Form New Employee Fills Out For Withholdings – There are many reasons why someone might choose to complete a form for withholding form. These include documents required, the exclusion of withholding as well as the withholding allowances. However, if a person chooses to file a form there are some points to be aware of.

Exemptions from withholding

Non-resident aliens are required to file Form 1040–NR at least once per calendar year. If you meet these requirements, you may be eligible to receive exemptions from the withholding forms. This page you’ll see the exemptions that are available to you.

The first step to filling out Form 1040-NR is to attach the Form 1042 S. This form is used to report federal income tax. It outlines the withholding by the withholding agent. Fill out the form correctly. If this information is not given, a person could be taken into custody.

The non-resident alien withholding rate is 30%. If the tax you pay is lower than 30 percent of your withholding, you may be eligible to receive an exemption from withholding. There are many different exemptions. Some of these exclusions are only applicable to spouses and dependents, such as children.

In general, you’re entitled to a reimbursement in accordance with chapter 4. Refunds can be granted according to Sections 471 through 474. Refunds are to be given by the withholding agents who is the person who is responsible for withholding taxes at the source.

Status of the relationship

A valid marital status and withholding form will simplify the work of you and your spouse. The bank may be surprised by the amount of money that you deposit. It can be difficult to determine which one of the many options is most attractive. Certain issues should be avoided. Unwise decisions could lead to costly negative consequences. There’s no problem when you adhere to the instructions and pay attention. If you’re lucky, you might even make new acquaintances while traveling. After all, today marks the anniversary of your wedding. I’m hoping you can make use of it to get that elusive engagement ring. To do it right, you will need the help of a certified accountant. This tiny amount is worth the time and money. You can get a lot of information on the internet. Reputable tax preparation firms like TaxSlayer are among the most helpful.

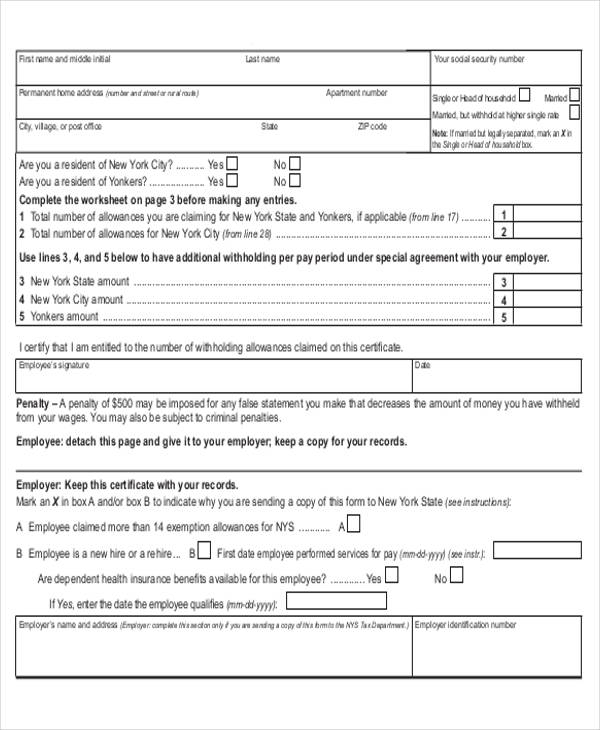

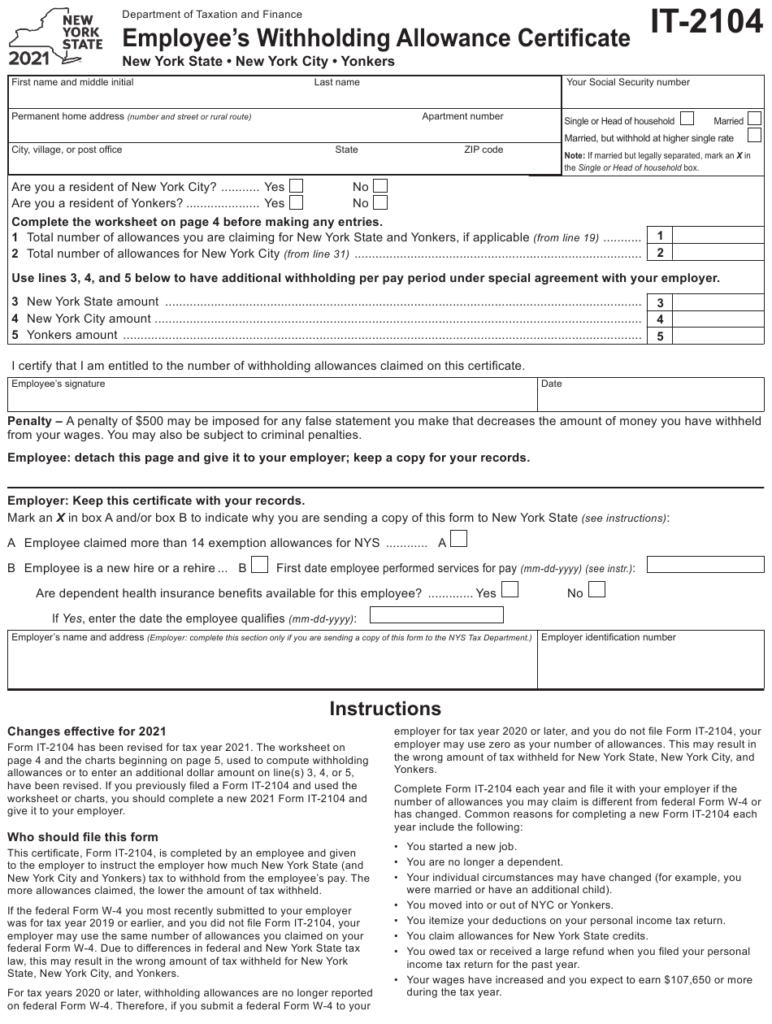

the number of claims for withholding allowances

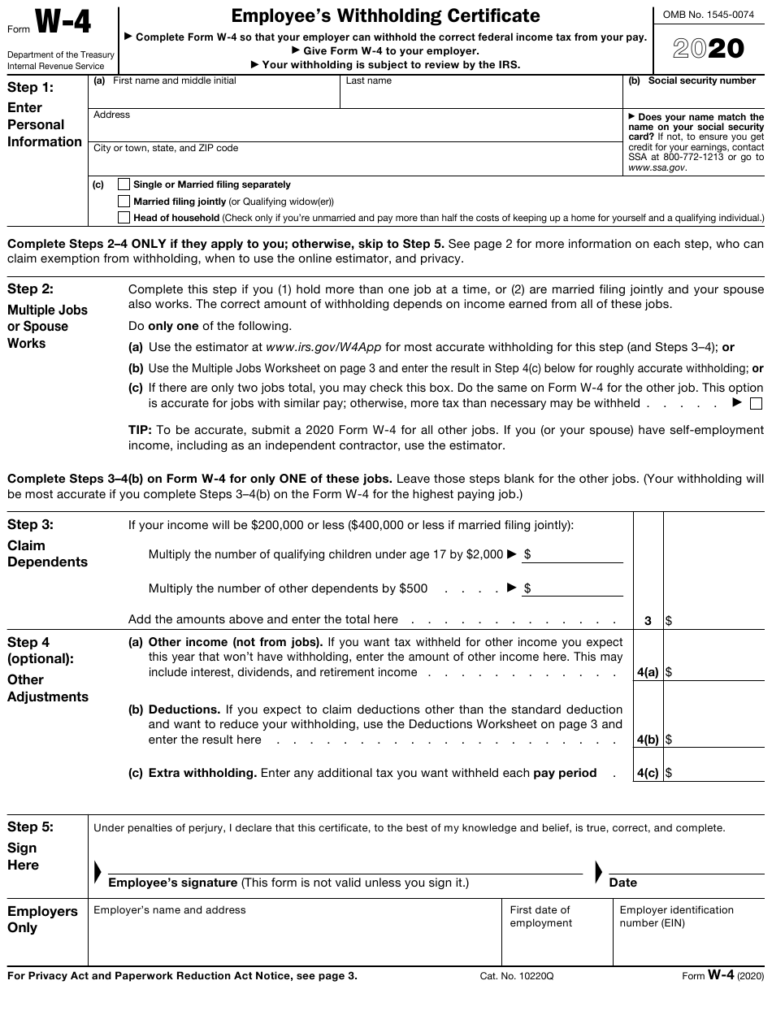

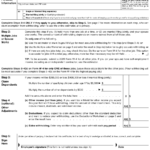

It is crucial to indicate the amount of withholding allowances you wish to claim on the form W-4. This is vital because it affects how much tax you will receive from your paychecks.

There are many variables that affect the allowance amount you can request. If you’re married, you may be eligible for a head-of-household exemption. You may also be eligible for higher allowances depending on how much you earn. If you have high income it could be possible to receive more allowances.

You could save a lot of money by choosing the correct amount of tax deductions. Refunds could be possible if you submit your tax return on income for the previous year. You need to be careful about how you approach this.

It is essential to do your homework the same way you would for any financial decision. Calculators can be used to determine how many withholding allowances need to be made. An alternative is to speak with a specialist.

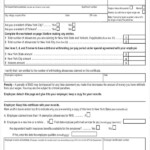

Formulating specifications

Employers are required to report the company who withholds tax from their employees. Some of these taxes can be reported to the IRS by submitting forms. A withholding tax reconciliation or an annual tax return for quarterly filing, as well as an annual tax return are examples of additional paperwork you might have to file. Here are some details about the various types of withholding tax forms along with the deadlines for filing.

To be qualified for reimbursement of tax withholding on salary, bonus, commissions or any other earnings that your employees receive You may be required to submit withholding tax return. You may also be eligible to be reimbursed for tax withholding if your employees were paid on time. The fact that certain taxes are also county taxes ought to be considered. Additionally, there are unique methods of withholding that are used in certain conditions.

Electronic submission of withholding forms is mandatory according to IRS regulations. You must provide your Federal Employer ID Number when you point to your tax return for national income. If you don’t, you risk facing consequences.