Ga Tax Withholding Form 2024 – There are numerous reasons that a person might decide to file a withholding application. These factors include documentation requirements and withholding exemptions. No matter the motive someone has to fill out the Form there are some aspects to keep in mind.

Withholding exemptions

Non-resident aliens are required to submit Form1040-NR once every year to file Form1040-NR. If the requirements are met, you may be eligible to apply for an exemption from withholding. The following page lists all exclusions.

The first step for submit Form 1040 – NR is attaching the Form 1042 S. The form contains information on the withholding done by the tax agency that handles withholding for federal tax reporting purposes. Make sure you enter the correct information when filling out this form. A person could be treated if this information is not provided.

The non-resident alien withholding tax is 30%. Non-resident aliens may be eligible for an exemption. This applies the case if your tax burden less than 30 percent. There are a variety of exemptions. Some are specifically designed for spouses, whereas others are intended to be used by dependents like children.

You may be entitled to an amount of money if you do not follow the terms of chapter 4. Refunds can be claimed in accordance with sections 1401, 1474, and 1475. The refunds are made by the agents who withhold taxes who is the person who collects taxes at the source.

Relational status

An appropriate marital status that is withheld can make it simpler for you and your spouse to complete your tasks. Additionally, the quantity of money you can put at the bank can surprise you. The trick is to decide which one of the many options to pick. You must be cautious in what you do. Making the wrong choice could result in a significant cost. There’s no problem If you simply follow the directions and be attentive. If you’re lucky, you might even make a few new pals when you travel. Today is your anniversary. I’m hoping they turn it against you to help you get that elusive engagement ring. It is best to seek the advice of a certified tax expert to ensure you’re doing it right. It’s worthwhile to create wealth over the course of your life. Online information is easily accessible. TaxSlayer and other trusted tax preparation firms are a few of the top.

There are a lot of withholding allowances being made available

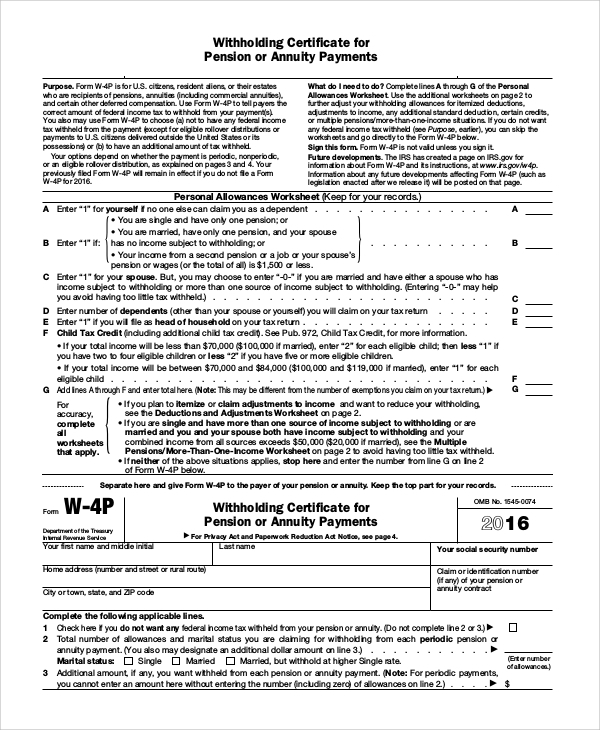

When you fill out Form W-4, you need to specify how many withholding allowances you want to claim. This is crucial since your wages could be affected by the amount of tax you have to pay.

There are many variables which affect the amount of allowances that you can apply for. If you’re married, you could be eligible for a head-of-household exemption. The amount of allowances you can claim will depend on your income. If you earn a higher income, you can request an increased allowance.

You might be able to save money on a tax bill by deciding on the correct amount of tax deductions. Refunds could be feasible if you submit your income tax return for the current year. Be sure to select your method carefully.

Like any financial decision you make it is essential to conduct your research. Calculators can assist you in determining the number of withholdings that need to be demanded. As an alternative contact a specialist.

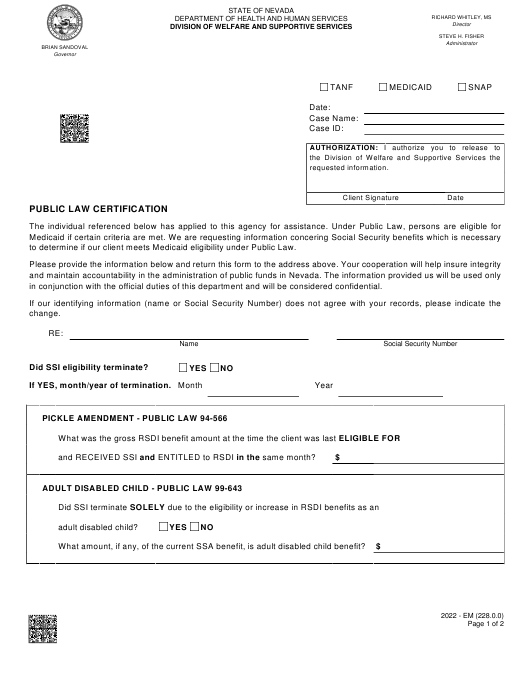

Formulating specifications

Withholding tax from employees need to be collected and reported in the event that you’re an employer. If you are unable to collect these taxes, you may provide documentation to the IRS. An annual tax return and quarterly tax returns, or tax withholding reconciliations are just a few kinds of documentation you may need. Here are some information on the different types of withholding tax forms and the filing deadlines.

Your employees may require you to file withholding tax return forms to get their wages, bonuses and commissions. If you pay your employees on time, you may be eligible for the refund of taxes that you withheld. Noting that certain of these taxes could be considered to be county taxes, is also crucial. In some situations the rules for withholding can be different.

You have to submit electronically tax withholding forms as per IRS regulations. It is mandatory to include your Federal Employer ID Number when you submit your national income tax return. If you don’t, you risk facing consequences.