Form For Withholding Tax Malaysia – There are many reasons one might choose to fill out forms withholding. This is due to the requirement for documentation, withholding exemptions, as well as the amount of required withholding allowances. There are certain important things to keep in mind regardless of the reason the person fills out the form.

Exemptions from withholding

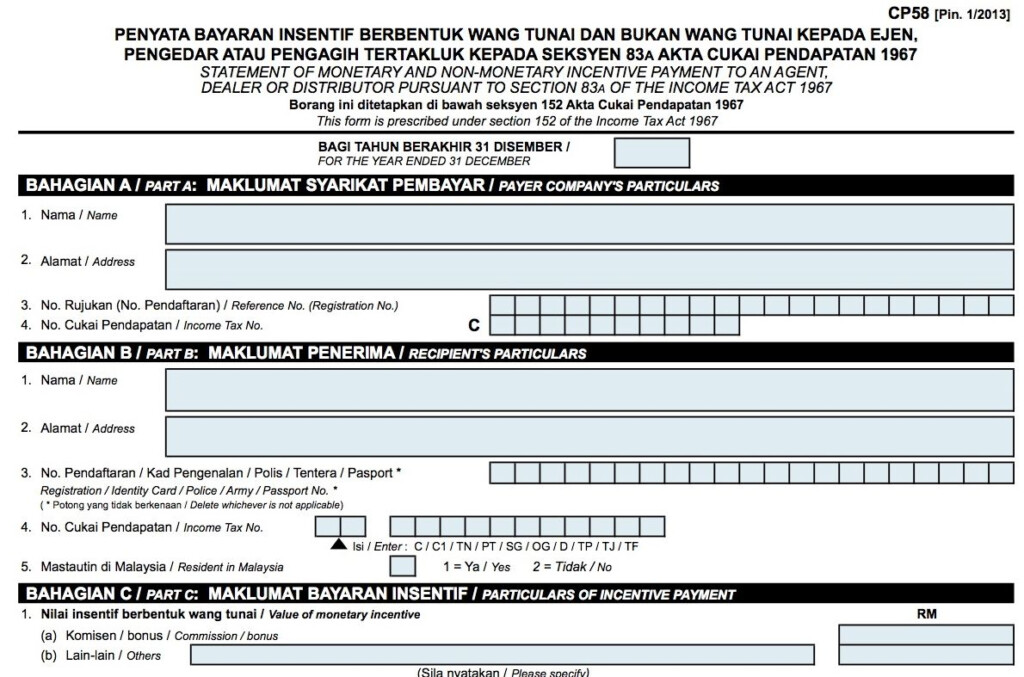

Non-resident aliens must submit Form 1040-NR at a minimum once per year. If you satisfy these requirements, you may be eligible to receive an exemption from the withholding forms. This page will list all exemptions.

To submit Form 1040-NR, the first step is attaching Form 1042S. The form provides information about the withholding process carried out by the withholding agency for federal income tax reporting to be used for reporting purposes. Make sure you enter the right information when filling in this form. There is a possibility for one person to be treated differently if the information isn’t provided.

The non-resident alien withholding tax is 30%. If the tax you pay is lower than 30% of your withholding, you could be eligible to receive an exemption from withholding. There are many exemptions. Certain of them are applicable to spouses and dependents, such as children.

In general, the chapter 4 withholding entitles you to an amount of money. Refunds are allowed according to Sections 1471-1474. Refunds will be made to the agent who withholds tax the person who withholds the tax from the source.

Status of relationships

An official marital status form withholding forms will assist you and your spouse get the most out of your time. You’ll be amazed by the amount you can deposit at the bank. The problem is deciding which one of the many options to select. There are some things to avoid. It’s costly to make a wrong decision. But if you follow it and pay attention to directions, you shouldn’t run into any problems. You may make new acquaintances if you’re lucky. Today marks the anniversary of your wedding. I’m sure you’ll be able to use it against them to get that elusive ring. To do it right, you will need the help of a certified accountant. A little amount could create a lifetime’s worth of wealth. Information on the internet is easily accessible. TaxSlayer is a well-known tax preparation firm is among the most helpful.

There are many withholding allowances that are being requested

When submitting Form W-4, you need to specify how many withholding allowances you want to claim. This is essential as the tax withheld will affect the amount taken out of your paychecks.

There are a variety of factors that influence the amount of allowances that you can apply for. If you’re married you may be qualified for an exemption for head of household. The amount you earn will determine how many allowances you are entitled to. You could be eligible to claim a greater allowance if you make a lot of money.

A tax deduction appropriate for you could allow you to avoid tax bills. Additionally, you may be eligible for a refund when your tax return for income has been completed. It is essential to pick the right method.

In any financial decision, it is important to do your research. Calculators can be utilized to figure out how many allowances for withholding are required to be requested. An alternative is to speak with a specialist.

Filing specifications

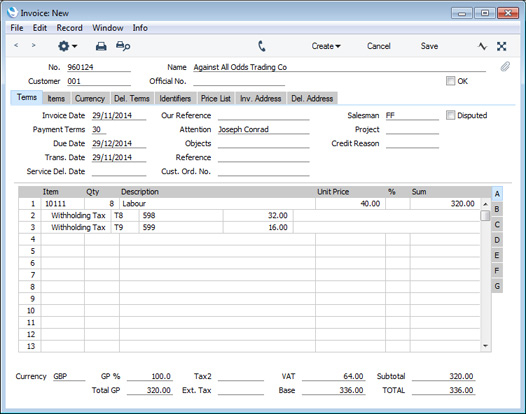

If you’re an employer, you are required to collect and report withholding taxes from your employees. Certain of these taxes can be reported to the IRS through the submission of paperwork. You may also need additional forms that you could require like the quarterly tax return or withholding reconciliation. Here is more information on the various forms of withholding taxes as well as the deadlines for filing them.

Withholding tax returns may be required for certain incomes like bonuses, salary or commissions as well as other earnings. You may also be eligible to be reimbursed for taxes withheld if your employees were paid promptly. It is important to note that some of these taxes are also county taxes must also be noted. In some situations the rules for withholding can be unique.

You have to submit electronically withholding forms in accordance with IRS regulations. If you are filing your national revenue tax returns ensure that you include your Federal Employee Identification Number. If you don’t, you risk facing consequences.