Form To Request Ss Withholding – There are many reasons an individual might decide to fill out withholding forms. This is due to the requirement for documentation, withholding exemptions and also the amount of required withholding allowances. No matter why the person decides to fill out a form there are some points to be aware of.

Exemptions from withholding

Non-resident aliens are required to submit Form 1040-NR once a year. You may be eligible to submit an exemption form for withholding tax if you meet all the criteria. This page you’ll find the exclusions available to you.

To submit Form 1040-NR The first step is attaching Form 1042S. This form is used to declare the federal income tax. It provides the details of the withholding by the withholding agent. Make sure that you fill in the right information when you fill out the form. If the correct information isn’t given, a person could be diagnosed with a medical condition.

The rate of withholding for non-resident aliens is 30%. A tax exemption may be possible if you’ve got a an income tax burden of less than 30%. There are many exemptions offered. Some of them are only available to spouses or dependents, such as children.

In general, withholding under Chapter 4 allows you to claim a return. According to Sections 1471 through 1474, refunds are granted. Refunds are provided by the withholding agent. The withholding agent is the individual responsible for withholding the tax at the source.

relational status

The work of your spouse and you can be made easier by a proper marriage status withholding form. The bank may be surprised by the amount that you deposit. The challenge is selecting the best option out of the many choices. You must be cautious in with what you choose to do. It will be costly to make the wrong choice. If you follow the directions and follow them, there shouldn’t be any issues. If you’re lucky, you could make new acquaintances on your trip. Today marks the anniversary of your wedding. I’m hoping they make it work against you in order to assist you in getting the elusive engagement ring. It will be a complicated job that requires the knowledge of an expert in taxation. A modest amount of money can make a lifetime of wealth. Online information is easily accessible. TaxSlayer is among the most trusted and reputable tax preparation companies.

The amount of withholding allowances requested

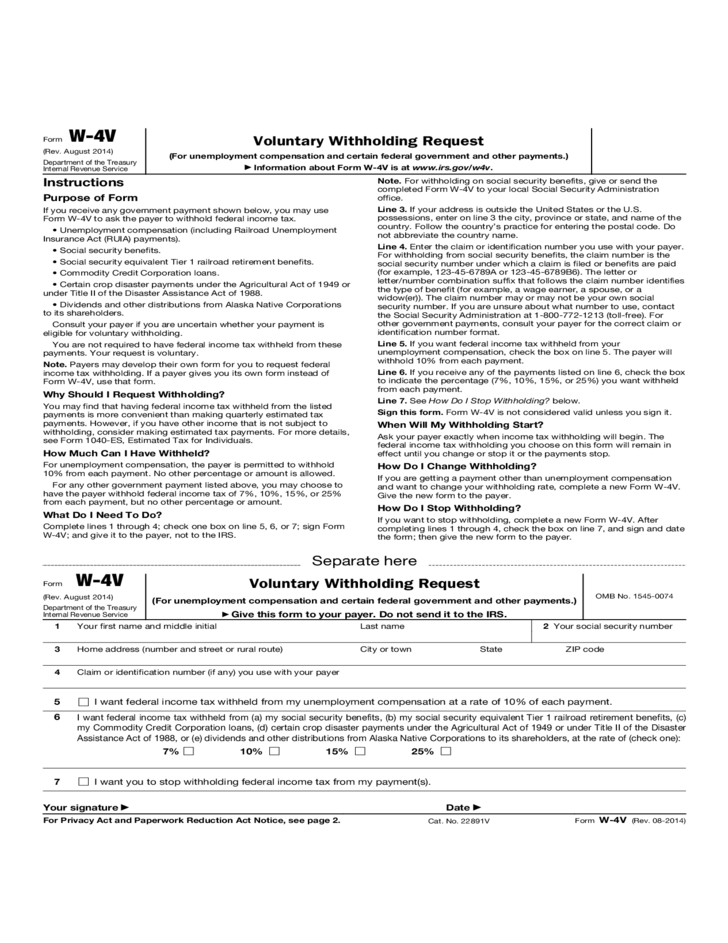

It is important to specify the amount of the withholding allowance you wish to claim on the W-4 form. This is crucial because your pay will depend on the tax amount you pay.

You could be eligible to claim an exemption for your spouse if you are married. Your income level can also determine the amount of allowances offered to you. A larger allowance might be granted if you make a lot.

A proper amount of tax deductions could help you avoid a significant tax charge. If you file your annual income tax returns and you are qualified for a tax refund. But it is important to choose the right approach.

Research like you would with any other financial decision. Calculators are a great tool to figure out how many withholding allowances are required to be claimed. A specialist might be a viable alternative.

Filing requirements

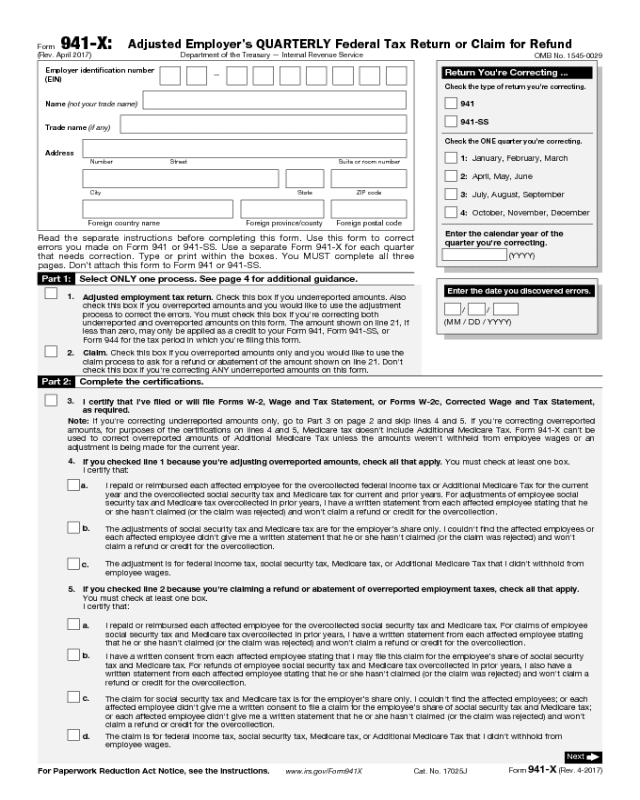

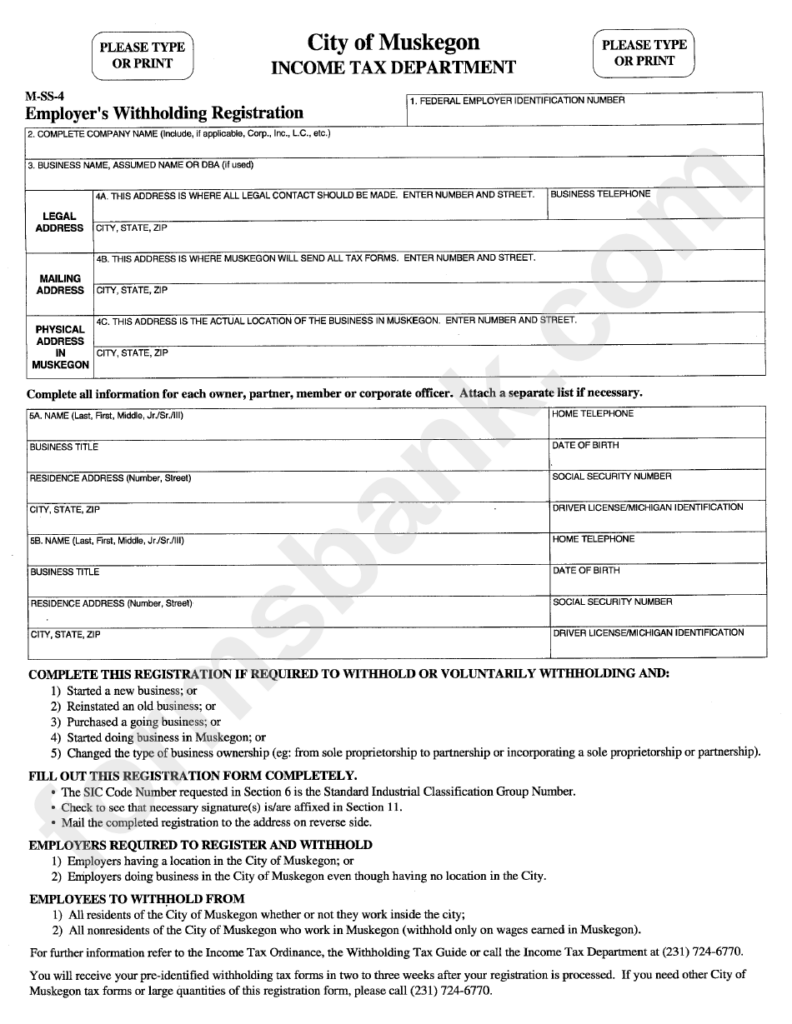

Employers must collect withholding taxes from their employees and report it. You may submit documentation to the IRS to collect a portion of these taxation. A tax reconciliation for withholding or an annual tax return for quarterly filing, or an annual tax return are all examples of additional documents you could have to file. Here’s some information about the different tax forms, and the time when they should be filed.

In order to be eligible for reimbursement of tax withholding on salary, bonus, commissions or other income earned by your employees You may be required to submit a tax return withholding. Additionally, if employees are paid in time, you could be eligible to get reimbursement of withheld taxes. It is crucial to remember that not all of these taxes are local taxes. There are also unique withholding strategies that are applicable in certain circumstances.

You must electronically submit withholding forms according to IRS regulations. Your Federal Employer identification number should be included when you submit at your national tax return. If you don’t, you risk facing consequences.