Florida State Tax Withholding Form 2024 – There stand a digit of reasons why someone might choose to fill out a tax form. These factors include documentation requirements, withholding exemptions, and the amount of requested withholding allowances. Whatever the reason one chooses to submit an application it is important to remember a few aspects to consider.

Exemptions from withholding

Nonresident aliens need to submit Form 1040–NR every calendar year. It is possible to submit an exemption form for withholding, in the event that you meet all criteria. The following page lists all exclusions.

If you are submitting Form1040-NR to the IRS, include Form 1042S. The form contains information on the withholding done by the withholding agency for federal income tax reporting to be used for reporting purposes. Be sure to enter the correct information as you fill in the form. This information may not be provided and could cause one person to be treated.

The non-resident alien withholding tax is 30%. Tax burdens should not exceed 30% to be eligible for exemption from withholding. There are numerous exemptions. Some of them are for spouses or dependents like children.

Generally, a refund is offered for the chapter 4 withholding. Refunds are available under sections 1401, 1474, and 1475. Refunds are to be given by the agents who withhold taxes, which is the person who withholds taxes at source.

Relationship status

You and your spouse’s work will be made easy by a proper marriage status withholding form. The bank could be shocked by the amount of money that you have to deposit. It isn’t easy to determine which of the many options you’ll choose. Certain things are best avoided. There will be a significant cost in the event of a poor choice. However, if you adhere to the instructions and be alert for any pitfalls and pitfalls, you’ll be fine. If you’re lucky, you might be able to make new friends as traveling. Today is the anniversary date of your wedding. I’m hoping that they will turn it against you to get you the perfect engagement ring. If you want to get it right you’ll require the aid of a qualified accountant. This tiny amount is enough to last the life of your wealth. Fortunately, you can find plenty of information on the internet. TaxSlayer is a reputable tax preparation company.

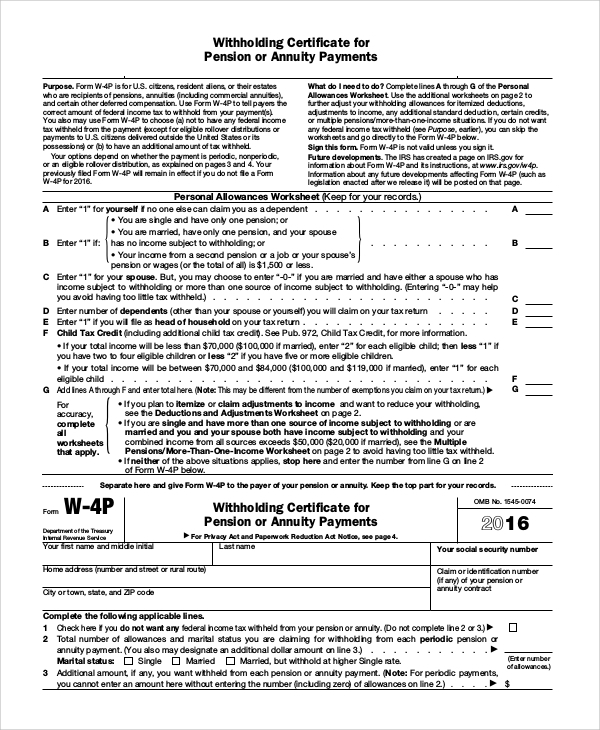

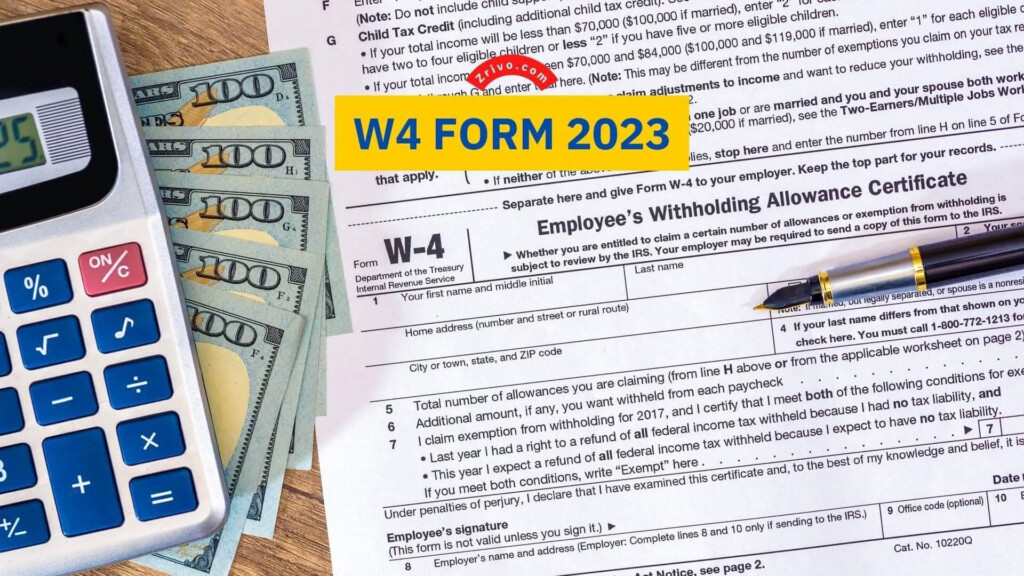

Number of claimed withholding allowances

The W-4 form must be filled out with the number of withholding allowances you would like to be able to claim. This is crucial since the withholdings can have an effect on the amount of tax is deducted from your paychecks.

There are a variety of factors which affect the allowance amount you can apply for. If you’re married you may be qualified for an exemption for head of household. The amount you earn will determine how many allowances you can receive. If you have a higher income, you might be eligible to receive higher amounts.

You may be able to save money on a tax bill by choosing the correct amount of tax deductions. If you submit your annual income tax returns and you are eligible for a refund. Be cautious about how you approach this.

Like any other financial decision, you should do your homework. Calculators are readily available to aid you in determining the amount of withholding allowances are required to be claimed. It is also possible to speak with an expert.

Filing requirements

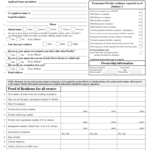

If you are an employer, you are required to be able to collect and report withholding taxes on your employees. Certain of these taxes can be filed with the IRS through the submission of paperwork. A tax return that is annually filed, quarterly tax returns or tax withholding reconciliations are just a few examples of paperwork you might require. Here are the details on various tax forms for withholding and the deadlines for each.

In order to be qualified for reimbursement of withholding taxes on the pay, bonuses, commissions or other revenue received from your employees, you may need to submit withholding tax return. If you also pay your employees on-time you may be eligible to receive reimbursement for taxes that were withheld. Remember that these taxes could be considered as taxation by the county. There are certain methods of withholding that are applicable in specific circumstances.

As per IRS regulations the IRS regulations, electronic filing of forms for withholding are required. If you are submitting your national tax return make sure you include the Federal Employer Identification number. If you don’t, you risk facing consequences.