Form To Reclaim German Withholding Tax – There are many explanations why somebody could decide to complete a withholding form. This is due to the requirement for documentation, exemptions to withholding and the amount of required withholding allowances. It is important to be aware of these things regardless of your reason for choosing to file a request form.

Exemptions from withholding

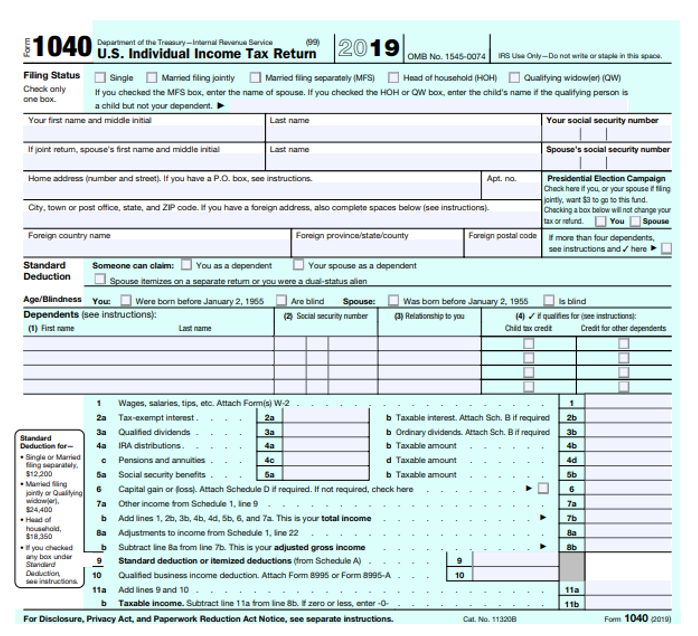

Nonresident aliens are required to submit Form 1040-NR at least once per year. If you satisfy these requirements, you could be able to claim exemptions from the form for withholding. The following page lists all exclusions.

When submitting Form1040-NR, Attach Form 1042S. This form is a record of the withholdings that the agency makes. Be sure to enter the correct information when you fill in the form. If the information you provide is not given, a person could be taken into custody.

The non-resident alien withholding rate is 30 percent. A tax exemption may be available if you have a tax burden that is less than 30%. There are many exemptions. Some of them are only applicable to spouses and dependents like children.

In general, refunds are offered for the chapter 4 withholding. Refunds can be granted according to Sections 471 through 474. The refunds are made to the tax agent withholding that is the person who collects taxes from the source.

Status of relationships

You and your spouse’s work is made simpler by a proper marriage status withholding form. You will be pleasantly surprised by how much you can put in the bank. The problem is choosing the right option among the numerous options. Certain aspects should be avoided. There will be a significant cost if you make a wrong decision. There’s no problem if you just adhere to the instructions and pay attention. If you’re lucky, you could make new acquaintances on your journey. Today is your anniversary. I’m sure you’ll be able to use it against them to secure that dream wedding ring. For a successful approach, you will need the assistance of a certified accountant. The small amount is well worth it for a lifetime of wealth. It is a good thing that you can access a ton of information online. Tax preparation firms that are reputable, such as TaxSlayer are among the most helpful.

The amount of withholding allowances claimed

When submitting Form W-4, you must specify how many withholdings allowances you would like to claim. This is important as it will impact the amount of tax you get from your wages.

You may be able to request an exemption for your spouse in the event that you are married. Additionally, you can claim additional allowances depending on how much you earn. If you earn a significant amount of money, you might be eligible for a larger allowance.

A proper amount of tax deductions will save you from a large tax bill. You could actually receive the amount you owe if you submit the annual tax return. Be sure to select your method carefully.

Similar to any other financial decision, you should conduct your homework. Calculators can be utilized for determining how many allowances for withholding need to be requested. A better option is to consult to a professional.

Sending specifications

If you’re an employer, you are required to collect and report withholding taxes from your employees. Certain of these taxes can be filed with the IRS by submitting paperwork. Additional paperwork that you may be required to file include an withholding tax reconciliation as well as quarterly tax returns and the annual tax return. Here is more information on the different forms of withholding taxes as well as the deadlines for filing them.

To be qualified for reimbursement of withholding tax on the pay, bonuses, commissions or any other earnings earned by your employees, you may need to submit a tax return withholding. If you also pay your employees on time it could be possible to qualify to receive reimbursement for taxes not withheld. Remember that these taxes can also be considered county taxes. In certain situations the rules for withholding can be different.

The IRS regulations require that you electronically submit your withholding documentation. The Federal Employer identification number should be listed when you point to your tax return for the nation. If you don’t, you risk facing consequences.