Hi Withholding Power Of Attorney Form – There are a variety of reasons an individual might decide to fill out withholding forms. These include documentation requirements, withholding exclusions as well as the withholding allowances. No matter what the reason is for an individual to file an application it is important to remember certain points that you need to remember.

Withholding exemptions

Non-resident aliens are required to submit Form1040-NR once each year to fill out Form1040-NR. If you meet the requirements, you may be able to claim an exemption from the withholding forms. This page you will see the exemptions that are for you to choose from.

When submitting Form1040-NR, Attach Form 1042S. This form lists the amount that is withheld by the withholding agencies to report federal income tax for tax reporting purposes. Be sure to enter the correct information when filling in this form. If the correct information isn’t supplied, one person may be taken into custody.

The non-resident alien withholding tax is 30 percent. Non-resident aliens may be eligible for an exemption. This happens when your tax burden is less than 30 percent. There are many exemptions. Some are specifically designed for spouses, while others are meant to be used by dependents like children.

Generally, you are entitled to a reimbursement under chapter 4. Refunds are made in accordance with Sections 471 to 474. Refunds are given to the tax agent withholding that is the person who collects the tax from the source.

Status of the relationship

A form for a marital withholding is an excellent way to simplify your life and aid your spouse. It will also surprise you how much money you could put in the bank. It is difficult to decide what option you’ll choose. Certain, there are items you must avoid. You will pay a lot in the event of a poor decision. It’s not a problem if you just follow the directions and pay attention. You may make new friends if you are fortunate. In the end, today is the date of your wedding anniversary. I’m hoping that you can utilize it to secure the sought-after diamond. To do this correctly, you’ll need the assistance of a certified Tax Expert. A small amount of money can create a lifetime of wealth. It is a good thing that you can access many sources of information online. TaxSlayer as well as other reliable tax preparation firms are some of the best.

The amount of withholding allowances claimed

You must specify how many withholding allowances you want to be able to claim on the W-4 that you file. This is critical since your wages could be affected by the amount of tax that you pay.

The amount of allowances you receive will depend on a variety of factors. For instance, if you are married, you might be qualified for an exemption for your household or head. Your income will determine how many allowances you are entitled to. If you earn a significant amount of income, you may get a bigger allowance.

You might be able to save money on a tax bill by selecting the appropriate amount of tax deductions. You could actually receive an income tax refund when you file the annual tax return. But you need to pick your approach wisely.

Similar to any financial decision, you must do your research. Calculators are useful for determining how many allowances for withholding are required to be requested. Alternate options include speaking to a specialist.

Specifications that must be filed

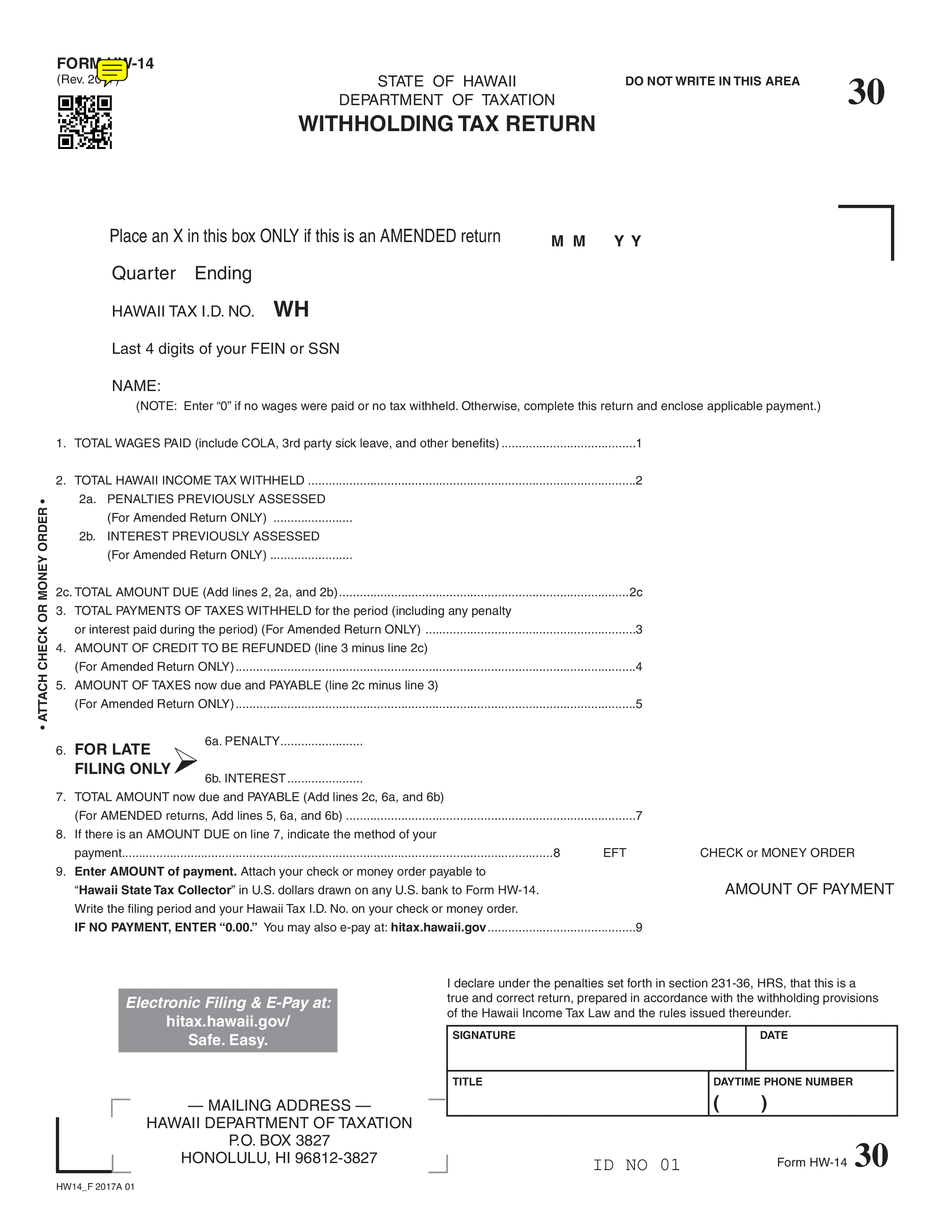

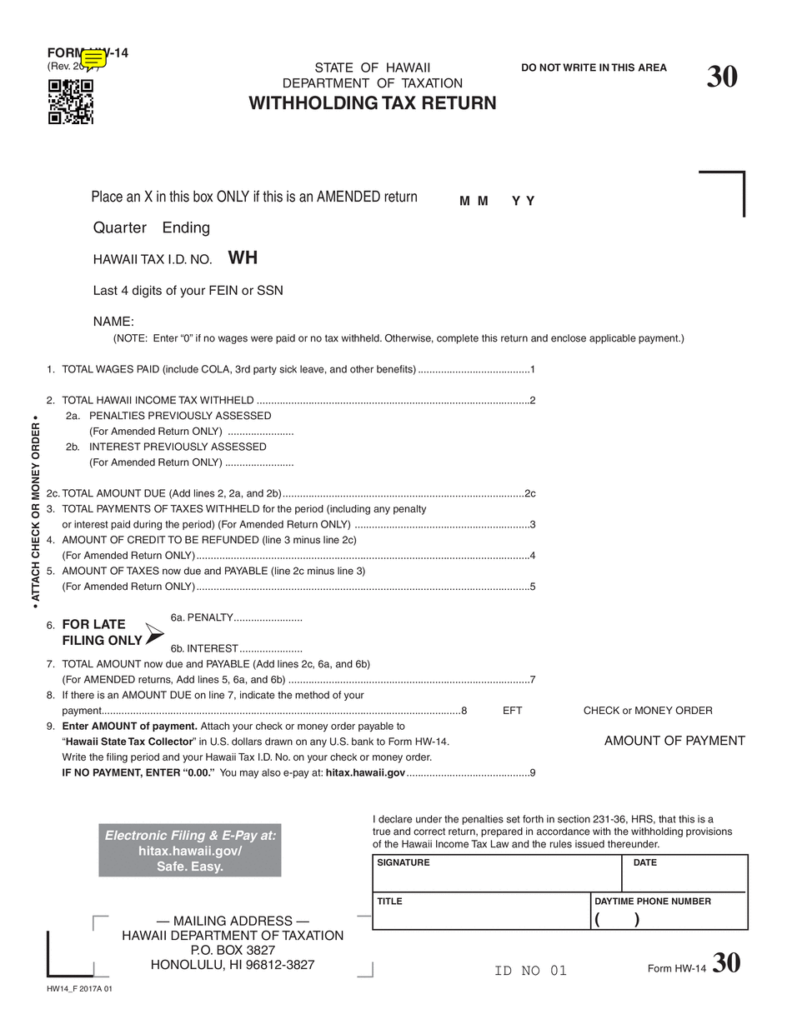

Employers must inform the IRS of any withholding tax that is being collected from employees. Some of these taxes may be submitted to the IRS by submitting forms. It is possible that you will require additional documentation such as a withholding tax reconciliation or a quarterly return. Here are some details about the various types of withholding tax forms as well as the deadlines for filing.

It is possible that you will need to file tax returns for withholding for the income you receive from your employees, including bonuses, commissions, or salary. It is also possible to receive reimbursement for taxes withheld if your employees received their wages in time. It is crucial to remember that not all of these taxes are local taxes. There are specific methods of withholding that are appropriate in particular circumstances.

You must electronically submit withholding forms in accordance with IRS regulations. Your Federal Employer Identification number must be listed when you point to your tax return for the nation. If you don’t, you risk facing consequences.