Form 8959 Fed Income Tax Withholding – There are many reasons why one might choose to fill out forms for withholding. These factors include the requirements for documentation, exemptions to withholding, as well as the amount of withholding allowances. You should be aware of these aspects regardless of your reason for choosing to file a request form.

Exemptions from withholding

Nonresident aliens need to submit Form 1040–NR once a calendar year. You may be eligible to apply for an exemption for withholding tax in the event that you meet all criteria. This page lists all exemptions.

The attachment of Form 1042-S is the first step to file Form 1040-NR. The form provides information about the withholding done by the tax agency that handles withholding for federal tax reporting for tax reporting purposes. When you fill out the form, ensure that you have provided the correct information. If the information you provide is not supplied, one person may be diagnosed with a medical condition.

Nonresident aliens pay a 30% withholding tax. You may be eligible to receive an exemption from withholding if the tax burden exceeds 30%. There are numerous exemptions. Some are specifically designed to be used by spouses, while some are meant to be used by dependents, such as children.

In general, you’re eligible for a reimbursement under chapter 4. In accordance with Section 1471 through 1474, refunds are granted. These refunds are provided by the withholding agent (the person who is responsible for withholding tax at source).

Relational status

A marital withholding form is an excellent way to simplify your life and aid your spouse. You’ll also be surprised by how much money you could make a deposit to the bank. It isn’t easy to decide which of many choices is the most attractive. There are some things you must avoid. Making the wrong choice could cost you a lot. If you adhere to the guidelines and follow them, there shouldn’t be any issues. If you’re lucky, you may be able to make new friends during your trip. Today is the anniversary. I’m hoping you’ll be able to take advantage of it to search for that one-of-a-kind ring. If you want to get it right, you will need the help of a certified accountant. A small amount of money can create a lifetime of wealth. Information on the internet is easily accessible. TaxSlayer is a trusted tax preparation firm is one of the most effective.

Amount of withholding allowances claimed

It is important to specify the number of withholding allowances to be able to claim on the W-4 you submit. This is crucial since your wages could be affected by the amount of tax you have to pay.

A variety of factors influence the amount of allowances requested.If you’re married, as an example, you might be eligible for an exemption for head of household. You can also claim more allowances, based on how much you earn. If you earn a high amount, you might be eligible to receive higher amounts.

A proper amount of tax deductions could help you avoid a significant tax cost. If you complete your yearly income tax return, you could even receive a refund. It is important to be cautious when it comes to preparing this.

Like any other financial decision, you must do your research. To determine the amount of tax withholding allowances that need to be claimed, you can use calculators. Other options include talking to an expert.

Formulating specifications

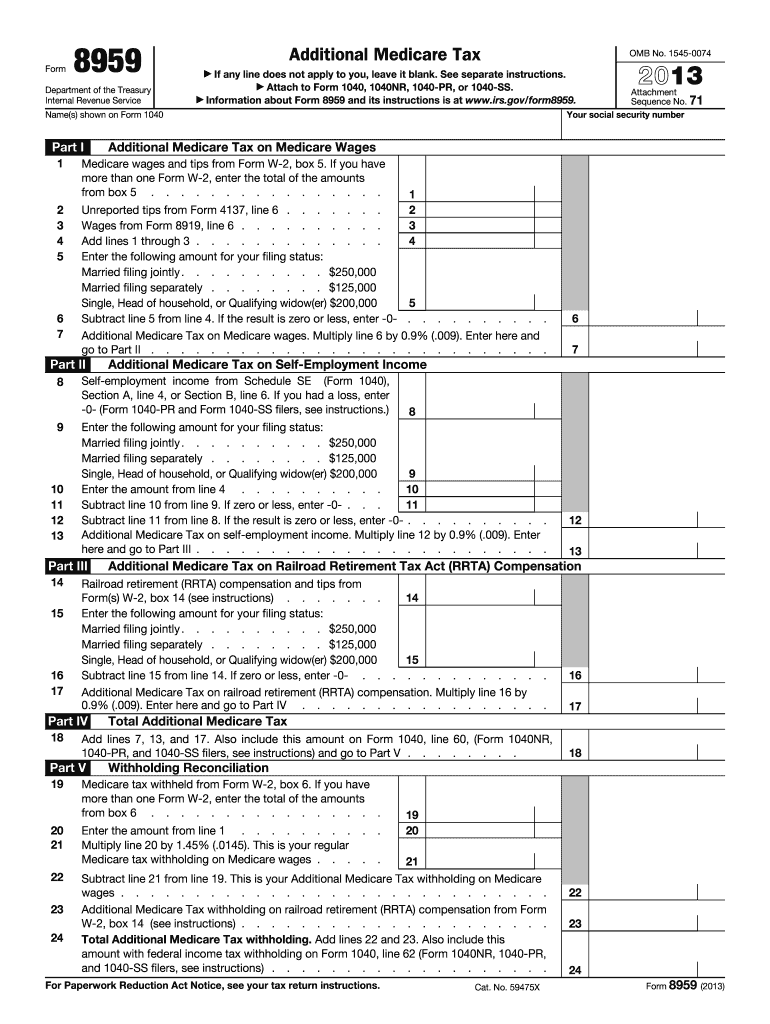

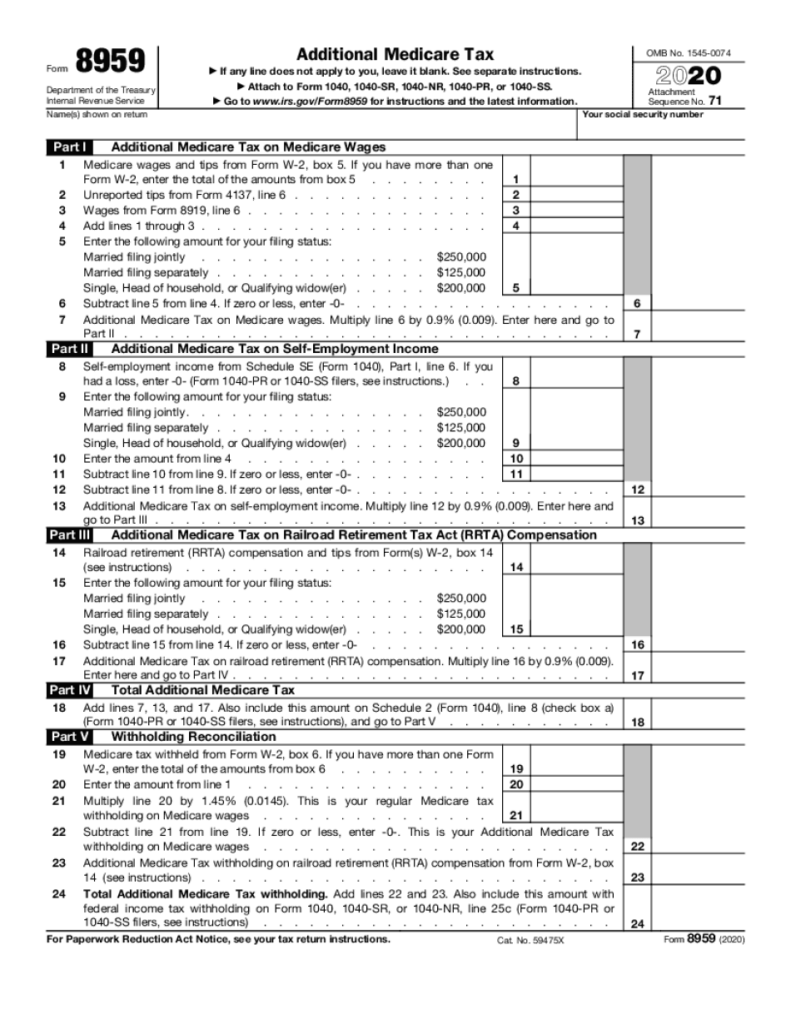

If you’re an employer, you are required to be able to collect and report withholding taxes from your employees. Certain of these taxes may be filed with the IRS by submitting paperwork. Additional paperwork that you may require to submit includes an withholding tax reconciliation as well as quarterly tax returns as well as the annual tax return. Here are some information about the various types of tax withholding forms as well as the filing deadlines.

The bonuses, salary, commissions, and other income you get from your employees could require you to file withholding tax returns. If you pay your employees on time, you may be eligible to receive the refund of taxes that you withheld. Be aware that certain taxes could be considered to be county taxes, is also crucial. Additionally, there are unique tax withholding procedures that can be applied under particular situations.

According to IRS regulations, you are required to electronically file withholding forms. The Federal Employer Identification Number needs to be included when you point your tax return for national revenue. If you don’t, you risk facing consequences.