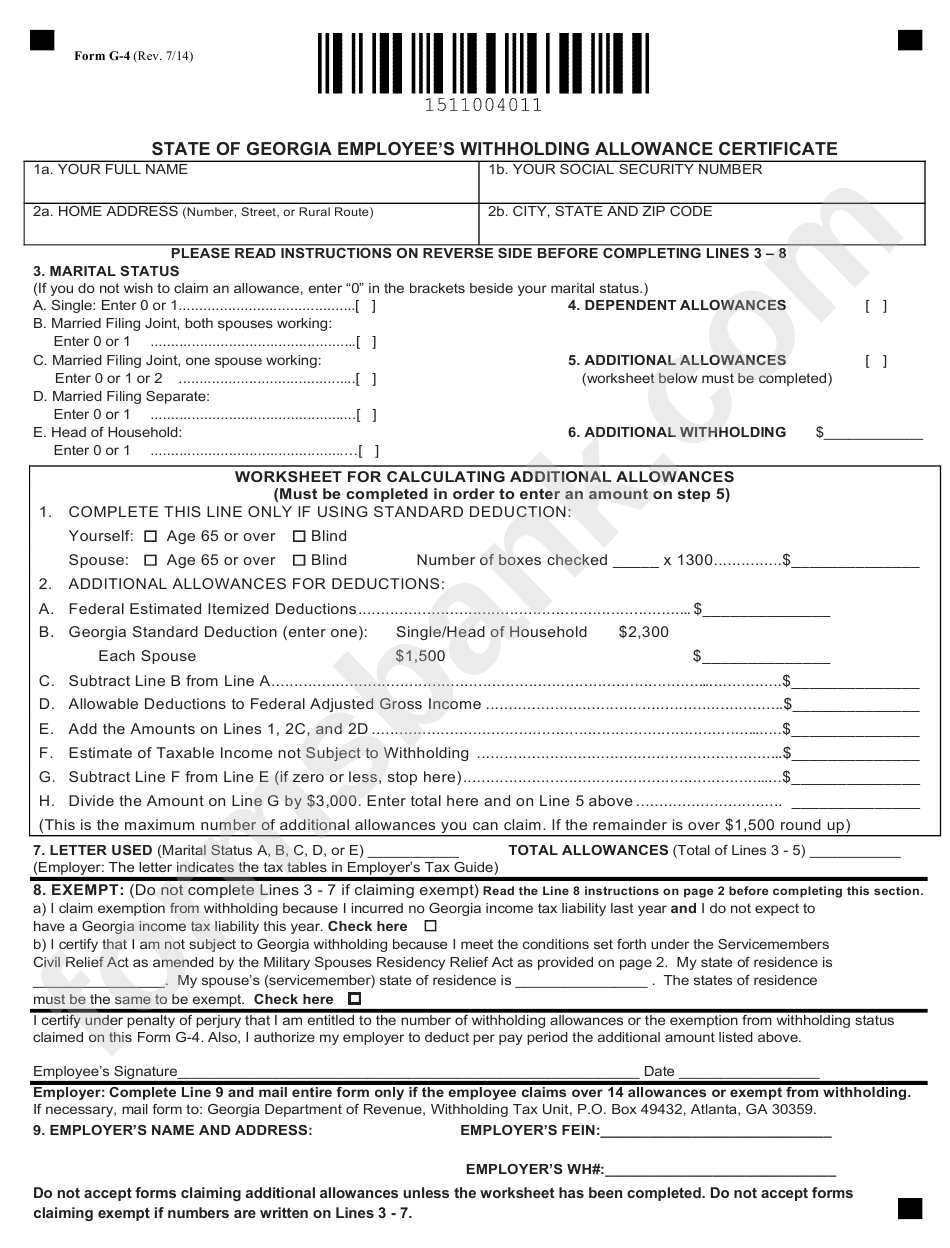

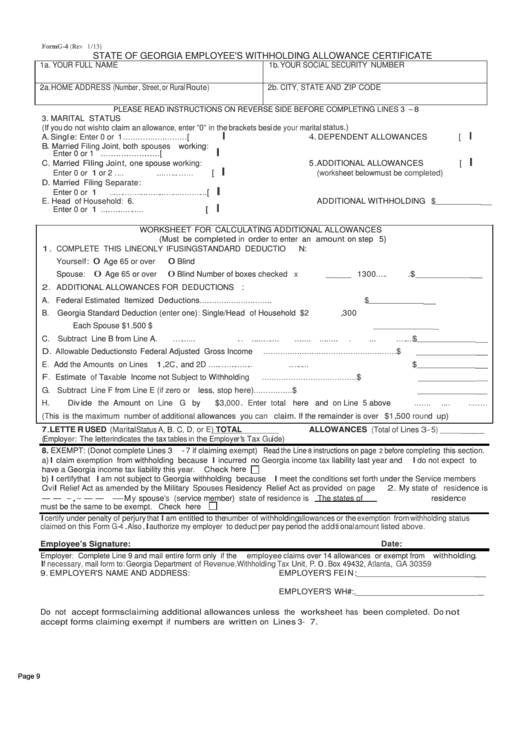

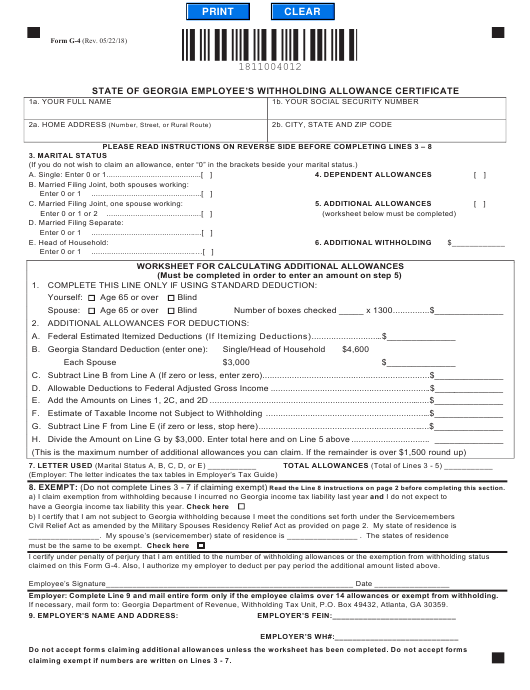

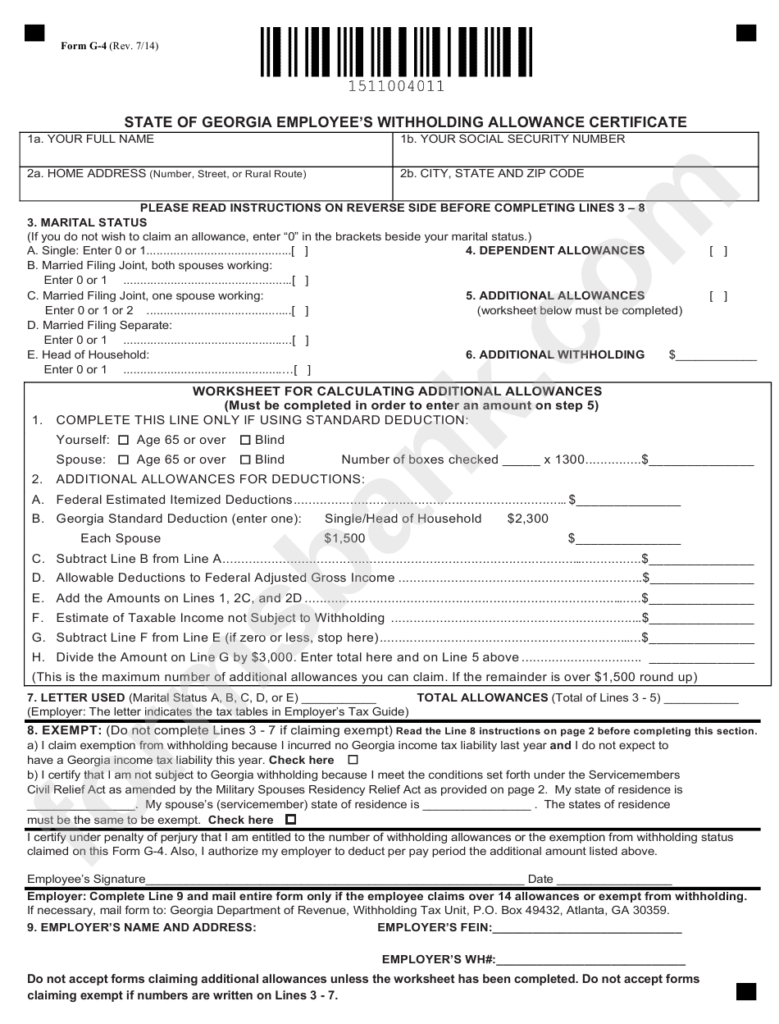

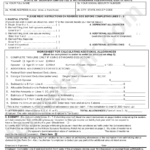

G-4 Withholding Form – There are numerous reasons that a person might decide to file a withholding application. This includes the need for documentation, exemptions from withholding and also the amount of required withholding allowances. Whatever the reason someone chooses to file the Form there are some aspects to keep in mind.

Exemptions from withholding

Nonresident aliens are required at least once a year to submit Form1040-NR. If you satisfy these conditions, you could be able to claim exemptions from the withholding form. This page lists all exclusions.

To submit Form 1040-NR, the first step is to attach Form 1042S. This form is used to record the federal income tax. It details the withholding by the withholding agent. When filling out the form ensure that you have provided the exact information. It is possible that you will have to treat a specific individual if you do not provide this information.

Non-resident aliens are subjected to the 30% tax withholding rate. A nonresident alien may be eligible for an exemption. This is the case if your tax burden less than 30%. There are many exclusions. Certain of them apply to spouses and dependents such as children.

The majority of the time, a refund is accessible for Chapter 4 withholding. Refunds are available under Sections 1401, 1474 and 1475. Refunds will be made to the agent who withholds tax the person who withholds the tax at the source.

Relational status

An official marital status form withholding forms will assist your spouse and you both make the most of your time. You will be pleasantly surprised by how much you can transfer to the bank. The problem is deciding what option to select. Certain things are best avoided. There will be a significant cost when you make a bad decision. You won’t have any issues if you just follow the directions and be attentive. You might make some new acquaintances if you’re fortunate. Today is the day you celebrate your wedding. I’m hoping that they will reverse the tide to get you the perfect engagement ring. It will be a complicated task that requires the expertise of a tax professional. The accumulation of wealth over time is more than the modest payment. Online information is easily accessible. TaxSlayer is a well-known tax preparation firm, is one of the most effective.

number of claimed withholding allowances

It is important to specify the amount of withholding allowances which you wish to claim on the form W-4. This is important since your wages could be affected by the amount of tax you have to pay.

You may be eligible to request an exemption for the head of your household if you are married. Your income will affect the amount of allowances you can receive. If you earn a significant amount of income, you may be eligible for a larger allowance.

Tax deductions that are appropriate for your situation could help you avoid large tax bills. In reality, if you complete your yearly income tax return, you may even receive a refund. However, be aware of your choices.

Do your research, as you would in any financial decision. Calculators can be utilized to figure out how many withholding allowances are required to be claimed. Other options include talking to an expert.

Specifications for filing

Employers are required to report any withholding taxes that are being collected from employees. For certain taxes you might need to submit documentation to IRS. A tax return that is annually filed and quarterly tax returns as well as the reconciliation of withholding tax are all kinds of documentation you may need. Here are some specifics about the various types of tax withholding forms and the filing deadlines.

Your employees might require you to submit withholding taxes return forms to get their salary, bonuses and commissions. Also, if employees are paid on time, you may be eligible to get the tax deductions you withheld. Remember that these taxes may also be considered county taxes. Furthermore, there are special tax withholding procedures that can be used in certain circumstances.

You must electronically submit tax withholding forms as per IRS regulations. Your Federal Employer identification number should be noted when you file to your tax return for the nation. If you don’t, you risk facing consequences.