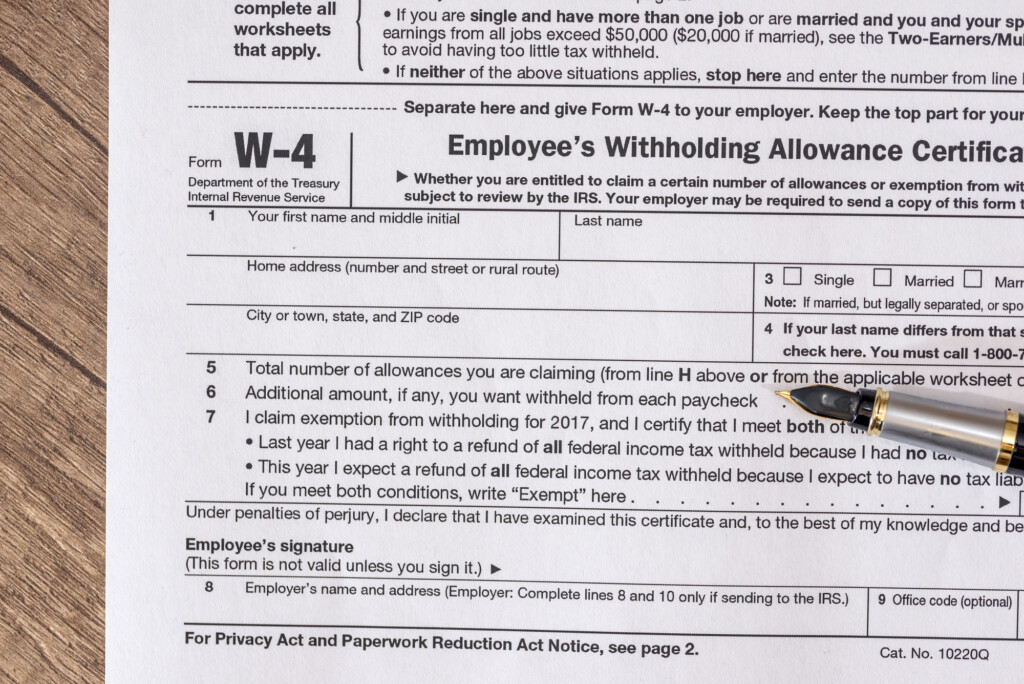

Form For Social Security Tax Withholding – There are numerous reasons an individual could submit the form to request withholding. The reasons include the need for documentation including withholding exemptions and the amount of requested withholding allowances. No matter why the person decides to fill out a form, there are a few points to be aware of.

Withholding exemptions

Non-resident aliens are required to submit Form1040-NR once every year to file Form1040-NR. You may be eligible to submit an exemption form from withholding in the event that you meet all conditions. The exclusions you can find here are yours.

To complete Form 1040-NR, add Form 1042-S. The document is required to declare the federal income tax. It details the amount of withholding that is imposed by the tax withholding agent. Fill out the form correctly. One person may be treated if this information is not entered.

The rate of withholding for non-resident aliens is 30%. You could be eligible to get an exemption from withholding if your tax burden exceeds 30%. There are many exemptions. Some are specifically for spouses, or dependents, for example, children.

The majority of the time, a refund is accessible for Chapter 4 withholding. Refunds are granted according to Sections 1471-1474. These refunds are made by the tax agent (the person who is responsible for withholding tax at source).

Relational status

A proper marital status withholding can make it simpler for both of you to accomplish your job. The bank might be shocked by the amount of money you’ve deposited. It can be difficult to choose what option you’ll pick. There are certain things that you shouldn’t do. You will pay a lot in the event of a poor choice. But if you adhere to the guidelines and watch out to any possible pitfalls and pitfalls, you’ll be fine. If you’re lucky you could even meet a few new pals on your travels. Today is the anniversary day of your wedding. I’m hoping you can use it against them to secure that dream ring. It’s a complex task that requires the expertise of an accountant. A modest amount of money could create a lifetime’s worth of wealth. There are a myriad of websites that offer information. TaxSlayer is a reputable tax preparation firm.

In the amount of withholding allowances claimed

You must specify how many withholding allowances to be able to claim on the Form W-4 you fill out. This is critical since your wages could be affected by the amount of tax you have to pay.

You may be eligible to request an exemption for your head of household if you are married. Additionally, you can claim additional allowances, based on how much you earn. An additional allowance could be granted if you make a lot.

Tax deductions that are appropriate for your situation could help you avoid large tax bills. The possibility of a refund is feasible if you submit your tax return on income for the previous year. But, you should be careful about how you approach the tax return.

You must do your homework, just like you would for any financial decision. Calculators are a great tool to determine the amount of withholding allowances should be claimed. Alternate options include speaking to a specialist.

Specifications to be filed

Withholding taxes from your employees must be collected and reported when you are an employer. A few of these taxes may be reported to the IRS by submitting forms. You may also need additional forms that you may require like an annual tax return, or a withholding reconciliation. Here are some details regarding the various forms of withholding tax forms and the deadlines for filing.

Your employees may require you to file withholding tax return forms to get their salary, bonuses and commissions. Also, if your employees receive their wages punctually, you might be eligible to get the tax deductions you withheld. The fact that some of these taxes are also county taxes should also be noted. In certain circumstances, withholding rules can also be unique.

You must electronically submit withholding forms according to IRS regulations. The Federal Employer Identification Number needs to be included when you point your tax return for national revenue. If you don’t, you risk facing consequences.