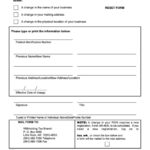

Form For Changing Tax Withholding – There are many reasons why one might choose to fill out withholding forms. This includes documentation requirements including withholding exemptions and the amount of requested withholding allowances. No matter what the reason is for a person to file documents it is important to remember certain points to keep in mind.

Exemptions from withholding

Nonresident aliens are required to complete Form 1040-NR every year. However, if you satisfy the criteria, you may be eligible to submit an exemption form from withholding. The exclusions are available on this page.

The first step to submitting Form 1040 – NR is attaching Form 1042 S. This form details the withholdings that the agency makes. Complete the form in a timely manner. If this information is not given, a person could be taken into custody.

Non-resident aliens are subject to 30 percent withholding. You could be eligible to receive an exemption from withholding if the tax burden exceeds 30 percent. There are many exemptions offered. Certain exclusions are only available to spouses or dependents such as children.

The majority of the time, a refund is offered for the chapter 4 withholding. Refunds are made according to Sections 471 through 474. Refunds are to be given by the tax withholding agents, which is the person who is responsible for withholding taxes at source.

Status of the relationship

The work of your spouse and you is made simpler with a valid marriage status withholding form. The bank may be surprised by the amount of money that you deposit. It isn’t easy to determine which one of the options you’ll pick. There are some things you shouldn’t do. There are a lot of costs when you make a bad decision. But if you adhere to the instructions and be alert for any pitfalls and pitfalls, you’ll be fine. If you’re lucky to meet some new friends while traveling. Today is your anniversary. I’m hoping they make it work against you to help you get that elusive engagement ring. It’s a complex task that requires the expertise of an accountant. It’s worthwhile to create wealth over the course of a lifetime. It is a good thing that you can access many sources of information online. TaxSlayer as well as other reliable tax preparation firms are a few of the most reliable.

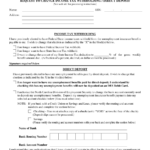

The amount of withholding allowances that were claimed

It is important to specify the number of withholding allowances you wish to claim on the Form W-4 that you file. This is crucial because the tax amount taken from your pay will be affected by the much you withhold.

You may be able to request an exemption for your spouse in the event that you are married. Your income will influence how many allowances your can receive. You may be eligible for more allowances if have a large amount of income.

Choosing the proper amount of tax deductions can allow you to avoid a significant tax bill. In reality, if you file your annual income tax return, you could even be eligible for a tax refund. It is important to be cautious when it comes to preparing this.

Just like with any financial decision it is crucial to conduct your research. Calculators are useful to determine how many allowances for withholding need to be made. You may also talk to an expert.

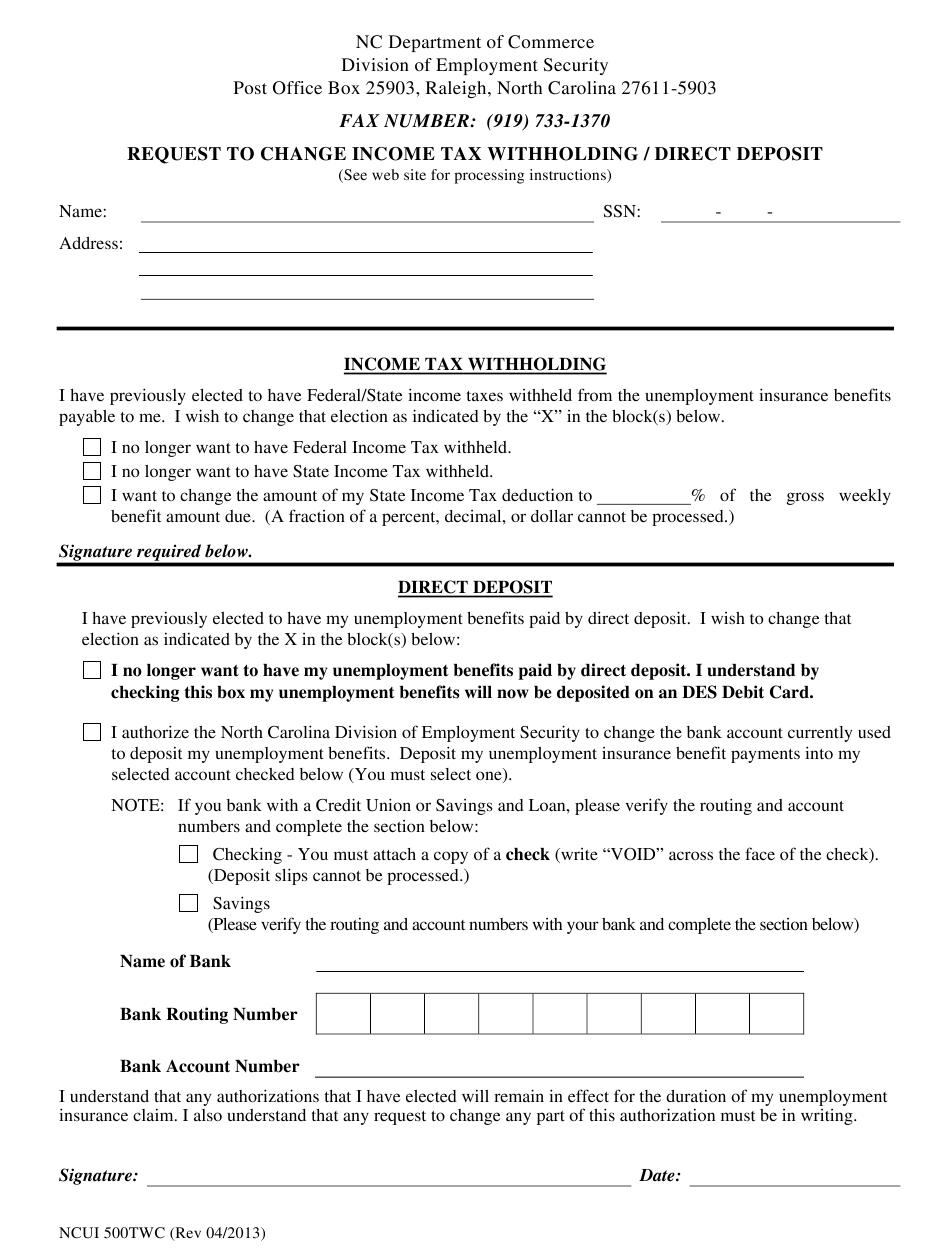

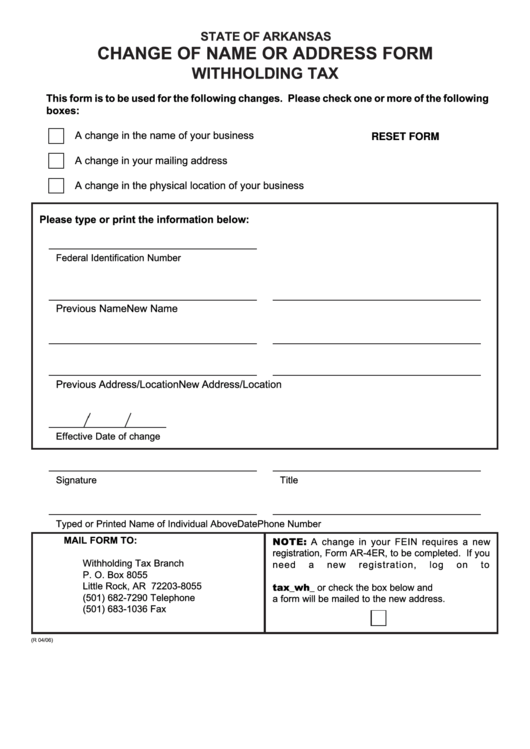

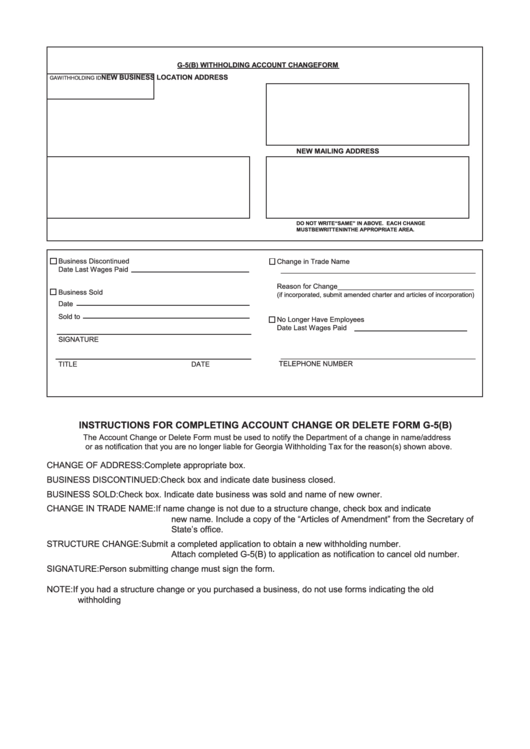

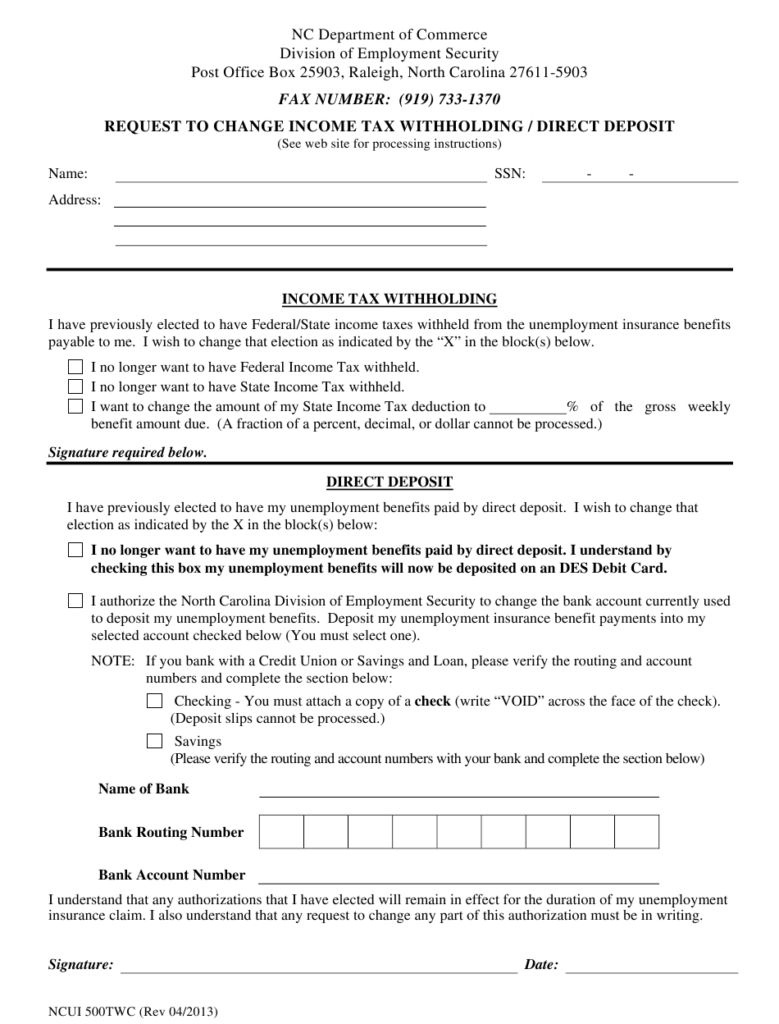

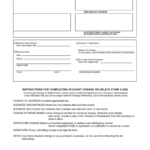

Specifications for filing

Employers must report the employer who withholds taxes from their employees. You may submit documentation to the IRS for a few of these taxation. An annual tax return and quarterly tax returns as well as tax withholding reconciliations are just a few kinds of documentation you may require. Here are some specifics regarding the various forms of withholding tax forms along with the deadlines for filing.

The salary, bonuses commissions, other income you get from your employees may require you to submit tax returns withholding. If you paid your employees in time, you may be eligible to receive reimbursement for taxes that you withheld. It is important to note that some of these taxes are also county taxes should be taken into consideration. In some situations, withholding rules can also be different.

According to IRS regulations, electronic filings of tax withholding forms are required. The Federal Employer Identification Number must be listed when you submit to your national tax return. If you don’t, you risk facing consequences.