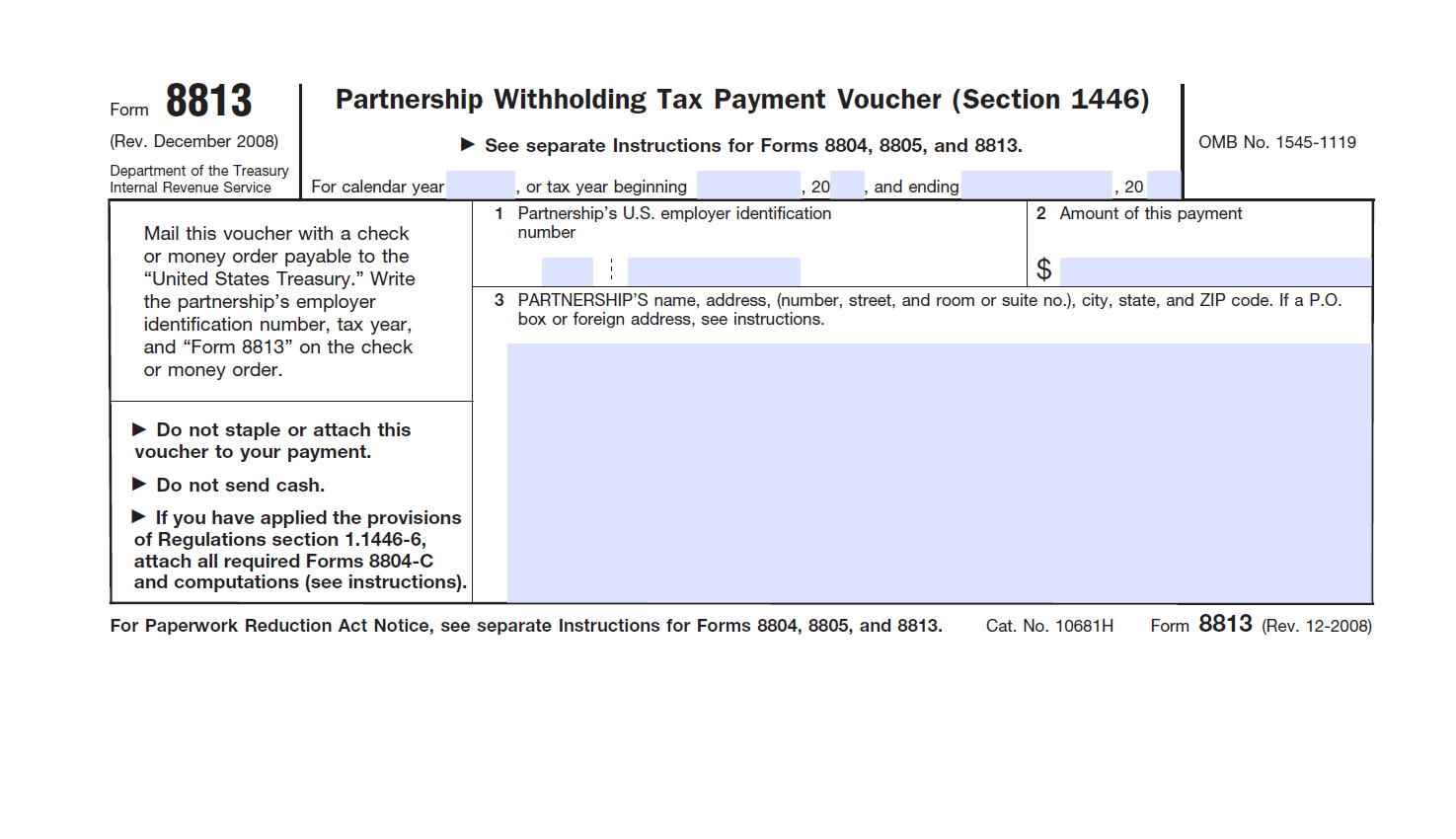

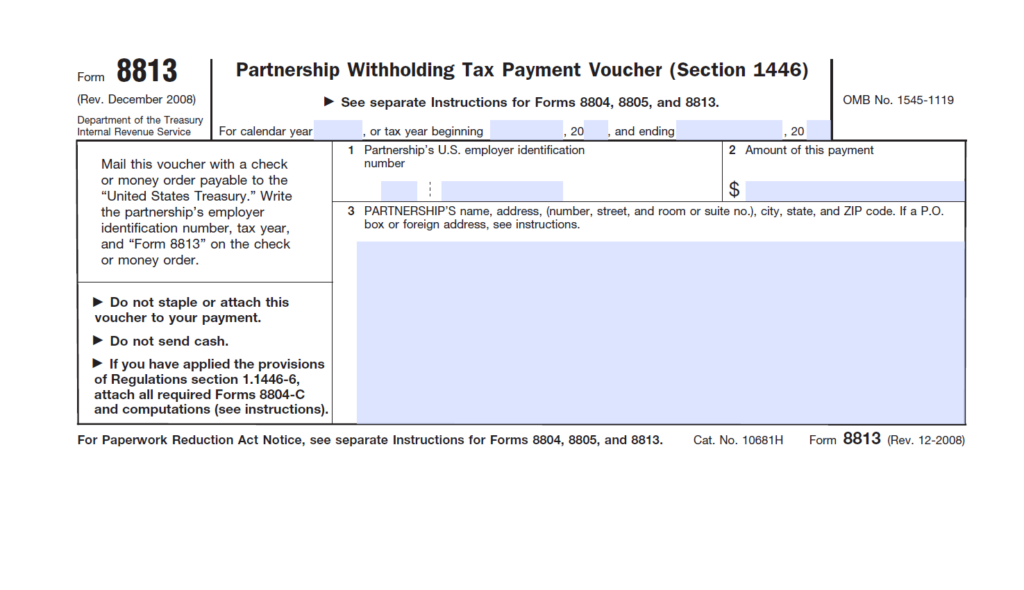

Form 8813 Withholding Due Dates – There are many reasons someone may choose to fill out withholding forms. The reasons include the need for documentation, withholding exemptions, and the quantity of requested withholding allowances. Whatever the reason the person decides to fill out the form it is important to remember a few aspects to consider.

Withholding exemptions

Nonresident aliens need to submit Form 1040–NR every calendar year. However, if you meet the requirements, you might be able to submit an exemption form from withholding. You will discover the exclusions available on this page.

The first step in submit Form 1040 – NR is to attach the Form 1042 S. To report federal income tax purposes, this form details the withholding made by the tax agency that handles withholding. Complete the form in a timely manner. This information might not be given and cause one person to be treated differently.

The withholding rate for nonresident aliens is 30%. Tax burdens is not to exceed 30% in order to be eligible for exemption from withholding. There are several different exclusions available. Certain are only for spouses or dependents, for example, children.

Generally, a refund is available for chapter 4 withholding. As per Sections 1471 to 1474, refunds can be made. Refunds are given by the withholding agent. The withholding agent is the person responsible for withholding the tax at the point of origin.

Relational status

A valid marital status and withholding forms will ease the work of you and your spouse. In addition, the amount of money you may deposit in the bank will pleasantly be awestruck. The trick is to decide which of the numerous options to choose. There are certain actions you shouldn’t do. Making the wrong choice could cost you dearly. However, if you adhere to the directions and be alert for any pitfalls, you won’t have problems. If you’re lucky you might meet some new friends on your trip. Today is the anniversary. I’m hoping you’ll utilize it in order to get the elusive diamond. You’ll want the assistance of a tax professional certified to ensure you’re doing it right. It’s worthwhile to create wealth over a lifetime. You can get many sources of information online. TaxSlayer is a trusted tax preparation company is one of the most effective.

The number of withholding allowances made

It is important to specify the number of withholding allowances you want to claim on the W-4 you fill out. This is crucial because the tax amount withdrawn from your paycheck will be affected by how much you withhold.

There are many variables that affect the amount of allowances you can apply for. If you’re married, you could be qualified for an exemption for head of household. Your income can determine the amount of allowances available to you. If you earn a substantial amount of money, you might be eligible for a higher allowance.

It is possible to avoid paying a large tax bill by deciding on the appropriate amount of tax deductions. Additionally, you may be eligible for a refund when the annual tax return is filed. Be sure to select your approach carefully.

In every financial decision, you must conduct your own research. Calculators will help you determine how many withholding amounts should be claimed. A specialist might be a viable alternative.

Filing requirements

If you’re an employer, you are required to pay and report withholding tax on your employees. The IRS may accept forms to pay certain taxes. A tax return for the year, quarterly tax returns or tax withholding reconciliations are just a few examples of paperwork you might require. Below are information on the various tax forms for withholding and their deadlines.

It is possible that you will need to file tax returns withholding to claim the earnings you earn from employees, including bonuses and commissions or salaries. If your employees are paid punctually, you might be eligible to get tax refunds for withheld taxes. It is important to note that certain taxes are also county taxes must also be noted. Additionally, there are unique withholding practices that can be implemented in specific circumstances.

In accordance with IRS rules, you have to electronically submit forms for withholding. When you submit your national tax return make sure you provide the Federal Employer Identification number. If you don’t, you risk facing consequences.