Foreign Partner Withholding Forms – There stand a digit of reasons why someone might choose to complete a withholding form. These factors include the documentation requirements, withholding exclusions and withholding allowances. Whatever the reason one chooses to submit the form, there are a few points to be aware of.

Exemptions from withholding

Nonresident aliens are required at least once each year to fill out Form1040-NR. If you fulfill the requirements, you might be able to submit an exemption from the withholding form. This page you will find the exclusions that you can avail.

For Form 1040-NR submission the first step is attaching Form 1042S. This form details the withholdings that are made by the agency. It is essential to fill in the correct information when filling out the form. If this information is not given, a person could be diagnosed with a medical condition.

The rate of withholding for non-resident aliens is 30 percent. A nonresident alien may be qualified for an exemption. This applies the case if your tax burden less than 30 percent. There are many exclusions. Some are specifically designed to be used by spouses, while some are meant to be used by dependents such as children.

In general, the withholding section of chapter 4 entitles you to a refund. Refunds are made according to Sections 471 through 474. Refunds will be made to the withholding agent, the person who withholds taxes from the source.

Status of the relationship

The correct marital status as well as withholding forms can simplify the work of you and your spouse. Furthermore, the amount of money you can put in the bank will pleasantly delight you. It isn’t easy to decide which of the many options is the most attractive. There are some things you shouldn’t do. Making the wrong decision will cost you dearly. But, if the directions are adhered to and you are attentive to the rules, you shouldn’t have any issues. If you’re lucky, you may even make new acquaintances while traveling. Today marks the day you celebrate your marriage. I’m hoping that you can leverage it to find that perfect engagement ring. For this to be done properly, you’ll require guidance of a certified Tax Expert. It’s worth it to build wealth over the course of a lifetime. You can find plenty of details online. TaxSlayer, a reputable tax preparation business, is one of the most useful.

The amount of withholding allowances requested

You need to indicate how many withholding allowances to be able to claim on the Form W-4 you fill out. This is important because the amount of tax you are able to deduct from your paycheck will be affected by the much you withhold.

A variety of factors influence the allowances requested.If you’re married, for instance, you might be able to apply for an exemption for head of household. Your income level also affects the amount of allowances you’re qualified to receive. If you earn a significant amount of income, you may be eligible for a larger allowance.

You might be able to avoid paying a large tax bill by choosing the right amount of tax deductions. If you submit the annual tax return for income, you may even be entitled to a refund. But be sure to choose the right method.

Do your research, as you would with any financial decision. Calculators are a great tool to figure out how many withholding allowances are required to be claimed. As an alternative to a consultation with an expert.

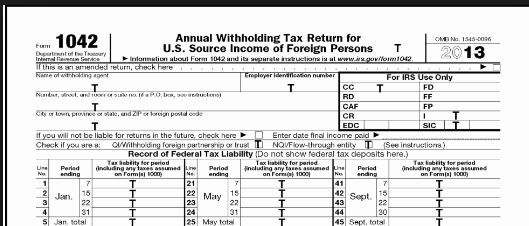

Filing requirements

Employers must inform the IRS of any withholding tax that is being paid by employees. It is possible to submit documents to the IRS for some of these taxes. There may be additional documentation , like the reconciliation of your withholding tax or a quarterly tax return. Below are details on the different forms of withholding taxes and the deadlines for filing them.

Withholding tax returns may be required for certain incomes such as salary, bonuses or commissions as well as other earnings. If you paid your employees in time, you may be eligible to receive reimbursement for taxes that you withheld. It is important to note that some of these taxes could be considered to be taxation by county is crucial. There are also specific withholding techniques which can be utilized in specific situations.

You must electronically submit withholding forms in accordance with IRS regulations. When you file your national revenue tax returns, be sure to include your Federal Employee Identification Number. If you don’t, you risk facing consequences.