Form Il 941 Illinois Withholding Income Tax Return – There are a variety of explanations why somebody could decide to complete a withholding form. These factors include documentation requirements and exemptions from withholding. It doesn’t matter what reason someone chooses to file the Form There are a few aspects to keep in mind.

Exemptions from withholding

Non-resident aliens are required to complete Form 1040-NR every year. If you meet the criteria, you may be eligible for an exemption to withholding. The exemptions you will find on this page are yours.

For submitting Form 1040-NR add Form 1042-S. This form provides details about the withholding done by the withholding agency for federal income tax reporting purposes. It is essential to fill in exact information when you fill out the form. You could be required to treat a single person for not providing the correct information.

Non-resident aliens are subject to the 30% tax withholding rate. A nonresident alien may be eligible for an exemption. This applies the case if your tax burden lower than 30%. There are many exemptions. Some are specifically for spouses, and dependents, like children.

You are entitled to refunds if you have violated the provisions of chapter 4. Refunds are made in accordance with Sections 471 to 474. The refunds are given by the withholding agent (the person who collects tax at the source).

relationship status

A form for a marital withholding is a good way to make your life easier and assist your spouse. Additionally, the quantity of money you may deposit at the bank can delight you. The trick is to decide which one of the many options to select. You should be careful with what you choose to do. A bad decision could result in a costly loss. If the rules are followed and you pay attention, you should not have any problems. If you’re lucky to meet some new acquaintances traveling. Today marks the anniversary of your wedding. I’m hoping they turn it against you to help you get the elusive engagement ring. To do this correctly, you’ll need the guidance of a tax expert who is certified. This small payment is well worth the time and money. There is a wealth of information online. TaxSlayer as well as other reliable tax preparation firms are a few of the top.

In the amount of withholding allowances that are claimed

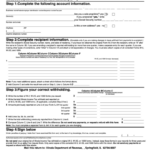

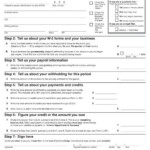

When you fill out Form W-4, you must specify how many withholdings allowances you would like to claim. This is crucial since the tax withheld will impact the amount of tax taken from your paycheck.

A number of factors can influence the amount you qualify for allowances. Your income level also affects how many allowances you are eligible to claim. You can apply for an increase in allowances if you have a large amount of income.

Making the right choice of tax deductions might help you avoid a hefty tax bill. Refunds could be possible if you submit your income tax return for the year. But , you have to choose the right method.

Like any financial decision, it is important that you must do your research. To determine the amount of tax withholding allowances to be claimed, you can utilize calculators. Another option is to talk with a specialist.

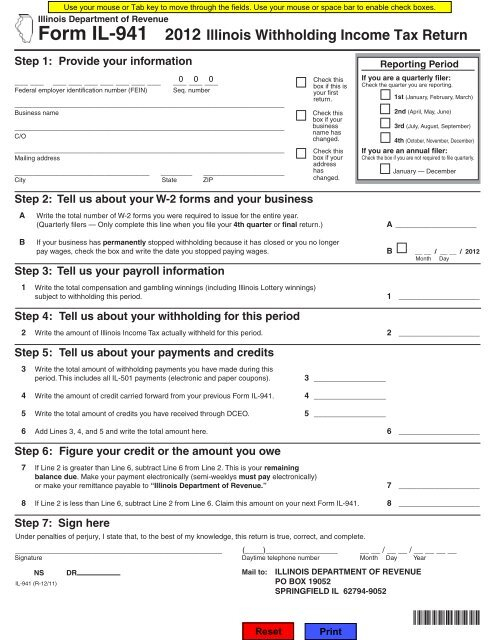

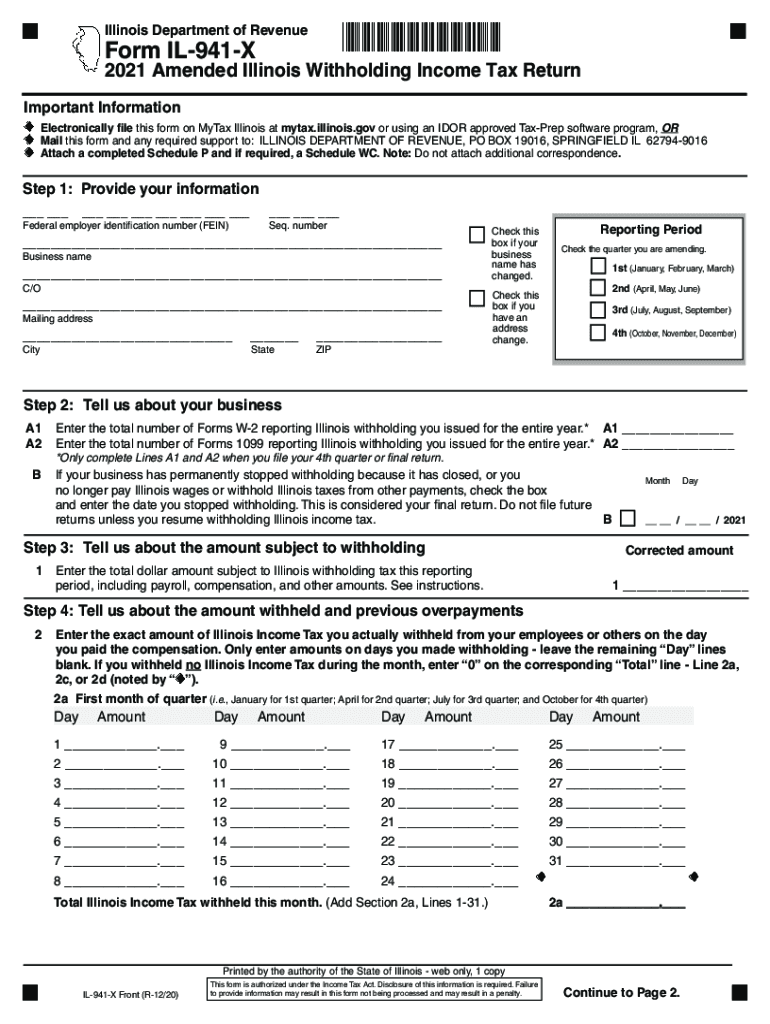

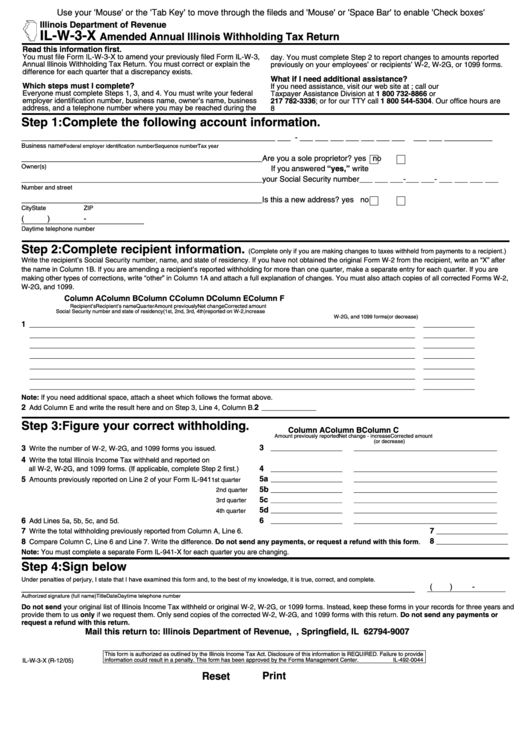

Filing specifications

Employers must take withholding tax from their employees and then report it. The IRS can accept paperwork for certain taxes. You might also need additional documents, such as the reconciliation of your withholding tax or a quarterly tax return. Here’s some information about the different tax forms for withholding categories, as well as the deadlines to the submission of these forms.

Employees may need the submission of withholding tax return forms to get their wages, bonuses and commissions. Additionally, if you pay your employees on time, you could be eligible to receive reimbursement for taxes that were withheld. It is important to note that some of these taxes are county taxes must also be noted. There are also special withholding methods that are applicable in specific situations.

In accordance with IRS regulations, electronic submissions of withholding forms are required. The Federal Employer Identification Number needs to be included when you point your national revenue tax return. If you don’t, you risk facing consequences.