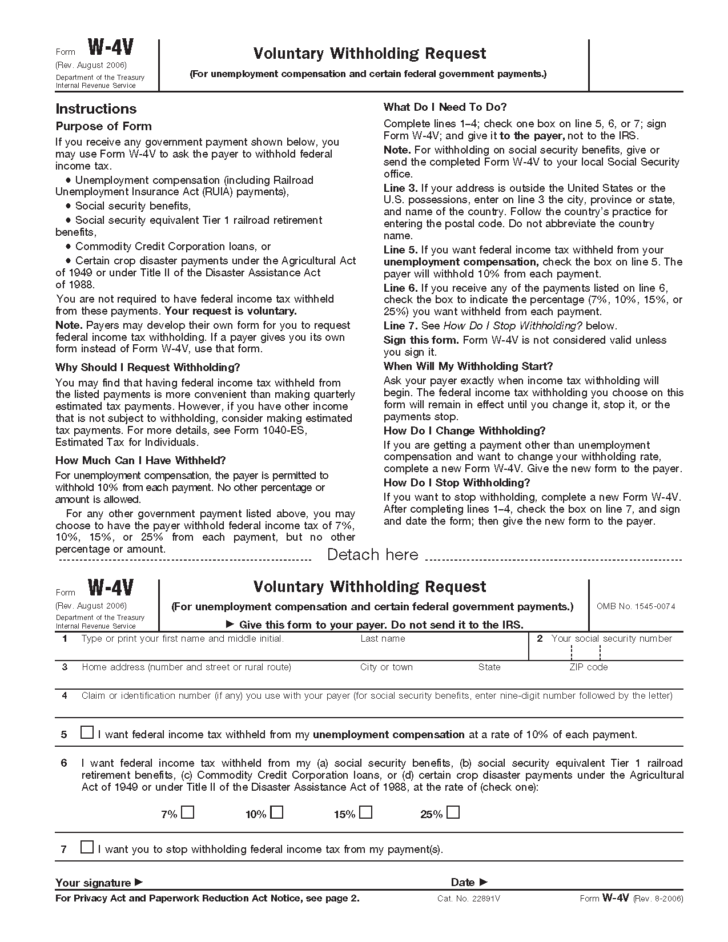

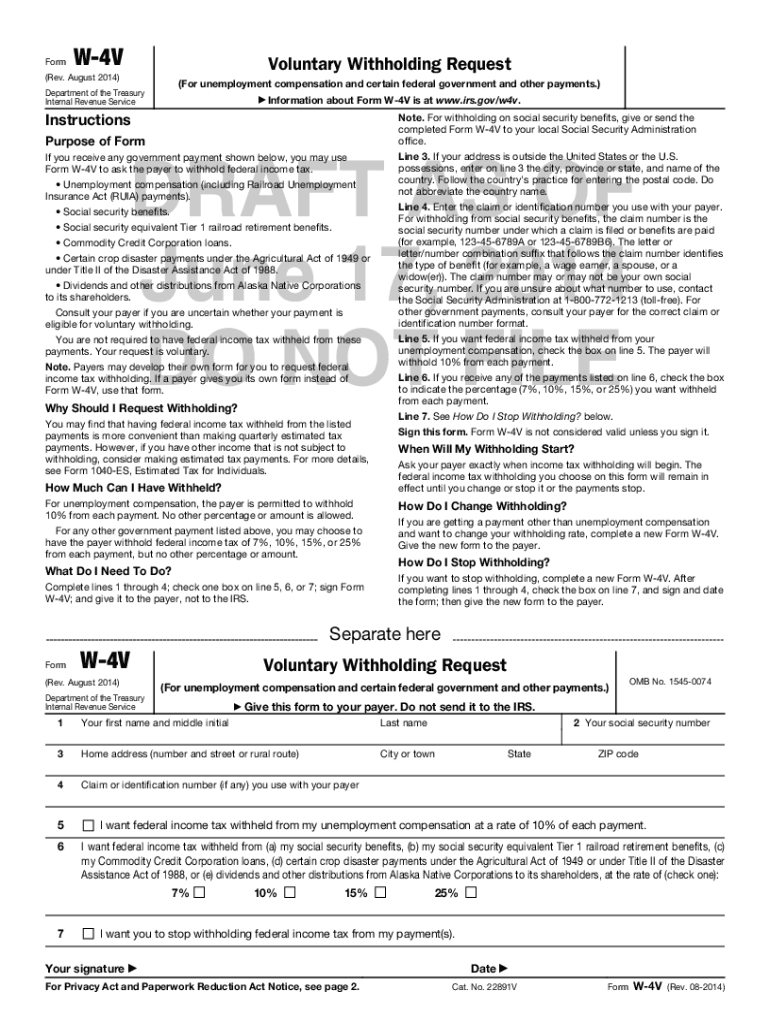

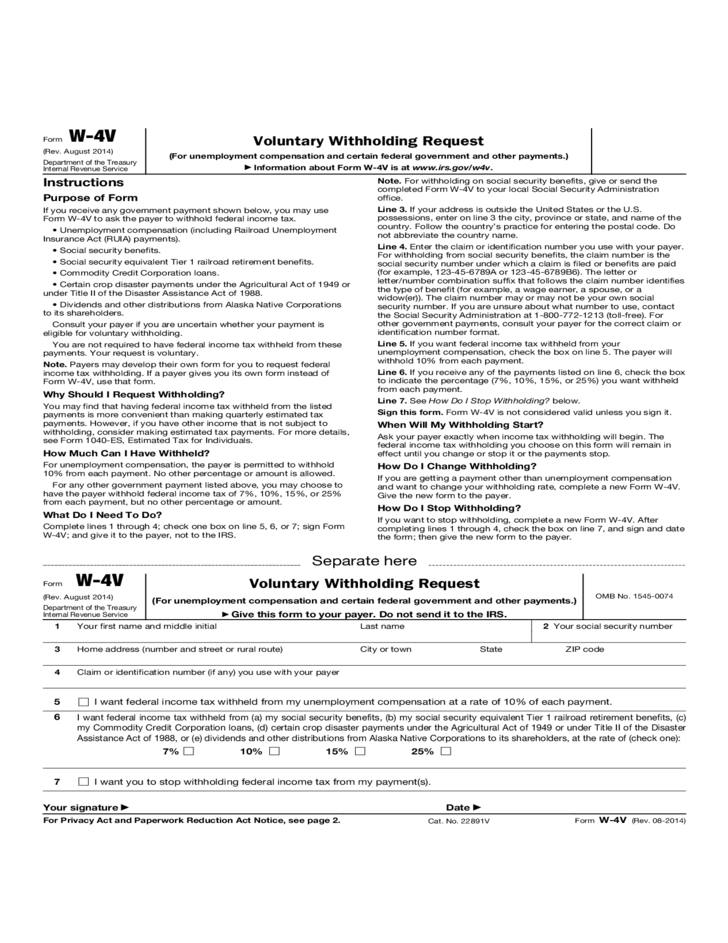

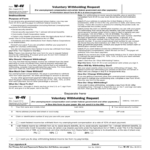

Government Social Security Form For Withholding Request – There are many reasons that one could fill out a form for withholding. Documentation requirements, withholding exemptions as well as the quantity of allowances for withholding requested are all factors. No matter why the person decides to fill out the form there are some aspects to consider.

Exemptions from withholding

Nonresident aliens are required to submit Form 1040-NR once a year. If your requirements meet, you may be eligible for an exemption from withholding. The following page lists all exemptions.

The application of Form 1042-S to Form 1042-S is a first step to submit Form 1040-NR. The form lists the amount withheld by the withholding agencies for federal tax reporting to be used for reporting purposes. Be sure to enter the correct information when you fill out the form. There is a possibility for a person to be treated if the information is not given.

Non-resident aliens are subjected to a 30% withholding rate. Your tax burden must not exceed 30% to be eligible for exemption from withholding. There are several different exclusions offered. Some of them are only for spouses or dependents such as children.

You may be entitled to a refund if you violate the provisions of chapter 4. Refunds are made in accordance with Sections 471 to 474. Refunds are given by the withholding agent. This is the individual accountable for tax withholding at the source.

Status of the relationship

The proper marital status and withholding forms will ease your work and that of your spouse. Additionally, the quantity of money you may deposit at the bank could delight you. Choosing which of the possibilities you’re likely pick is the tough part. There are some things you shouldn’t do. Making the wrong choice could cost you dearly. If you stick to the guidelines and adhere to them, there won’t be any issues. If you’re lucky, you might find some new acquaintances traveling. Today is the day you celebrate your marriage. I’m sure you’ll be able to use it against them to find that perfect ring. You’ll need the help from a certified tax expert to ensure you’re doing it right. A little amount could create a lifetime’s worth of wealth. Online information is easily accessible. TaxSlayer and other trusted tax preparation companies are some of the best.

Number of withholding allowances claimed

When you fill out Form W-4, you must specify how many withholding allowances you want to claim. This is important because the tax amount you are able to deduct from your pay will be affected by the much you withhold.

There are a variety of factors which affect the amount of allowances you can apply for. If you’re married you could be eligible for a head-of-household exemption. Your income level also affects the amount of allowances you’re entitled to. A larger allowance might be available if you earn a lot.

The right amount of tax deductions could help you avoid a significant tax bill. In addition, you could even get a refund if your tax return for income has been completed. However, you must be careful about how you approach the tax return.

Do your research, as you would in any other financial decision. Calculators are readily available to assist you in determining how much withholding allowances you can claim. An expert could be a good option.

Filing specifications

Employers must pay withholding taxes to their employees and report the tax. For some taxes you can submit paperwork to the IRS. There are other forms you may require, such as the quarterly tax return or withholding reconciliation. Here’s some information about the different forms of withholding tax categories, as well as the deadlines to filing them.

To be eligible for reimbursement of withholding taxes on the compensation, bonuses, salary or other revenue earned by your employees, you may need to file a tax return for withholding. If you also pay your employees on-time it could be possible to qualify to be reimbursed for any taxes that were taken out of your paycheck. It is important to note that certain taxes are also county taxes ought to be considered. There are also unique withholding procedures that can be utilized in certain situations.

The IRS regulations require that you electronically file withholding documents. Your Federal Employer Identification number must be listed when you point at your national tax return. If you don’t, you risk facing consequences.