Hawaii Withholding Form Tax 2024 – There are many reasons an individual might decide to fill out withholding forms. Documentation requirements, withholding exemptions as well as the quantity of the allowance requested are all factors. Whatever the reason someone chooses to file an Application there are some points to be aware of.

Exemptions from withholding

Non-resident aliens are required to submit Form 1040NR once every year. However, if your requirements are met, you could be eligible to apply for an exemption from withholding. This page lists all exclusions.

When you submit Form1040-NR, attach Form 1042S. The form is used to report the federal income tax. It details the withholding of the withholding agent. Make sure you enter the correct information when filling out this form. It is possible that you will have to treat a single person if you don’t provide this information.

Non-resident aliens are subject to the option of paying a 30% tax on withholding. A nonresident alien may be qualified for exemption. This happens the case if your tax burden less than 30 percent. There are many exemptions. Some are specifically designed for spouses, while others are intended to be used by dependents like children.

You can claim a refund if you violate the rules of chapter 4. Refunds are allowed according to Sections 1471-1474. Refunds are provided by the tax agent. This is the person who is responsible for withholding tax at the source.

Status of relationships

The proper marital status and withholding forms can simplify your work and that of your spouse. Furthermore, the amount of money you may deposit in the bank will pleasantly surprise you. The difficulty lies in selecting the best option among the numerous possibilities. There are certain actions you shouldn’t do. False decisions can lead to costly consequences. If you stick to it and pay attention to instructions, you won’t run into any problems. If you’re lucky, you may make new acquaintances on your journey. After all, today marks the anniversary of your wedding. I’m hoping they can reverse the tide to get you the elusive engagement ring. In order to complete the job correctly you must obtain the assistance of a certified tax expert. It’s worthwhile to create wealth over the course of a lifetime. Information on the internet is easily accessible. TaxSlayer as well as other reliable tax preparation companies are some of the top.

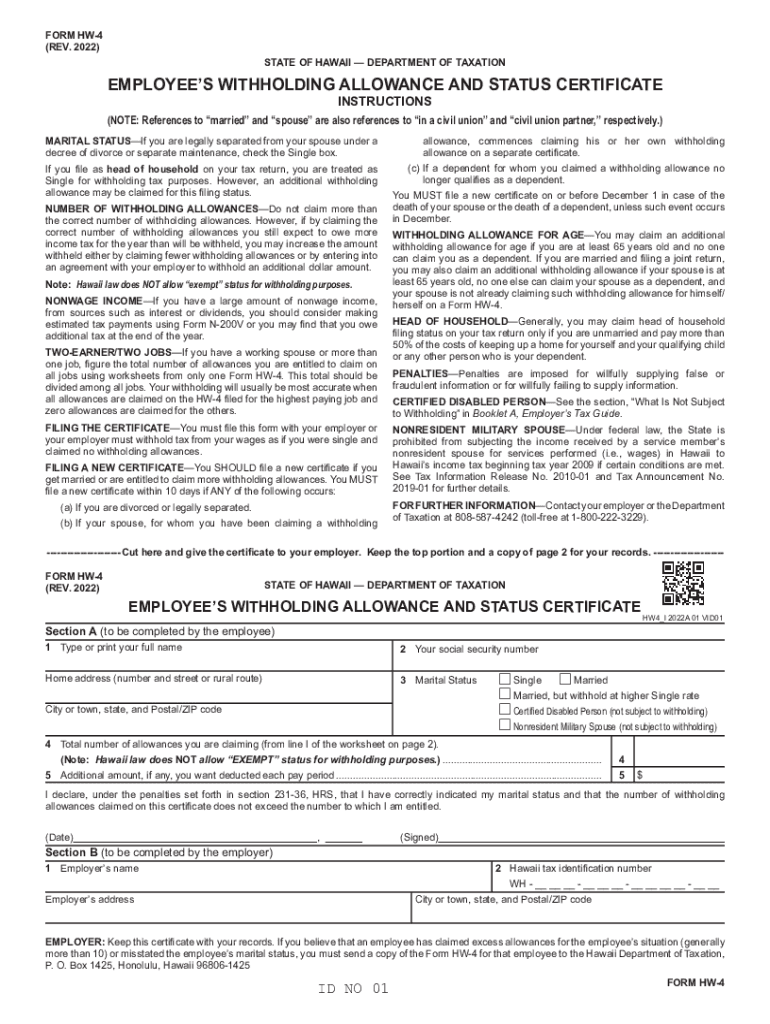

Number of withholding allowances claimed

The W-4 form must be filled out with the number of withholding allowances that you want to be able to claim. This is crucial because your pay will be affected by the amount of tax you have to pay.

There are many factors that influence the amount of allowances that you can request. If you’re married, you might be eligible for a head-of-household exemption. Your income also determines how many allowances you are eligible to claim. If you have high income it could be possible to receive a higher allowance.

You may be able to avoid paying a large tax bill by selecting the appropriate amount of tax deductions. It is possible to receive an income tax refund when you file your annual income tax return. But it is important to pick the right method.

In every financial decision, it is important to be aware of the facts. Calculators can assist you in determining how many withholding amounts should be requested. A specialist may be an option.

Formulating specifications

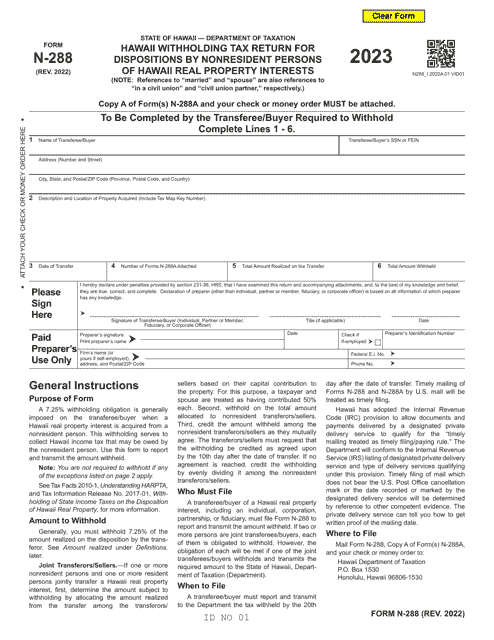

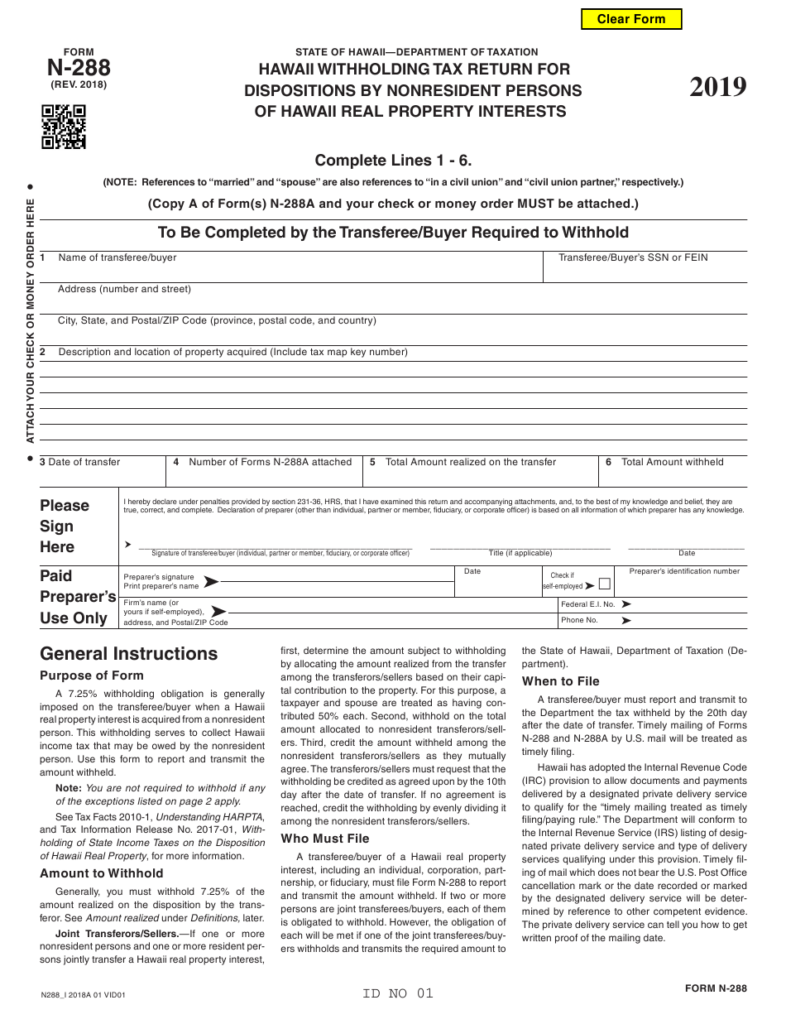

Employers must report any withholding taxes that are being collected from employees. A few of these taxes can be submitted to the IRS through the submission of paperwork. There are additional forms you might need like a quarterly tax return or withholding reconciliation. Here are some information on the different types of tax forms for withholding along with the filing deadlines.

Withholding tax returns may be required to prove income such as bonuses, salary or commissions as well as other earnings. Additionally, if your employees receive their wages on time, you may be eligible to get the tax deductions you withheld. It is important to note that there are a variety of taxes that are local taxes. In addition, there are specific tax withholding procedures that can be used in certain situations.

According to IRS regulations Electronic submissions of withholding forms are required. When you file your tax return for national revenue make sure you provide your Federal Employer Identification number. If you don’t, you risk facing consequences.