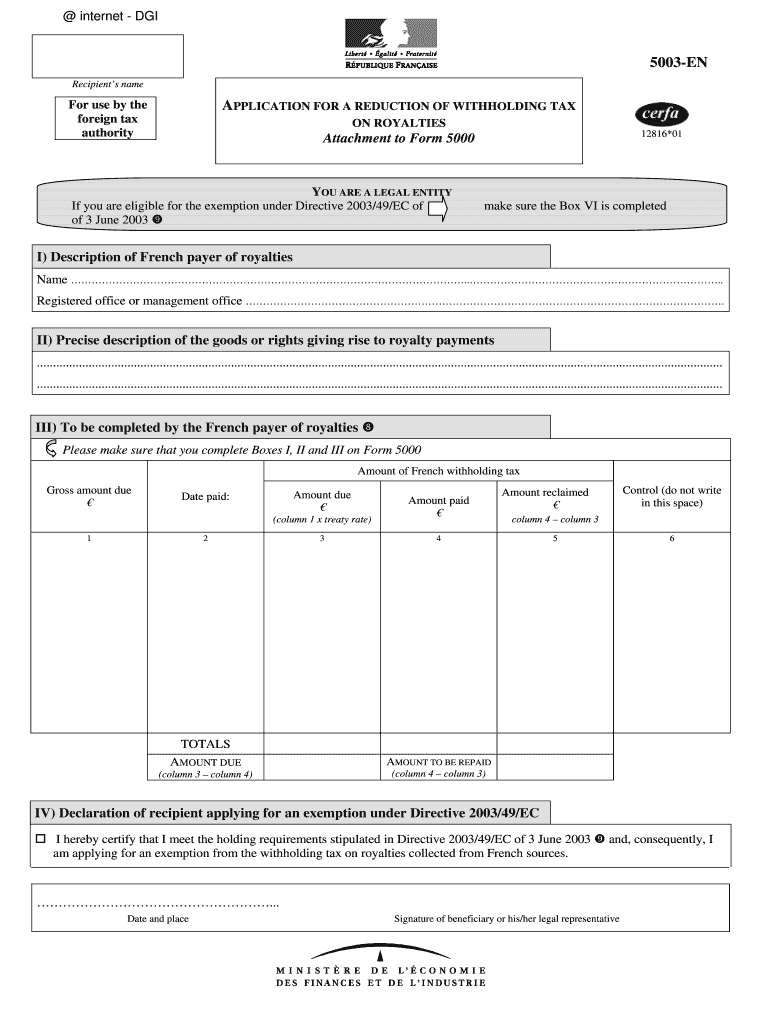

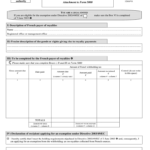

French Withholding Tax Form 5003 – There are many reasons someone could choose to submit an application for withholding. This includes the documents required, the exclusion of withholding and withholding allowances. It doesn’t matter what motive someone has to fill out the Form There are a few points to be aware of.

Exemptions from withholding

Non-resident aliens are required to complete Form 1040-NR once per year. However, if you meet the requirements, you might be eligible to submit an exemption from withholding form. The following page lists all exemptions.

For submitting Form 1040-NR include Form 1042-S. The form is used to declare the federal income tax. It outlines the amount of withholding that is imposed by the tax withholding agent. Make sure that you fill in the right information when you fill out the form. There is a possibility for one person to be treated if the correct information is not provided.

The tax withholding rate for non-resident aliens is 30%. It is possible to be exempted from withholding if your tax burden is greater than 30 percent. There are many exemptions. Some of these exclusions are only available to spouses or dependents, such as children.

In general, chapter 4 withholding allows you to receive an amount of money. Refunds can be made in accordance with Sections 471 to 474. The refunds are made to the tax agent withholding the person who withholds the tax from the source.

Status of relationships

Your and your spouse’s job will be made easy by the proper marriage status withholding form. You will be pleasantly surprised at how much money you can transfer to the bank. The difficulty lies in choosing the right option out of the many choices. You must be cautious in when you make a decision. It can be costly to make the wrong decision. It’s not a problem when you adhere to the instructions and pay attention. If you’re lucky, you may be able to make new friends as traveling. Today is the anniversary. I’m hoping you’ll be able to utilize it to secure that elusive diamond. It is best to seek the advice of a tax professional certified to ensure you’re doing it right. This tiny amount is worth the lifetime of wealth. You can get plenty of information on the internet. TaxSlayer is one of the most trusted and respected tax preparation firms.

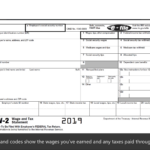

The amount of withholding allowances that were made

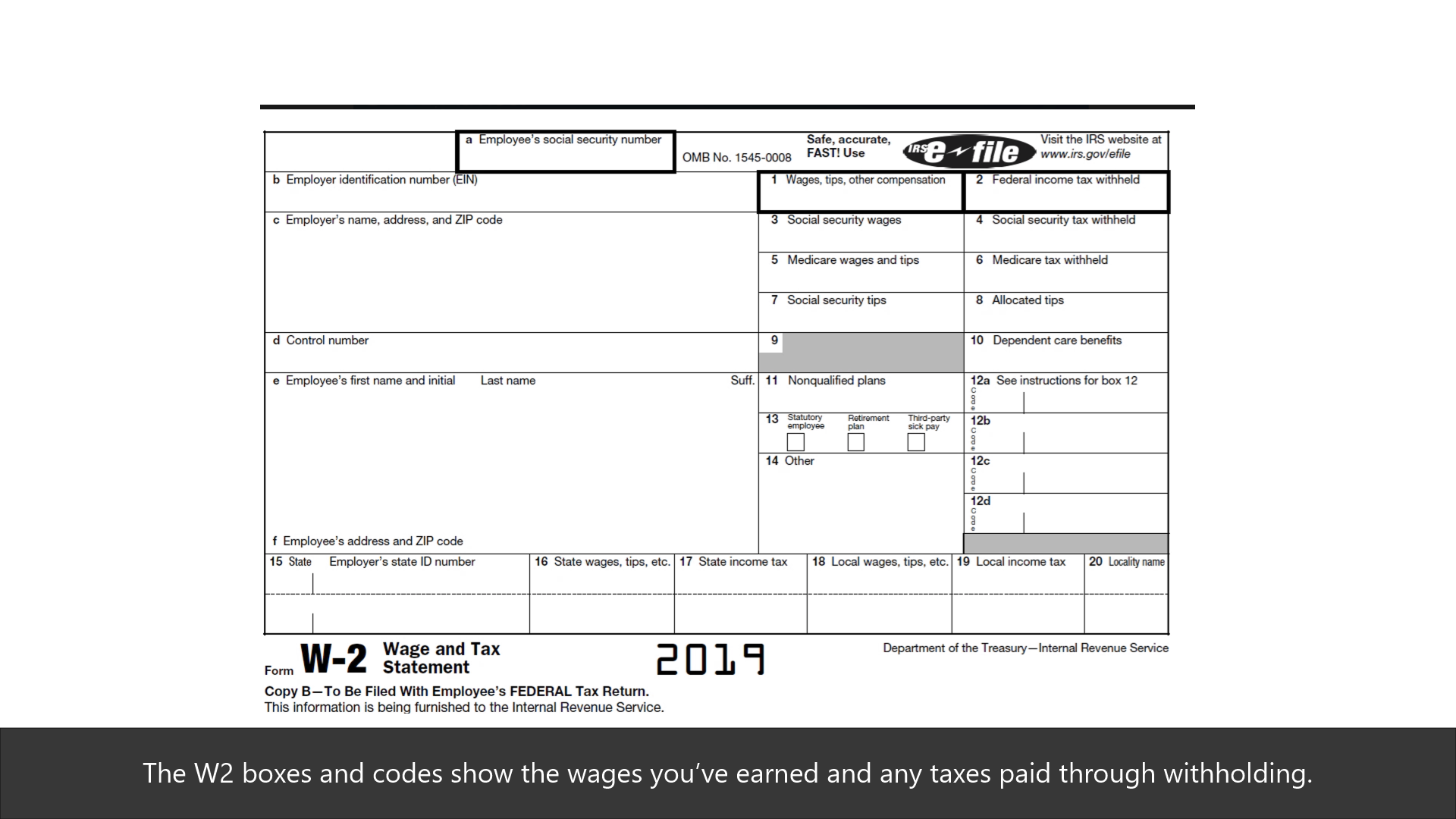

The Form W-4 must be filled in with the amount of withholding allowances that you want to take advantage of. This is crucial since the tax withheld will affect how much is taken from your paychecks.

A variety of factors influence the allowances requested.If you’re married for instance, you might be able to apply for a head of household exemption. Your income level will also affect the amount of allowances you are eligible for. If you earn a substantial amount of money, you might be eligible for a larger allowance.

The right amount of tax deductions could save you from a large tax charge. It is possible to receive the amount you owe if you submit your annual income tax return. But, you should be aware of your choices.

It is essential to do your homework, just like you would with any financial choice. To figure out the amount of tax withholding allowances to be claimed, make use of calculators. If you prefer contact an expert.

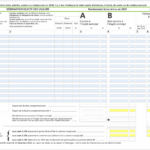

Specifications for filing

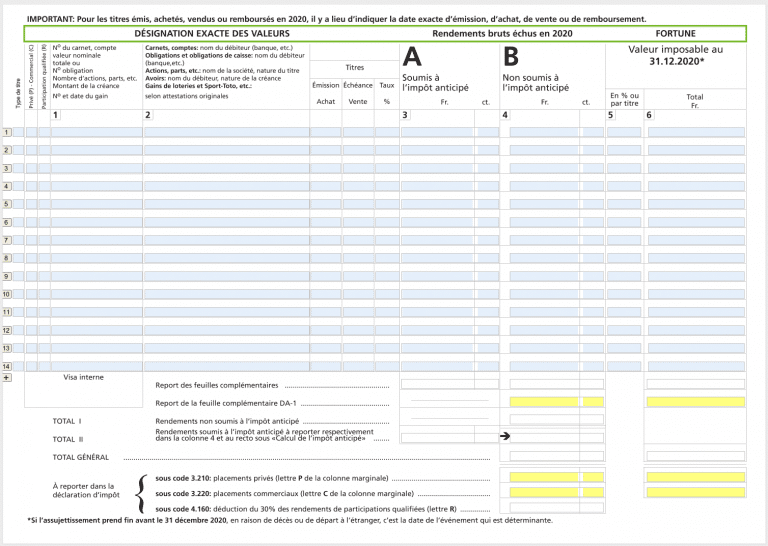

Employers must take withholding tax from their employees and then report the amount. If you are taxed on a specific amount you might need to submit documentation to the IRS. Additional documents that you could require to submit includes the reconciliation of your withholding tax and quarterly tax returns and the annual tax return. Here is some information on the various withholding tax form categories and the deadlines for filing them.

It is possible that you will need to file tax returns withholding in order to report the income you get from your employees, like bonuses and commissions or salaries. Also, if your employees receive their wages punctually, you might be eligible to get reimbursement of withheld taxes. Be aware that these taxes can be considered as county taxes. In addition, there are specific withholding practices that can be applied under particular conditions.

You must electronically submit tax withholding forms as per IRS regulations. The Federal Employer Identification Number needs to be listed when you submit your tax return for national revenue. If you don’t, you risk facing consequences.