Georgia Withholding Tax Forms 2024 – There are a variety of reasons for a person to decide to fill out a form for withholding. Documentation requirements, withholding exemptions as well as the quantity of withholding allowances demanded are all elements. Whatever the reason behind an individual to file a document there are certain aspects you must keep in mind.

Exemptions from withholding

Non-resident aliens are required to submit Form1040-NR once every year to file Form1040-NR. If you meet these requirements, you could be eligible to receive exemptions from the withholding form. This page will list all exclusions.

The first step in filling out Form 1040-NR is to attach Form 1042 S. To report federal income tax purposes, this form provides the withholding made by the agency responsible for withholding. Make sure you enter the correct information when you fill out the form. If this information is not provided, one individual could be taken into custody.

The rate of withholding for non-resident aliens is 30%. Non-resident aliens may be qualified for an exemption. This is if your tax burden is lower than 30%. There are a variety of exemptions. Certain of them are applicable to spouses and dependents, such as children.

In general, you’re eligible to receive a refund under chapter 4. Refunds are granted according to Sections 1471-1474. The refunds are made by the agents who withhold taxes that is, the person who is responsible for withholding taxes at the source.

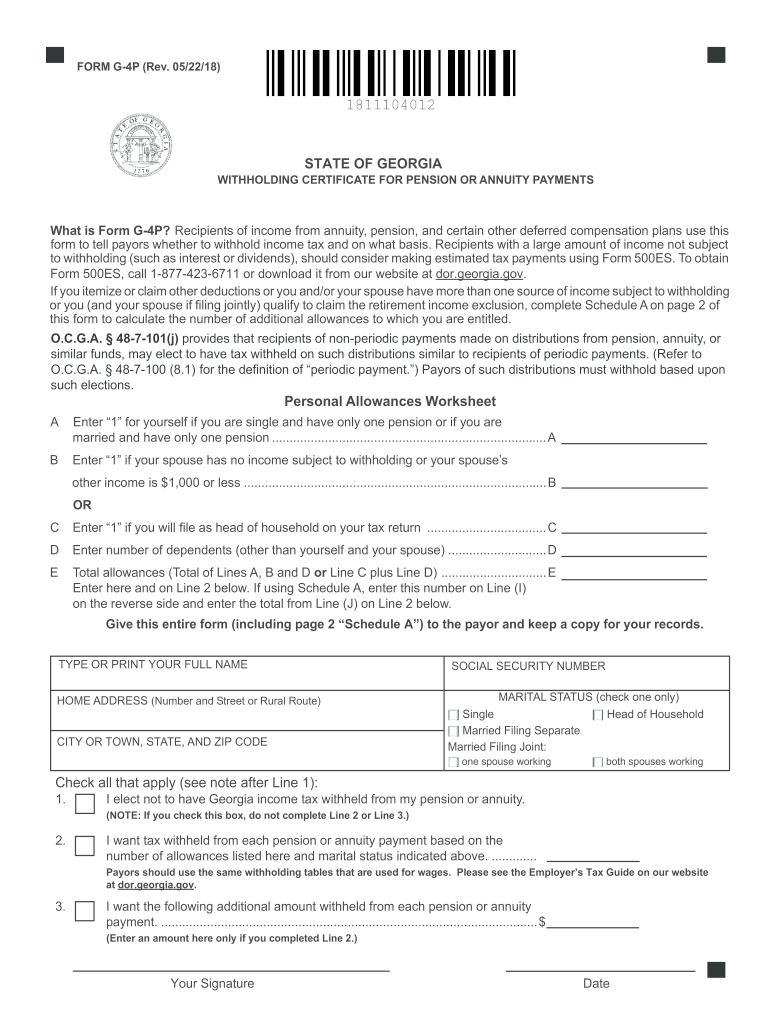

Status of the relationship

The correct marital status as well as withholding form will simplify the work of you and your spouse. You’ll be amazed at how much money you can deposit to the bank. It isn’t easy to determine what option you’ll pick. There are certain things to avoid. A bad decision can cost you dearly. If you stick to it and pay attention to instructions, you won’t encounter any issues. It is possible to make new acquaintances if fortunate. Today is the anniversary day of your wedding. I’m hoping you’ll be able to use it against them to search for that one-of-a-kind ring. To complete the task correctly it is necessary to get the help from a qualified tax professional. A little amount could create a lifetime’s worth of wealth. There are tons of online resources that provide information. TaxSlayer is a reputable tax preparation company.

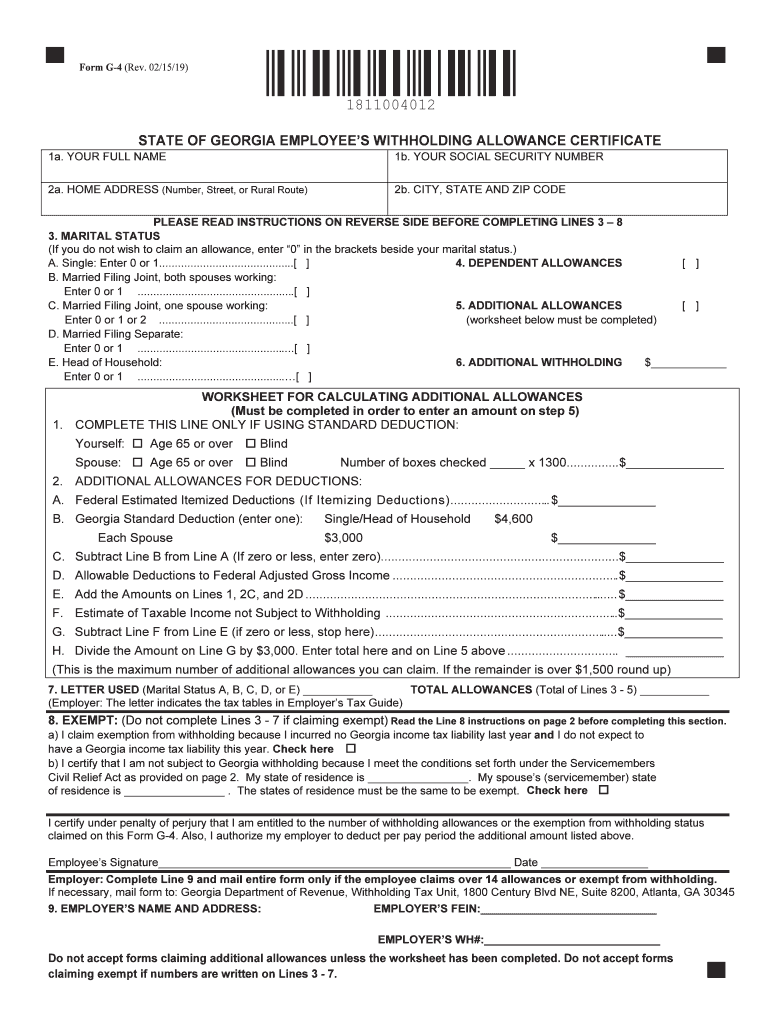

Number of claimed withholding allowances

It is important to specify the amount of withholding allowances you want to claim in the form W-4. This is important because the tax withheld can affect the amount taken out of your paychecks.

A variety of factors influence the allowances requested.If you’re married, for instance, you might be eligible to claim an exemption for head of household. The amount of allowances you’re eligible to claim will depend on the income you earn. A larger allowance might be granted if you make a lot.

Selecting the appropriate amount of tax deductions could save you from a large tax bill. It is possible to receive an income tax refund when you file the annual tax return. But it is important to select the correct method.

Like any financial decision it is essential to research the subject thoroughly. Calculators can assist you in determining how much withholding allowances you can claim. You can also speak to an expert.

Filing specifications

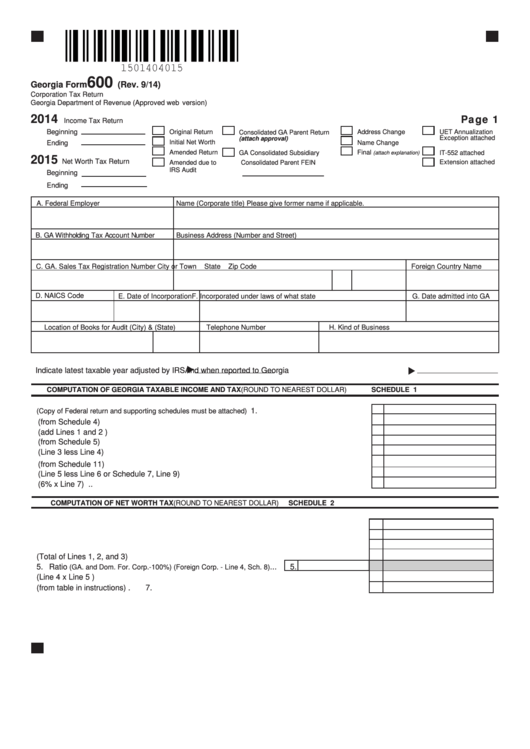

Employers are required to collect withholding taxes from their employees and then report the amount. The IRS may accept forms to pay certain taxes. There are other forms you could require for example, an annual tax return, or a withholding reconciliation. Here are the details on various tax forms for withholding and their deadlines.

The compensation, bonuses commissions, other income you get from employees might require you to file tax returns withholding. Additionally, if your employees are paid in time, you could be eligible for the tax deductions you withheld. It is important to note that some of these taxes are taxes imposed by the county, is crucial. In certain circumstances there are rules regarding withholding that can be different.

Electronic filing of withholding forms is required under IRS regulations. It is mandatory to provide your Federal Employer Identification Number when you submit at your income tax return from the national tax system. If you don’t, you risk facing consequences.