Ga S Corp Withholding Form – There are many reasons someone could choose to submit a withholding application. This includes the need for documentation, withholding exemptions, as well as the amount of required withholding allowances. Whatever the motive someone has to fill out the Form There are a few aspects to keep in mind.

Withholding exemptions

Nonresident aliens are required to submit Form 1040-NR once a year. If you satisfy these requirements, you may be able to claim exemptions from the withholding form. The exemptions you will find on this page are yours.

To submit Form 1040-NR the first step is to attach Form 1042S. The document is required to report the federal income tax. It provides the details of the amount of withholding that is imposed by the tax withholding agent. Make sure you enter the correct information when you fill out the form. There is a possibility for one person to be treated differently if the information isn’t provided.

The withholding rate for nonresident aliens is 30%. Exemption from withholding could be possible if you’ve got a a tax burden that is less than 30%. There are a variety of exclusions. Some of them apply to spouses and dependents, such as children.

In general, the chapter 4 withholding gives you the right to the possibility of a refund. Refunds are allowed according to Sections 1471-1474. These refunds must be made by the tax withholding agents who is the person who is responsible for withholding taxes at source.

Status of relationships

A form for a marital withholding can make your life easier and assist your spouse. You’ll also be surprised by with the amount of money you can put in the bank. The problem is picking the right bank from the multitude of possibilities. Be cautious about with what you choose to do. The wrong decision can cost you dearly. If you adhere to the instructions and adhere to them, there won’t be any problems. If you’re lucky enough, you could be able to make new friends as you travel. Today is your anniversary. I’m hoping you’ll utilize it in order to get the sought-after diamond. For a successful completion of the task you must get the help of a certified tax expert. It’s worth it to build wealth over a lifetime. Information on the internet is readily available. TaxSlayer is a well-known tax preparation firm is one of the most helpful.

the number of claims for withholding allowances

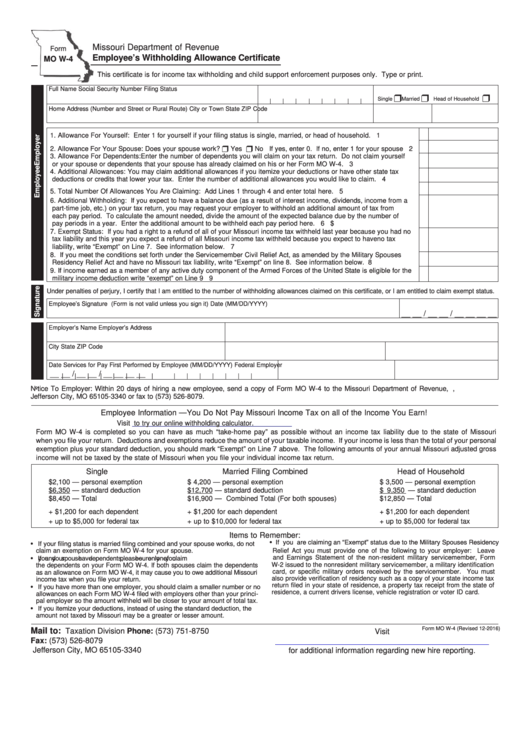

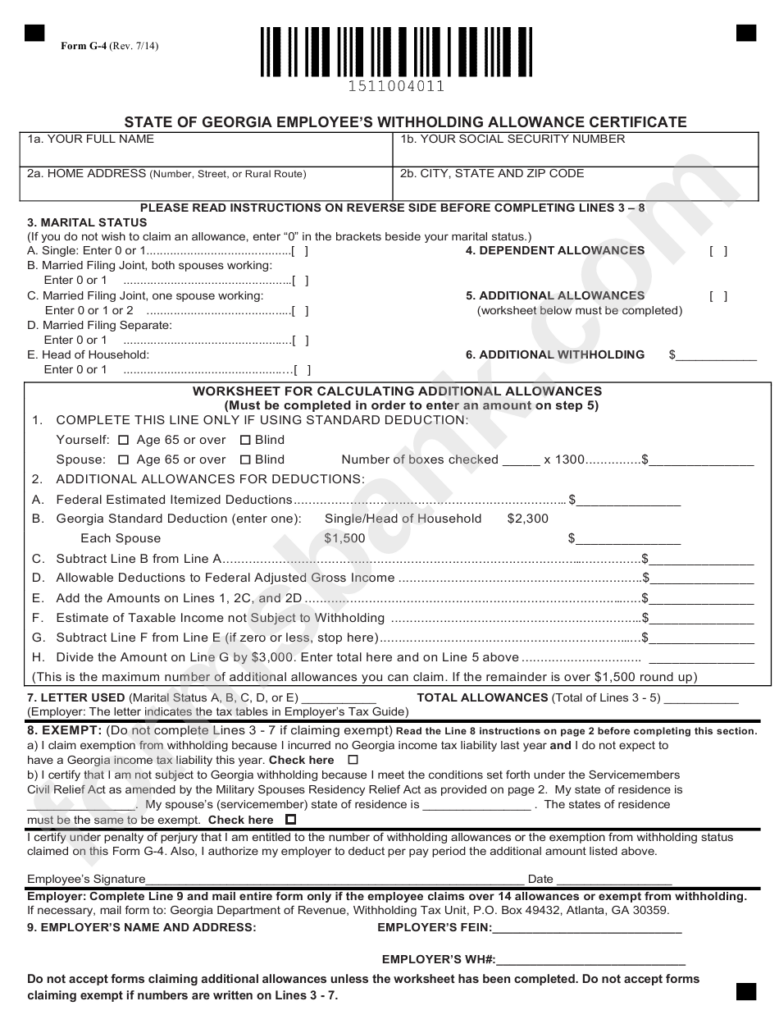

You must specify how many withholding allowances to be able to claim on the Form W-4 you submit. This is crucial because your pay will depend on the tax amount that you pay.

A number of factors can determine the amount that you can claim for allowances. The amount you are eligible for will be contingent on the income you earn. If you have high income, you might be eligible to receive more allowances.

It could save you a lot of money by selecting the appropriate amount of tax deductions. If you complete your yearly income tax return, you might even be eligible for a tax refund. But, you should be aware of your choices.

As with any financial decision, you should do your research. Calculators can assist you in determining how many withholding amounts should be demanded. A professional may be an option.

Specifications to be filed

Withholding taxes from your employees must be collected and reported in the event that you are an employer. Certain of these taxes can be filed with the IRS by submitting paperwork. There are additional forms you could require for example, an annual tax return, or a withholding reconciliation. Below is information about the different types of withholding tax and the deadlines for filing them.

To be eligible for reimbursement of withholding taxes on the pay, bonuses, commissions or other income earned by your employees You may be required to file a tax return for withholding. Additionally, if employees are paid in time, you could be eligible to get tax refunds for withheld taxes. You should also remember that some of these taxes may be county taxes. There are also special withholding methods that can be used in certain circumstances.

Electronic filing of withholding forms is mandatory according to IRS regulations. The Federal Employer identification number should be noted when you file your national tax return. If you don’t, you risk facing consequences.