Form To Have Withholding From Social Security – There are many explanations why somebody could decide to fill out a form for withholding. Withholding exemptions, documentation requirements as well as the quantity of the allowance demanded are all elements. No matter the reason for the filing of a document it is important to remember certain points you must keep in mind.

Withholding exemptions

Non-resident aliens must submit Form 1040-NR at least once per year. However, if your requirements are met, you may be eligible to apply for an exemption from withholding. This page lists all exclusions.

To file Form 1040-NR The first step is attaching Form 1042S. The form is used to record the federal income tax. It provides the details of the withholding by the withholding agent. Make sure you fill out the form correctly. If this information is not provided, one individual could be diagnosed with a medical condition.

The tax withholding rate for non-resident aliens is 30 percent. It is possible to be exempted from withholding if your tax burden exceeds 30 percent. There are many exemptions. Some of these exclusions are only applicable to spouses and dependents like children.

Generally, you are eligible for a reimbursement under chapter 4. Refunds are permitted under Sections 1471-1474. Refunds will be made to the tax agent withholding the person who withholds the tax at the source.

Relational status

A valid marital status and withholding form will simplify the job of both you and your spouse. Additionally, the quantity of money you can put at the bank can surprise you. The challenge is picking the right bank out of the many options. There are certain actions you should not do. Making a mistake can have expensive negative consequences. However, if you adhere to the directions and keep your eyes open for any pitfalls, you won’t have problems. If you’re lucky enough to meet some new friends while on the road. Today marks the anniversary of your wedding. I’m sure you’ll take advantage of it to locate that perfect engagement ring. If you want to get it right you’ll need the assistance of a certified accountant. It’s worth it to build wealth over the course of your life. You can get a ton of information online. TaxSlayer and other trusted tax preparation companies are some of the best.

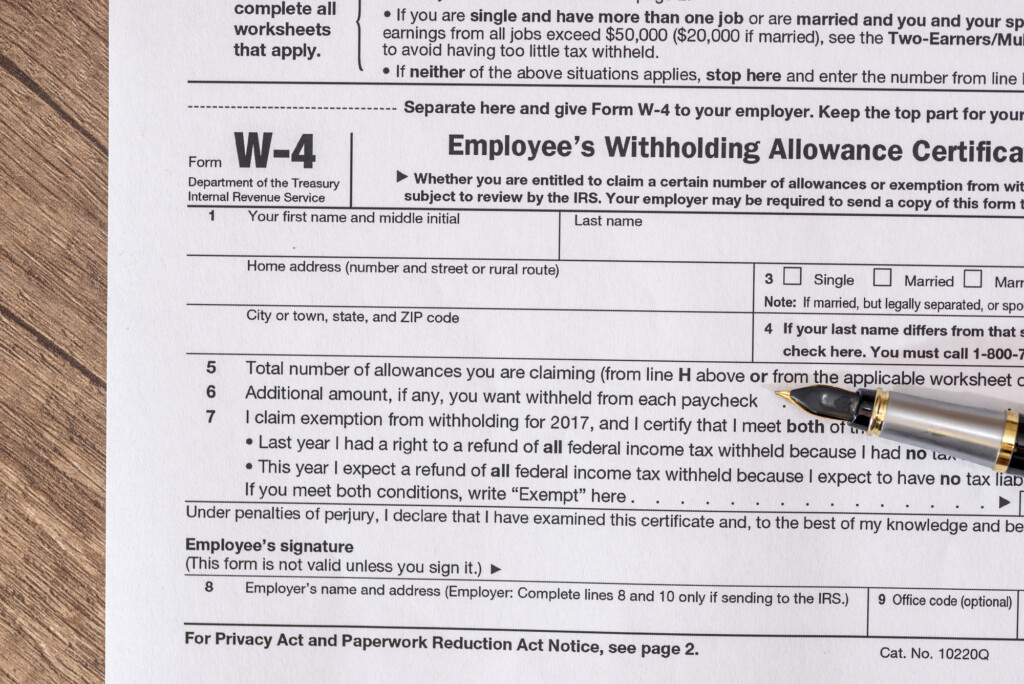

There are numerous withholding allowances being requested

When submitting Form W-4, you need to specify how many withholding allowances you wish to claim. This is important because the withholdings will have an effect on the amount of tax is taken out of your paychecks.

You may be able to claim an exemption for your head of household when you’re married. The amount you’re eligible to claim will depend on the income you earn. If you have a higher income, you might be eligible to receive higher amounts.

Making the right choice of tax deductions can help you avoid a hefty tax payment. If you file the annual tax return for income, you may even be qualified for a tax refund. It is important to be cautious when it comes to preparing this.

In any financial decision, it is important to be aware of the facts. Calculators are a great tool to determine the amount of withholding allowances you should claim. Alternative options include speaking with an expert.

Filing specifications

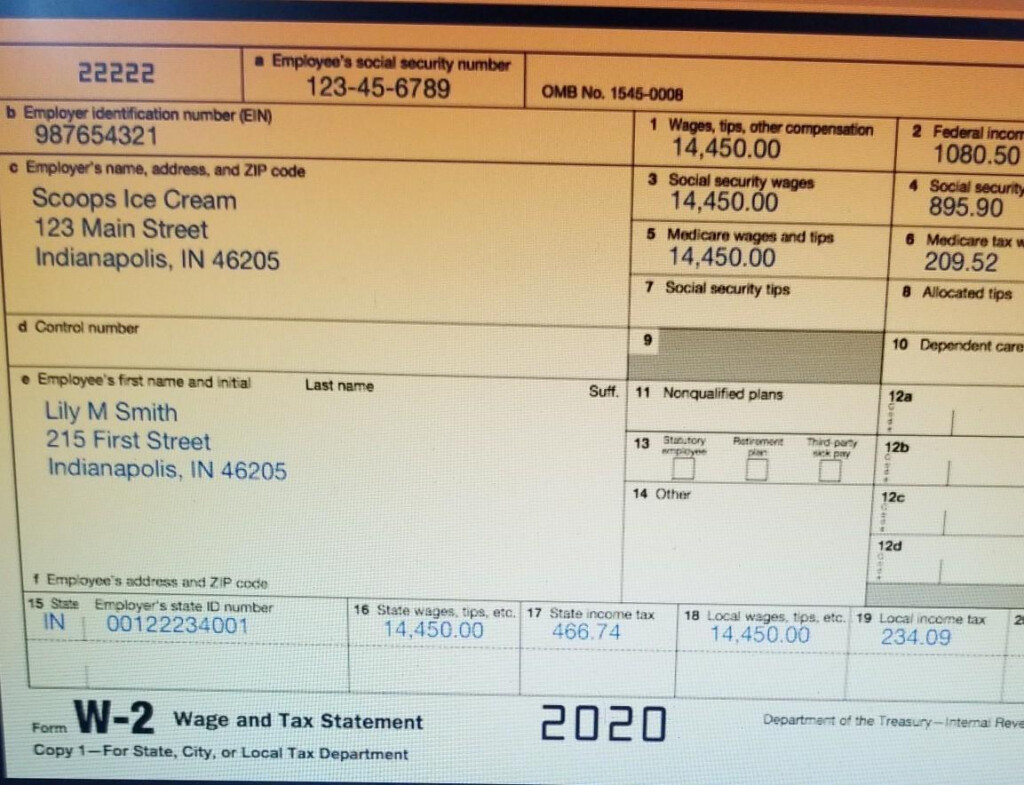

Withholding taxes from employees need to be reported and collected when you’re an employer. If you are taxed on a specific amount, you may submit paperwork to IRS. You may also need additional forms that you might need for example, an annual tax return, or a withholding reconciliation. Here are some details on the different types of withholding tax forms along with the filing deadlines.

The bonuses, salary, commissions, and other income you get from your employees may require you to file withholding tax returns. If you make sure that your employees are paid on time, then you may be eligible for the refund of taxes that you withheld. The fact that some of these taxes are also county taxes should also be noted. There are also specific withholding techniques that are applicable under certain conditions.

The IRS regulations require that you electronically file withholding documents. When you file your tax returns for the national income tax, be sure to provide the Federal Employee Identification Number. If you don’t, you risk facing consequences.