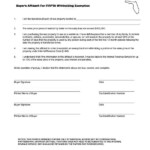

Firpta Withholding Exemption Form – There are a variety of reasons why an individual could submit an application for withholding. This is due to the requirement for documentation, withholding exemptions and also the amount of required withholding allowances. Whatever the reasons someone is deciding to file a Form There are a few points to be aware of.

Exemptions from withholding

Nonresident aliens are required at least once each year to fill out Form1040-NR. If your requirements are met, you could be eligible to apply for an exemption from withholding. The exclusions you can find here are yours.

For submitting Form 1040-NR attach Form 1042-S. This form provides details about the withholding done by the tax agency that handles withholding for federal tax reporting to be used for reporting purposes. When filling out the form, ensure that you have provided the correct information. You could be required to treat a single person for not providing the correct information.

The 30% non-resident alien tax withholding rate is 30. A tax exemption may be granted if you have a a tax burden that is lower than 30 percent. There are numerous exemptions. Certain are only for spouses and dependents, such as children.

Generally, a refund is available for chapter 4 withholding. Refunds may be granted in accordance with Sections 1400 through 1474. The refunds are made by the agent who withholds tax. The withholding agent is the person responsible for withholding the tax at the point of origin.

Relational status

Your and your spouse’s job will be made easy with a valid marital status withholding form. The bank may be surprised by the amount of money that you have to deposit. It is difficult to decide which one of the options you’ll pick. Be cautious about what you do. A bad decision could result in a costly loss. However, if the instructions are adhered to and you are attentive to the rules, you shouldn’t have any issues. You might make some new friends if you are fortunate. Today marks the anniversary. I hope you are capable of using this against them in order to acquire that elusive wedding ring. It will be a complicated task that requires the expertise of a tax professional. The tiny amount is enough for a life-long wealth. You can get a ton of information online. TaxSlayer, a reputable tax preparation firm is among the most helpful.

The number of withholding allowances that were requested

On the Form W-4 that you file, you should specify how many withholding allowances are you asking for. This is essential because the amount of tax taken from your paychecks will depend on how much you withhold.

There are a variety of factors that influence the allowance amount that you can apply for. If you’re married, you could be eligible for a head-of-household exemption. Additionally, you can claim additional allowances, based on how much you earn. If you earn a substantial amount of money, you might be eligible for a larger allowance.

The proper amount of tax deductions will save you from a large tax cost. A refund could be possible if you file your income tax return for the current year. However, be careful about how you approach the tax return.

In any financial decision, you should be aware of the facts. Calculators are readily available to help you determine how much withholding allowances are required to be claimed. You may also talk to an expert.

Specifications that must be filed

If you’re an employer, you have to collect and report withholding taxes from your employees. You can submit paperwork to the IRS for some of these taxes. You may also need additional forms that you might need, such as an annual tax return, or a withholding reconciliation. Here’s a brief overview of the different tax forms and the time when they should be filed.

Withholding tax returns may be required to prove income such as bonuses, salary or commissions as well as other earnings. In addition, if you pay your employees in time, you may be eligible for reimbursement of taxes that you withheld. Be aware that these taxes could be considered as taxation by the county. Additionally, there are unique withholding practices that can be used in certain conditions.

Electronic submission of withholding forms is mandatory according to IRS regulations. Your Federal Employer identification number should be listed when you point to your tax return for the nation. If you don’t, you risk facing consequences.