Georgia Withholding Form G-7 – There are many reasons one might choose to fill out forms for withholding. This is due to the requirement for documentation, exemptions from withholding, as well as the amount of the required withholding allowances. Whatever the motive someone has to fill out a Form, there are several points to be aware of.

Exemptions from withholding

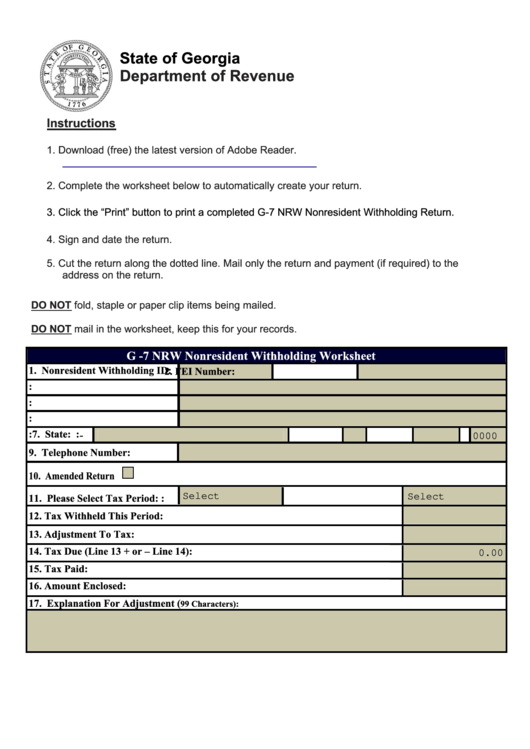

Non-resident aliens are required to file Form 1040–NR every calendar year. If the requirements are met, you could be eligible to request an exemption from withholding. This page will list the exclusions.

To file Form 1040-NR the first step is to attach Form 1042S. This form details the withholdings that the agency makes. Complete the form in a timely manner. This information may not be disclosed and cause one person to be treated.

The non-resident alien withholding rate is 30%. A tax exemption may be granted if you have a an income tax burden of less than 30 percent. There are many different exemptions. Certain of them are applicable to spouses or dependents like children.

In general, you’re entitled to a reimbursement in accordance with chapter 4. Refunds are granted according to Sections 1471-1474. The withholding agent or the person who withholds the tax at source, is the one responsible for distributing these refunds.

Relational status

The proper marital status and withholding forms can simplify your work and that of your spouse. In addition, the amount of money you may deposit at the bank can be awestruck. The difficulty lies in picking the right bank among the numerous possibilities. There are certain things that you shouldn’t do. It can be costly to make a wrong decision. But if you follow it and pay attention to the directions, you shouldn’t run into any problems. If you’re lucky, you might find some new friends while driving. Today marks the anniversary. I’m hoping you’re in a position to leverage this against them to obtain that wedding ring you’ve been looking for. For a successful completion of the task it is necessary to get the help of a tax professional who is certified. A modest amount of money can create a lifetime of wealth. Information on the internet is easily accessible. Tax preparation firms that are reputable, such as TaxSlayer are among the most efficient.

The number of withholding allowances requested

It is important to specify the amount of withholding allowances you want to claim in the W-4 form. This is important since the tax amount you are able to deduct from your paychecks will be affected by the you withhold.

There are a variety of factors that influence the allowance amount you are able to apply for. If you’re married you may be eligible for a head-of-household exemption. Your income will determine how many allowances you are entitled to. You can apply for an increase in allowances if you earn a significant amount of money.

You could save lots of money by choosing the correct amount of tax deductions. A refund could be feasible if you submit your tax return on income for the previous year. Be sure to select your method carefully.

Research like you would with any other financial decision. Calculators are useful to determine how many withholding allowances are required to be requested. A specialist could be a good alternative.

Specifications that must be filed

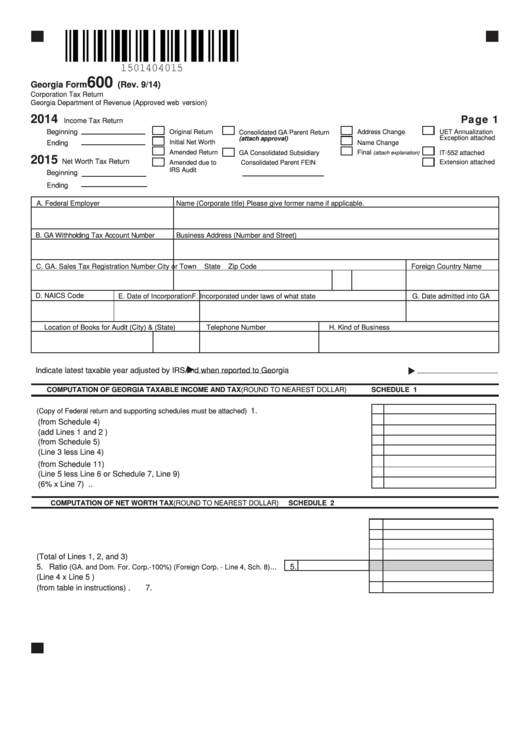

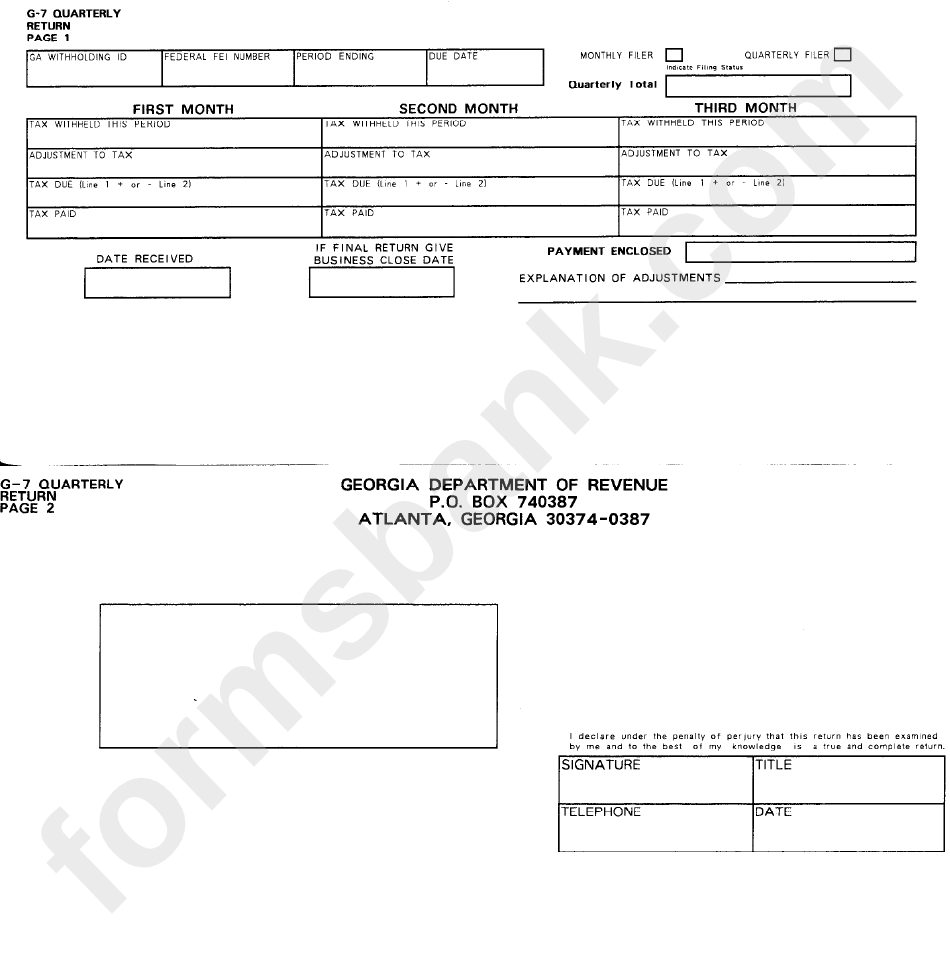

Withholding taxes from your employees have to be collected and reported when you’re an employer. The IRS may accept forms for certain taxes. There may be additional documentation such as the reconciliation of your withholding tax or a quarterly tax return. Here are some information regarding the various forms of withholding tax forms and the deadlines for filing.

To be qualified for reimbursement of tax withholding on pay, bonuses, commissions or any other earnings earned by your employees You may be required to submit a tax return withholding. Additionally, if your employees receive their wages on time, you may be eligible to get the tax deductions you withheld. Be aware that these taxes may be considered to be taxation by the county. Additionally, you can find specific withholding procedures that can be applied in particular circumstances.

You have to submit electronically withholding forms in accordance with IRS regulations. Your Federal Employer identification number should be included when you submit your national tax return. If you don’t, you risk facing consequences.