Form For Ss Tax Withholding – There are a variety of reasons why someone might choose to complete a withholding form. This is due to the requirement for documentation, exemptions from withholding, as well as the amount of withholding allowances. You must be aware of these aspects regardless of the reason you decide to submit a request form.

Withholding exemptions

Nonresident aliens are required once each year to fill out Form1040-NR. If you meet these requirements, you could be eligible to receive an exemption from the withholding form. The following page lists all exclusions.

To submit Form 1040-NR, attach Form 1042-S. This form details the withholdings made by the agency. When filling out the form, ensure that you have provided the correct information. This information may not be disclosed and result in one person being treated differently.

Nonresident aliens have a 30% withholding tax. You could be eligible to get an exemption from withholding if the tax burden exceeds 30 percent. There are many exemptions. Some are specifically designed for spouses, whereas others are intended for use by dependents like children.

You may be entitled to refunds if you have violated the terms of chapter 4. Refunds are permitted under Sections 1471-1474. These refunds must be made by the withholding agents who is the person who collects taxes at source.

relational status

The proper marital status and withholding forms will ease your work and that of your spouse. Additionally, the quantity of money that you can deposit at the bank could be awestruck. It is difficult to decide what option you’ll pick. There are certain items you must avoid. A bad decision could cause you to pay a steep price. If you stick to the instructions and be alert for any pitfalls, you won’t have problems. It is possible to make new acquaintances if you’re lucky. Since today is the date of your wedding anniversary. I’m sure you’ll take advantage of it to find that elusive wedding ring. To complete the task correctly it is necessary to get the help of a certified tax expert. The accumulation of wealth over time is more than the modest payment. Information on the internet is easily accessible. Reputable tax preparation firms like TaxSlayer are among the most efficient.

number of claimed withholding allowances

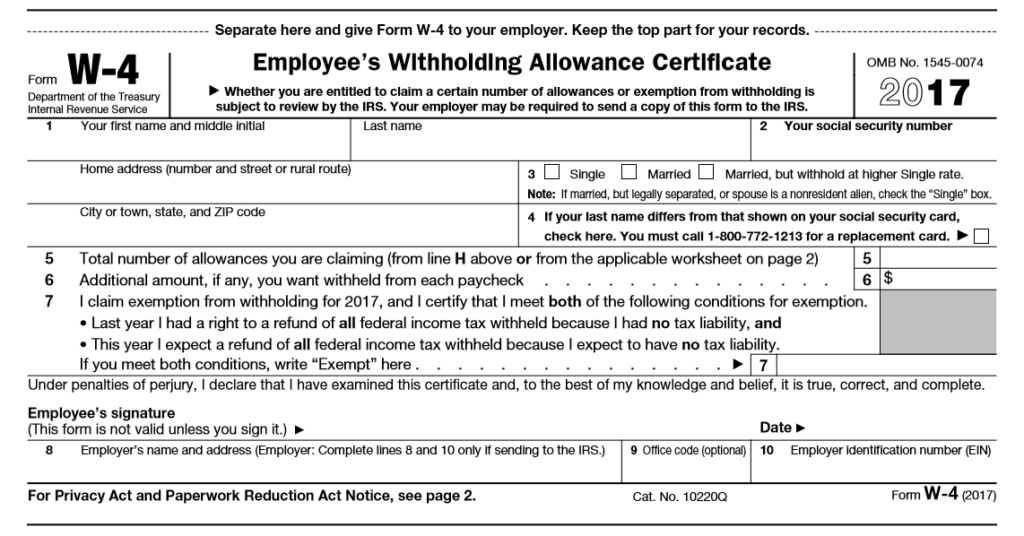

On the Form W-4 that you file, you should declare the amount of withholding allowances you requesting. This is crucial since your wages could be affected by the amount of tax you have to pay.

Many factors determine the amount that you can claim for allowances. Your income will affect the amount of allowances you are eligible for. If you have a high income, you could be eligible to request an increase in your allowance.

It could save you a lot of money by selecting the appropriate amount of tax deductions. If you submit your annual income tax return, you may even receive a refund. However, you must be careful about how you approach the tax return.

It is essential to do your homework the same way you would with any financial option. Calculators can aid you in determining the amount of withholding allowances are required to be claimed. In addition to a consultation with a specialist.

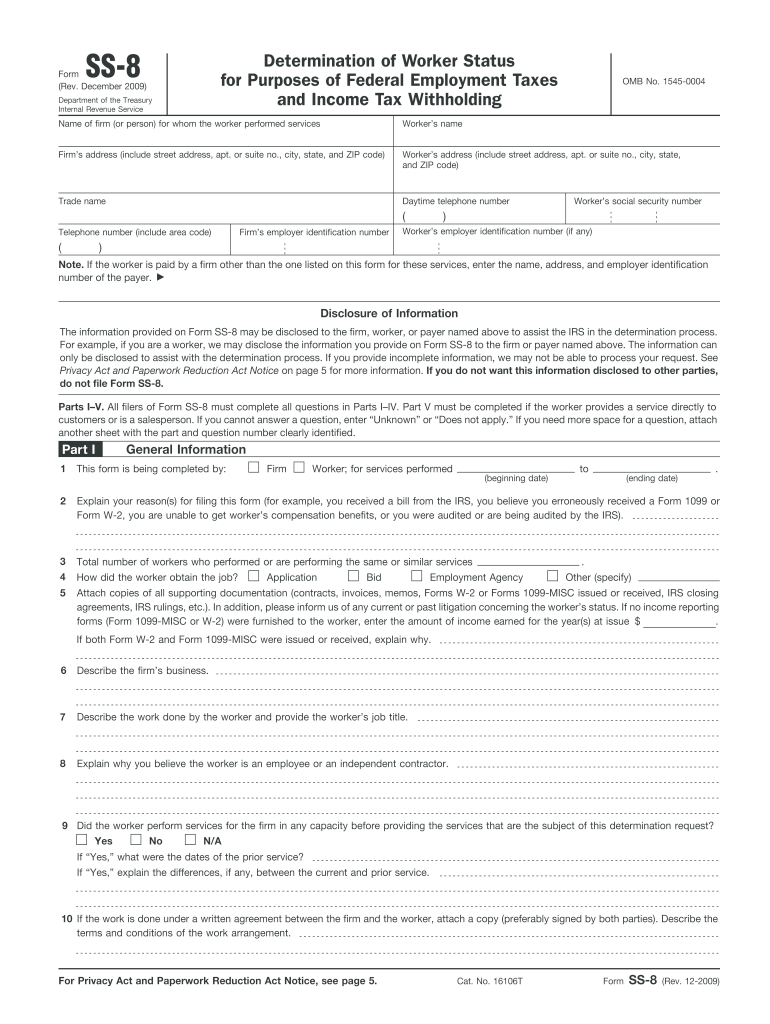

Specifications for filing

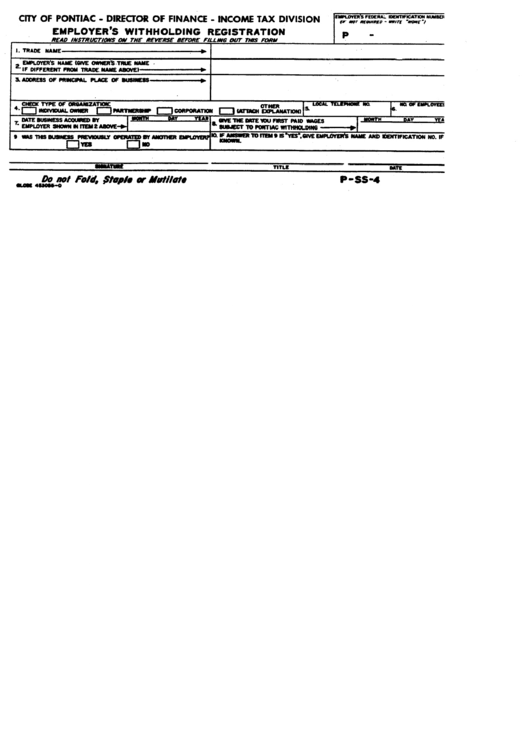

If you’re an employer, you must collect and report withholding taxes from your employees. It is possible to submit documents to the IRS for some of these taxation. A tax return for the year, quarterly tax returns or tax withholding reconciliations are just a few types of documents you could need. Here are some specifics about the various types of tax withholding forms as well as the deadlines for filing.

The compensation, bonuses commissions, other earnings you earn from employees might require you to submit withholding tax returns. If you make sure that your employees are paid on time, then you may be eligible to receive the refund of taxes that you withheld. It is important to keep in mind that some of these taxes are local taxes. In certain circumstances there are rules regarding withholding that can be different.

You must electronically submit tax withholding forms as per IRS regulations. If you are submitting your national tax return, please provide the Federal Employer Identification number. If you don’t, you risk facing consequences.