Form Ct-941 Connecticut Quarterly Reconciliation Of Withholding – There are numerous reasons that a person might decide to file an application for withholding. The requirements for documentation, exemptions from withholding as well as the quantity of withholding allowances required are just a few of the factors. No matter the reason for a person to file a document it is important to remember certain points that you need to remember.

Exemptions from withholding

Non-resident aliens are required to submit Form1040-NR once every year to file Form1040-NR. However, if you meet the criteria, you may be able to submit an exemption from withholding form. You will discover the exclusions available on this page.

Attaching Form 1042-S is the first step in submitting Form 1040-NR. This form provides details about the withholding that is performed by the tax agency that handles withholding to report federal income tax for tax reporting purposes. When filling out the form, make sure you fill in the correct information. The information you provide may not be disclosed and cause one person to be treated.

Non-resident aliens are subject to 30 percent withholding tax. If the tax you pay is lower than 30 percent of your withholding, you could be eligible to receive an exemption from withholding. There are many exclusions. Some are for spouses and dependents, such as children.

In general, the chapter 4 withholding entitles you to the possibility of a refund. Refunds may be granted under Sections 1400 to 1474. The refunds are made by the withholding agent. The withholding agent is the person responsible for withholding the tax at the source.

Relational status

A marriage certificate and withholding forms will assist both of you get the most out of your time. You’ll also be surprised by how much you can deposit at the bank. The trick is to decide which one of the many options to pick. There are some things you shouldn’t do. The wrong decision can result in a costly loss. It’s not a problem when you adhere to the instructions and pay attention. It is possible to make new acquaintances if you’re lucky. Today is your birthday. I’m sure you’ll take advantage of it to search for that one-of-a-kind engagement ring. To do this properly, you’ll require guidance of a qualified Tax Expert. The tiny amount is worth it for a lifetime of wealth. There are a myriad of online resources that provide details. TaxSlayer and other reputable tax preparation firms are a few of the top.

The amount of withholding allowances made

The form W-4 should be filled in with the amount of withholding allowances you want to take advantage of. This is important because the withholdings will have an impact on how much tax is deducted from your paychecks.

A number of factors can influence the amount you qualify for allowances. Your income can determine the amount of allowances accessible to you. If you have high income, you might be eligible to receive a higher allowance.

Choosing the proper amount of tax deductions can save you from a large tax bill. You could actually receive the amount you owe if you submit the annual tax return. However, be careful about how you approach the tax return.

Like any financial decision, it is important that you should conduct your homework. To figure out the amount of tax withholding allowances to be claimed, use calculators. An expert may be an option.

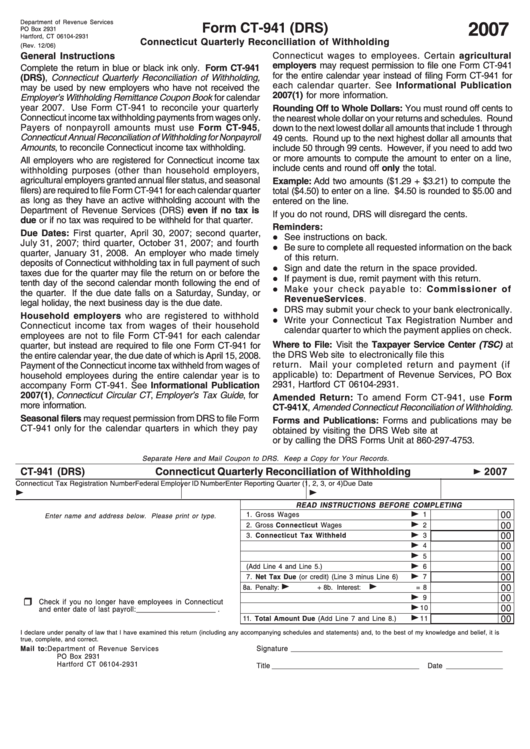

Submitting specifications

Employers are required to pay withholding taxes to their employees and then report the tax. If you are taxed on a specific amount, you may submit paperwork to the IRS. Additional documents that you could need to submit include a withholding tax reconciliation as well as quarterly tax returns as well as the annual tax return. Below are details about the different withholding tax forms and their deadlines.

Tax withholding returns can be required for income such as bonuses, salary or commissions as well as other earnings. In addition, if you pay your employees on time, you might be eligible for reimbursement for any taxes that were not withheld. Be aware that certain taxes may be county taxes. Additionally, there are unique methods of withholding that are applied under particular situations.

Electronic submission of withholding forms is mandatory according to IRS regulations. The Federal Employer Identification number must be noted when you file to your tax return for the nation. If you don’t, you risk facing consequences.