Florida State Income Tax Withholding Form – There are many reasons why someone might choose to fill out a form for withholding. This includes the document requirements, exclusions from withholding and withholding allowances. However, if the person decides to fill out the form it is important to remember a few things to keep in mind.

Withholding exemptions

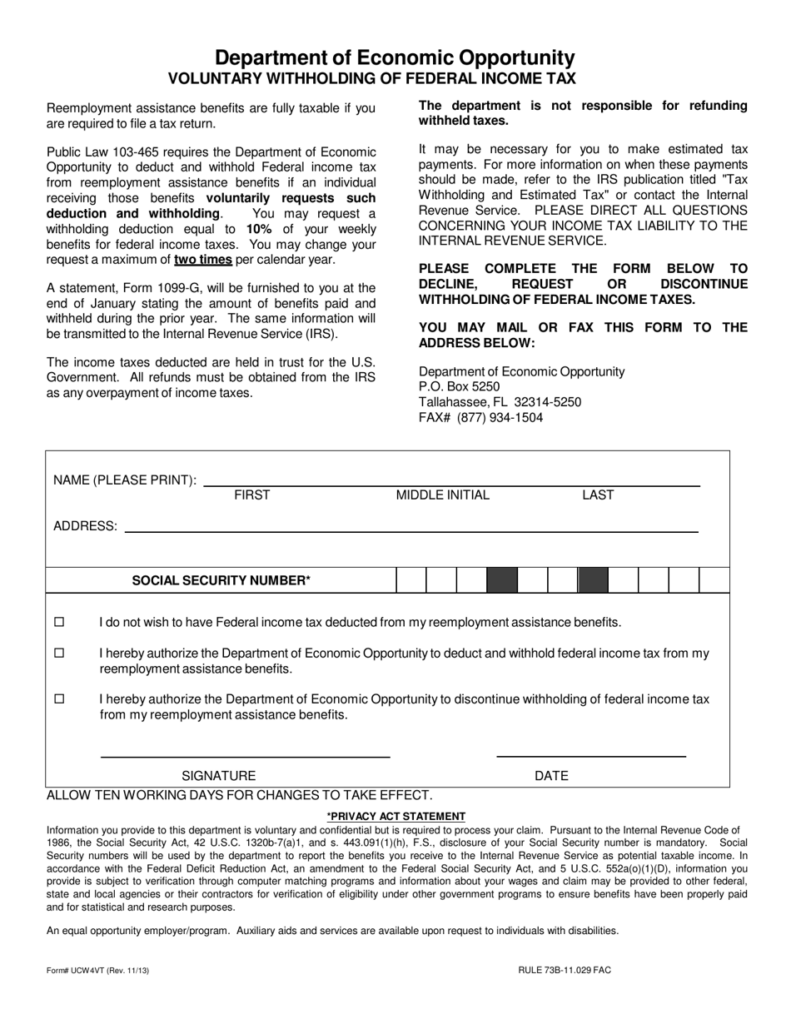

Non-resident aliens are required to file Form 1040–NR every calendar year. If you satisfy the requirements, you could be eligible for an exemption to withholding. This page lists all exclusions.

To submit Form 1040-NR The first step is to attach Form 1042S. This form is used to report the federal income tax. It details the amount of withholding that is imposed by the tax withholding agent. Fill out the form correctly. One person may be treated if the information is not entered.

The withholding rate for nonresident aliens is 30%. Nonresident aliens could be eligible for an exemption. This applies if your tax burden is less than 30 percent. There are many different exemptions. Certain of them are applicable to spouses or dependents, like children.

You may be entitled to refunds if you have violated the rules of chapter 4. Refunds can be made according to Sections 1400 through 1474. The refunds are made to the withholding agent that is the person who collects taxes from the source.

Status of the relationship

An official marriage status withholding form will help you and your spouse make the most of your time. The bank could be shocked by the amount of money you’ve deposited. It isn’t always easy to determine which one of the options the most appealing. Certain things are best avoided. A bad decision could cause you to pay a steep price. You won’t have any issues if you just adhere to the instructions and pay attention. If you’re fortunate you may even meet a few new pals while traveling. Today is your birthday. I’m hoping that you can apply it against them to secure that elusive diamond. It will be a complicated job that requires the experience of an expert in taxation. A lifetime of wealth is worth that tiny amount. There is a wealth of information online. TaxSlayer is a trusted tax preparation firm.

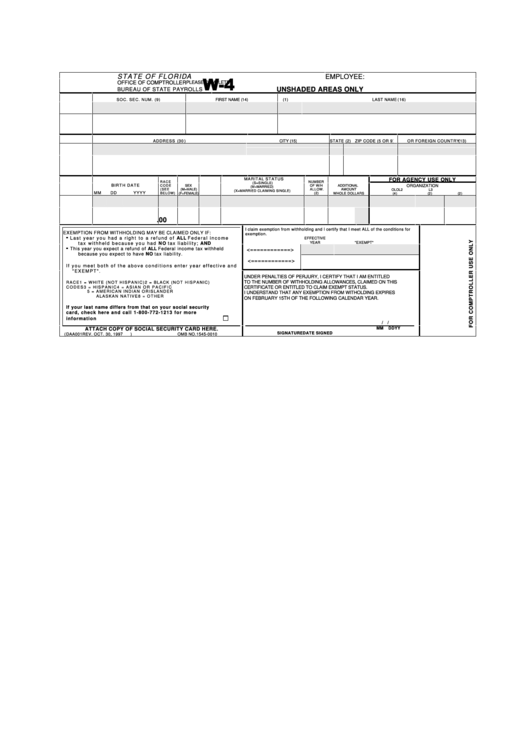

The amount of withholding allowances that are claimed

It is essential to state the amount of withholding allowances you would like to claim on the W-4 form. This is important because the tax withheld will impact how much is taken from your paycheck.

You may be eligible to claim an exemption for your head of household if you are married. The amount you earn will influence how many allowances your are eligible for. If you earn a higher income, you may be eligible for a higher allowance.

The right amount of tax deductions can help you avoid a significant tax cost. Additionally, you may even get a refund if your annual income tax return is filed. It is important to be cautious about how you approach this.

As with any other financial decision, you should conduct your homework. Calculators can be used to figure out how many allowances for withholding must be claimed. Alternate options include speaking to a specialist.

Formulating specifications

Employers are required to report any withholding taxes being collected from employees. It is possible to submit documents to the IRS for some of these taxes. There may be additional documentation , like an withholding tax reconciliation or a quarterly return. Here are the details on various tax forms for withholding and their deadlines.

Withholding tax returns may be required for certain incomes such as bonuses, salary and commissions, as well as other income. It is also possible to get reimbursements for tax withholding if your employees were paid on time. Be aware that some of these taxes may be county taxes. There are also unique withholding rules that can be used in specific situations.

Electronic submission of withholding forms is mandatory according to IRS regulations. The Federal Employer Identification Number needs to be listed when you submit to your national tax return. If you don’t, you risk facing consequences.