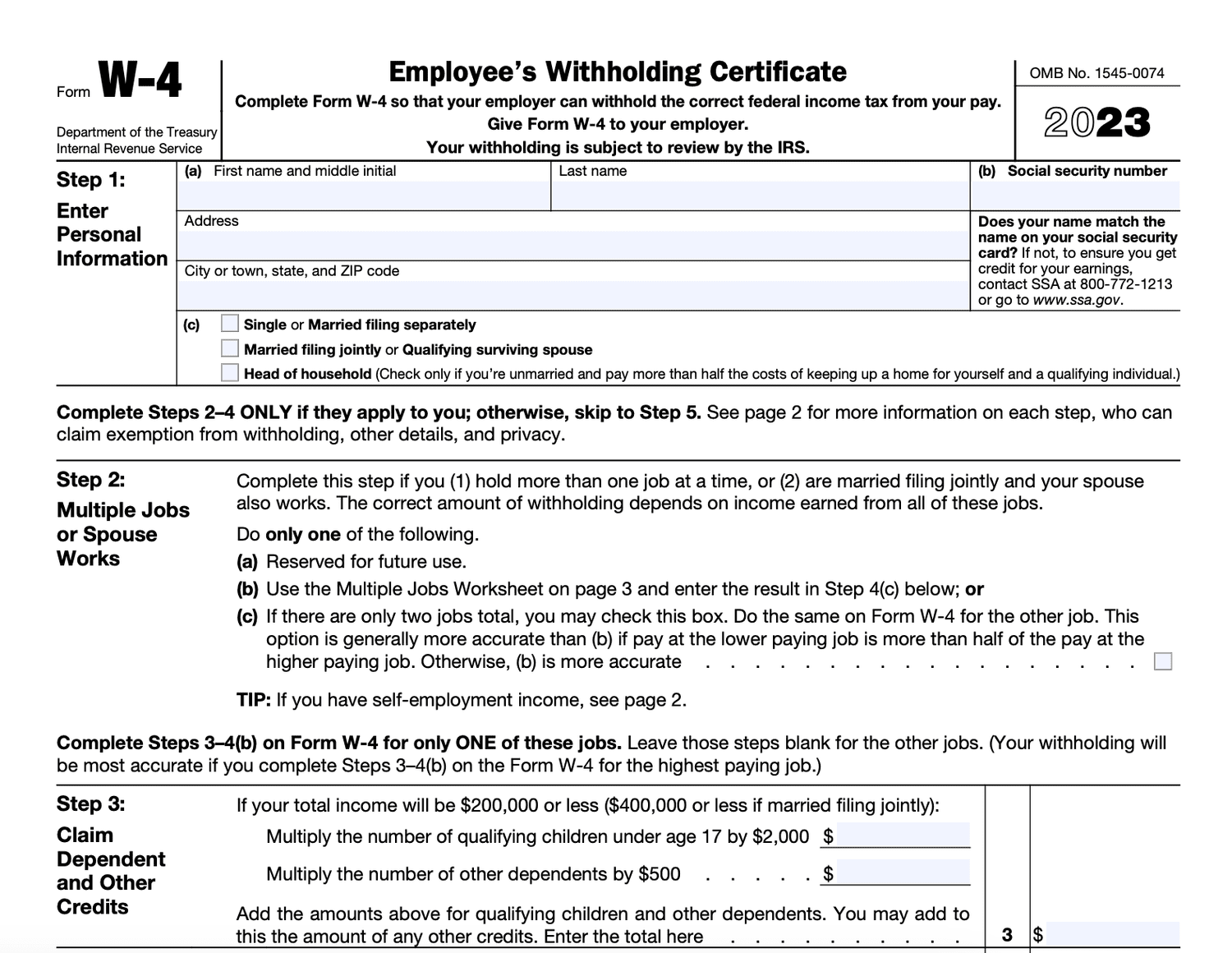

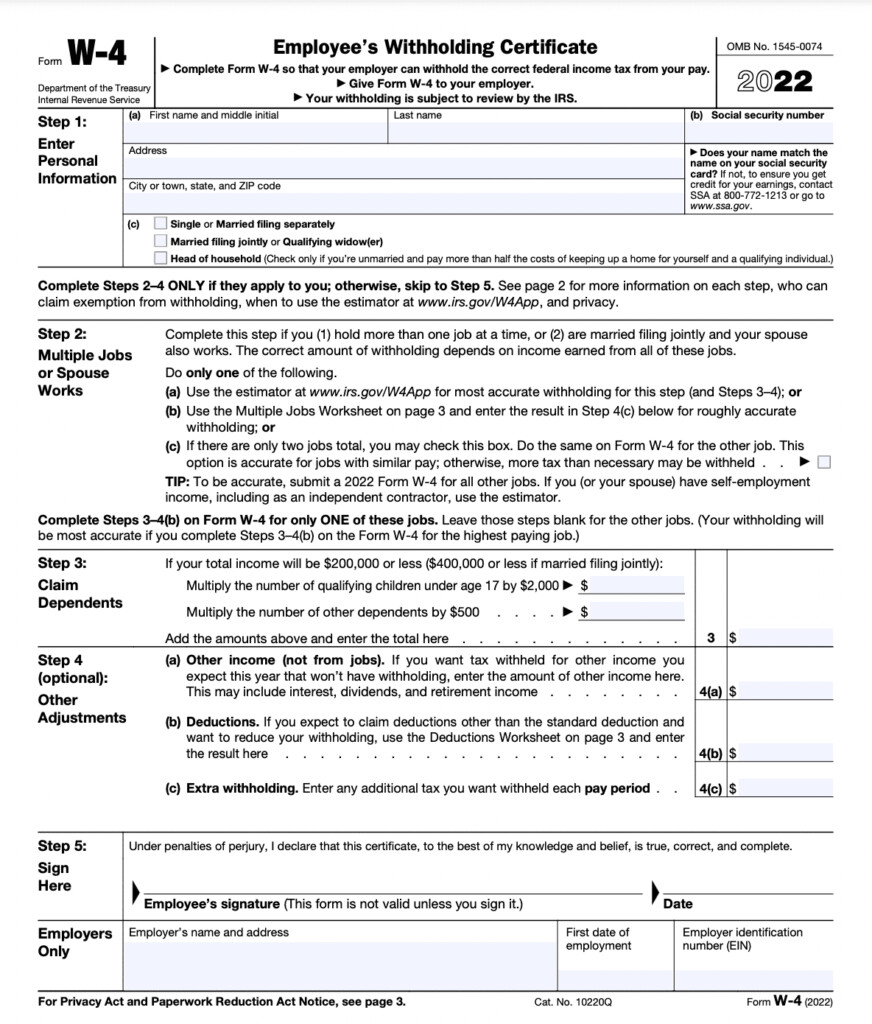

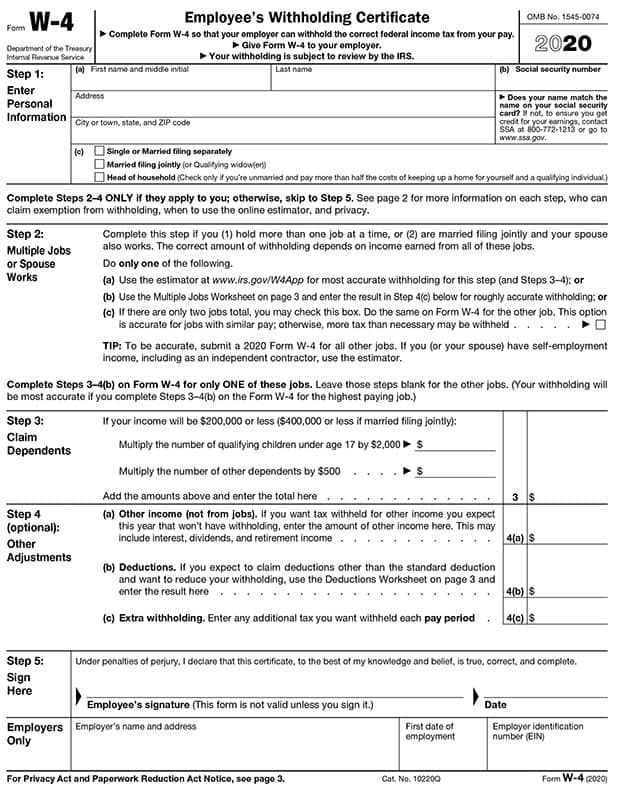

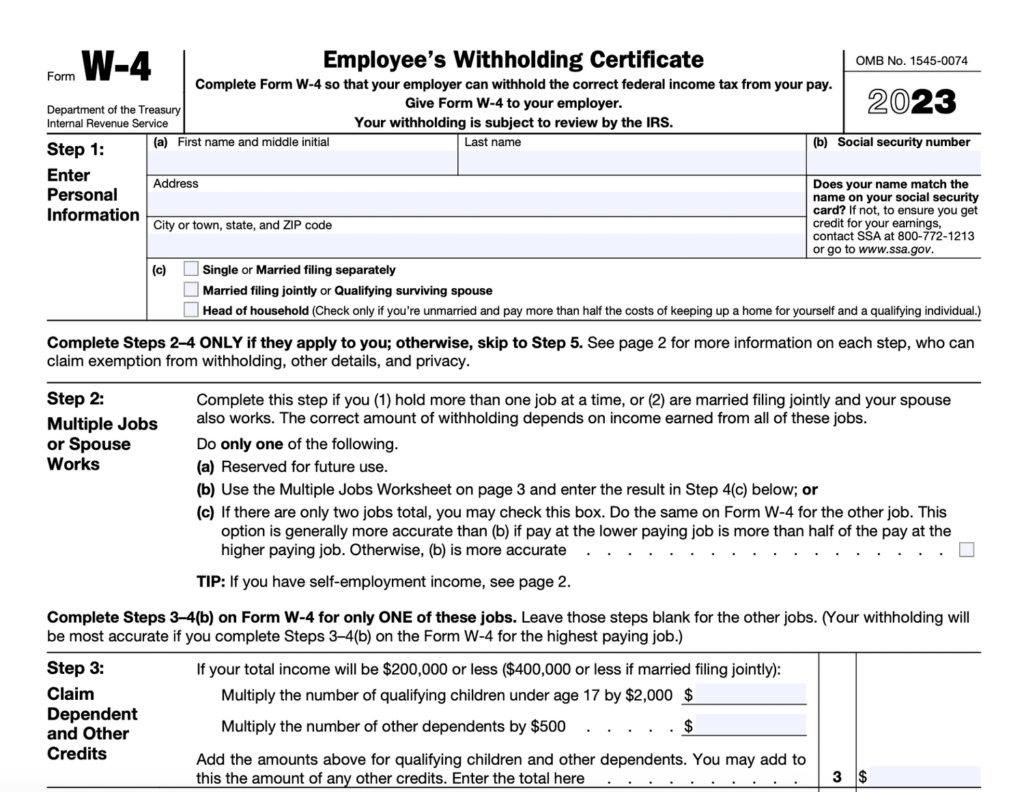

When filling out the form W-4 you fill out, you need to specify how many withholding allowances are you seeking. This is crucial since the tax amount withdrawn from your pay will be affected by how you withhold.

You may be able to apply for an exemption on behalf of your head of household if you are married. The amount of allowances you’re eligible to claim will depend on the income you earn. An additional allowance could be available if you earn a lot.

It can save you thousands of dollars by selecting the appropriate amount of tax deductions. Even better, you might be eligible for a refund when your tax return for income is filed. However, you must choose the right method.

Like any financial decision you make, it is important to do your homework. Calculators are available to aid you in determining the amount of withholding allowances are required to be claimed. Alternate options include speaking to a specialist.

Submitting specifications

Withholding tax from employees need to be reported and collected if you’re an employer. The IRS will accept documents to pay certain taxes. A tax return that is annually filed and quarterly tax returns, or tax withholding reconciliations are just a few types of documents you could need. Here is some information on the various withholding tax form categories, as well as the deadlines to filing them.

Your employees may require you to submit withholding taxes returns to be eligible for their salary, bonuses and commissions. If you make sure that your employees are paid on time, you may be eligible to receive the refund of taxes that you withheld. The fact that certain taxes are county taxes must also be noted. There are also specific withholding methods which can be utilized in certain circumstances.

You are required to electronically submit tax withholding forms as per IRS regulations. The Federal Employer Identification Number needs to be included when you point to your national tax return. If you don’t, you risk facing consequences.