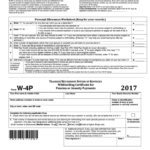

Form W 4p A Election Of Federal Income Tax Withholding – There are a variety of reasons someone might choose to fill out a withholding form. These factors include documentation requirements and exemptions from withholding. You must be aware of these factors regardless of the reason you decide to file a request form.

Withholding exemptions

Non-resident aliens must submit Form 1040-NR at least once per year. If you meet these requirements, you could be eligible to receive an exemption from the withholding forms. The following page lists all exemptions.

When you submit Form1040-NR, attach Form 1042S. To report federal income tax reasons, this form provides the withholding made by the tax agency that handles withholding. Fill out the form correctly. One person may be treated differently if this information is not supplied.

The rate of withholding for non-resident aliens is 30%. Your tax burden is not to exceed 30% in order to be eligible for exemption from withholding. There are a variety of exemptions. Some of them apply to spouses or dependents, like children.

In general, the chapter 4 withholding entitles you to an amount of money. Refunds are granted in accordance with Sections 1400 through 1474. Refunds are given to the tax agent withholding the person who withholds taxes from the source.

Status of relationships

An official marriage status withholding form can help your spouse and you both get the most out of your time. You’ll be surprised at how much money you can transfer to the bank. It can be difficult to choose which of the many options you’ll choose. Certain issues should be avoided. Unwise decisions could lead to expensive consequences. However, if you adhere to the guidelines and watch out for any pitfalls You won’t face any issues. If you’re lucky enough, you might find some new acquaintances while traveling. In the end, today is the anniversary of your wedding. I’m hoping you’ll utilize it in order to find the sought-after diamond. It will be a complicated task that requires the expertise of a tax professional. This small payment is well worth the lifetime of wealth. Information on the internet is easy to find. Reputable tax preparation firms like TaxSlayer are among the most helpful.

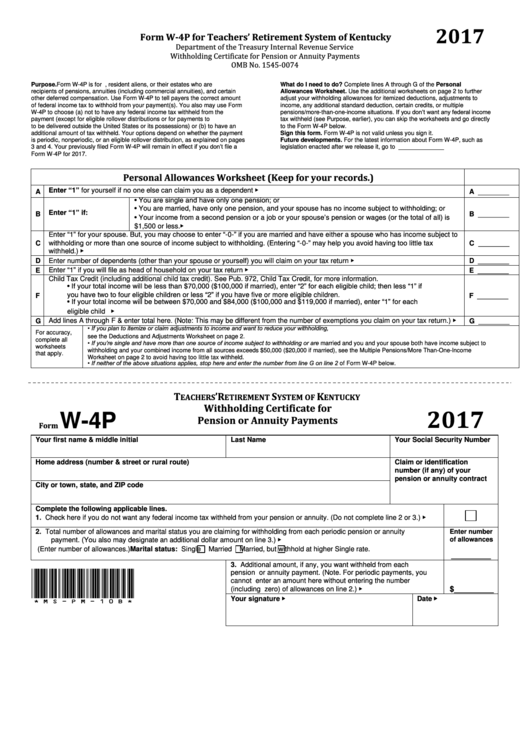

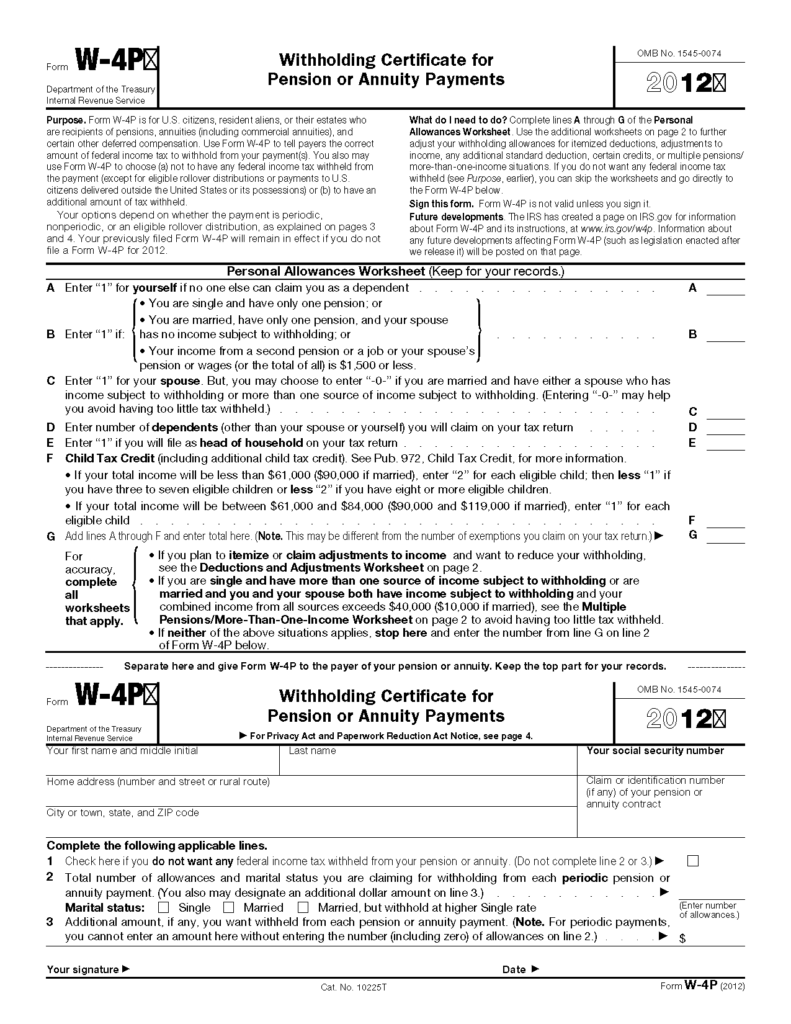

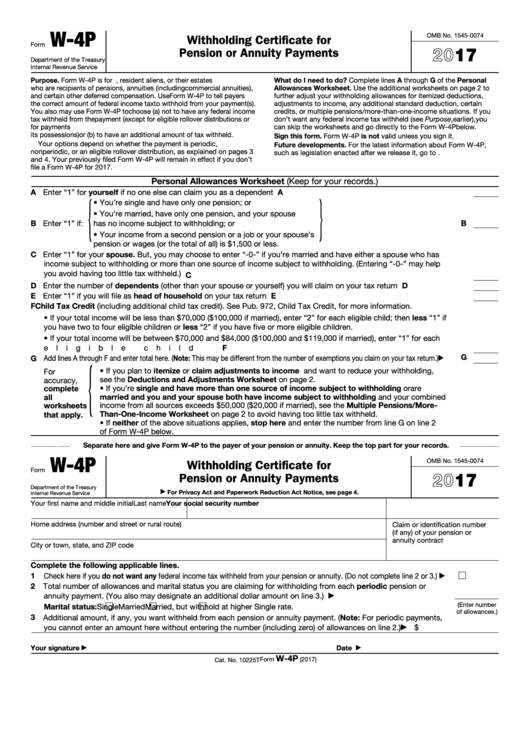

The amount of withholding allowances claimed

When submitting Form W-4, you need to specify how many withholding allowances you want to claim. This is important because the withholdings will effect on the amount of tax that is deducted from your paychecks.

Many factors determine the amount that you can claim for allowances. The amount you are eligible for will be contingent on the income you earn. If you have a high income, you could be eligible to request an increased allowance.

A tax deduction appropriate for your situation could help you avoid large tax payments. The possibility of a refund is possible if you submit your tax return on income for the year. But, you should be cautious about your approach.

You must do your homework, just like you would for any financial decision. Calculators can be utilized to figure out how many withholding allowances you should claim. You can also speak to an expert.

Formulating specifications

Employers must report the employer who withholds taxes from their employees. Certain of these taxes can be submitted to the IRS by submitting forms. There are other forms you might need for example, an annual tax return, or a withholding reconciliation. Below are information on the different tax forms that you can use for withholding as well as the deadlines for each.

The bonuses, salary, commissions, and other income you get from employees might require you to file tax returns withholding. You could also be eligible to be reimbursed for tax withholding if your employees were paid in time. Remember that these taxes could also be considered county taxes. In certain circumstances, withholding rules can also be unique.

As per IRS regulations the IRS regulations, electronic filing of forms for withholding are required. Your Federal Employer Identification Number needs to be listed on your tax return for national revenue. If you don’t, you risk facing consequences.