Filling California State Withholding Form – There are many reasons an individual might want to fill out a withholding form. These factors include the document requirements, exclusions from withholding as well as the withholding allowances. It doesn’t matter what reason someone chooses to file the Form, there are several aspects to keep in mind.

Withholding exemptions

Non-resident aliens must complete Form 1040-NR every year. However, if your requirements meet, you may be eligible to request an exemption from withholding. The following page lists all exemptions.

The first step in submitting Form 1040 – NR is to attach Form 1042 S. The form lists the amount that is withheld by the tax authorities for federal tax reporting for tax reporting purposes. Make sure you enter the correct information when you fill out the form. If the correct information isn’t given, a person could be taken into custody.

The rate of withholding for non-resident aliens is 30%. An exemption from withholding may be available if you have an income tax burden of less than 30 percent. There are numerous exemptions. Some of them are intended for spouses, while others are intended for use by dependents such as children.

Generally, withholding under Chapter 4 gives you the right to an amount of money back. Refunds are permitted under Sections 1471-1474. The refunds are made to the tax agent withholding, the person who withholds taxes from the source.

relationship status

You and your spouse’s work will be made easy with a valid marriage status withholding form. Furthermore, the amount of money you may deposit at the bank could surprise you. Knowing which of the many options you’re likely to pick is the tough part. Certain aspects should be avoided. Unwise decisions could lead to costly negative consequences. If you stick to the guidelines and keep your eyes open for any pitfalls, you won’t have problems. If you’re lucky, you may even make new acquaintances while you travel. Today marks the anniversary. I’m hoping you can use it against them to find that perfect engagement ring. It’s a complex job that requires the knowledge of a tax professional. The small amount of money you pay is enough to last the life of your wealth. There is a wealth of information online. TaxSlayer is one of the most trusted and reputable tax preparation firms.

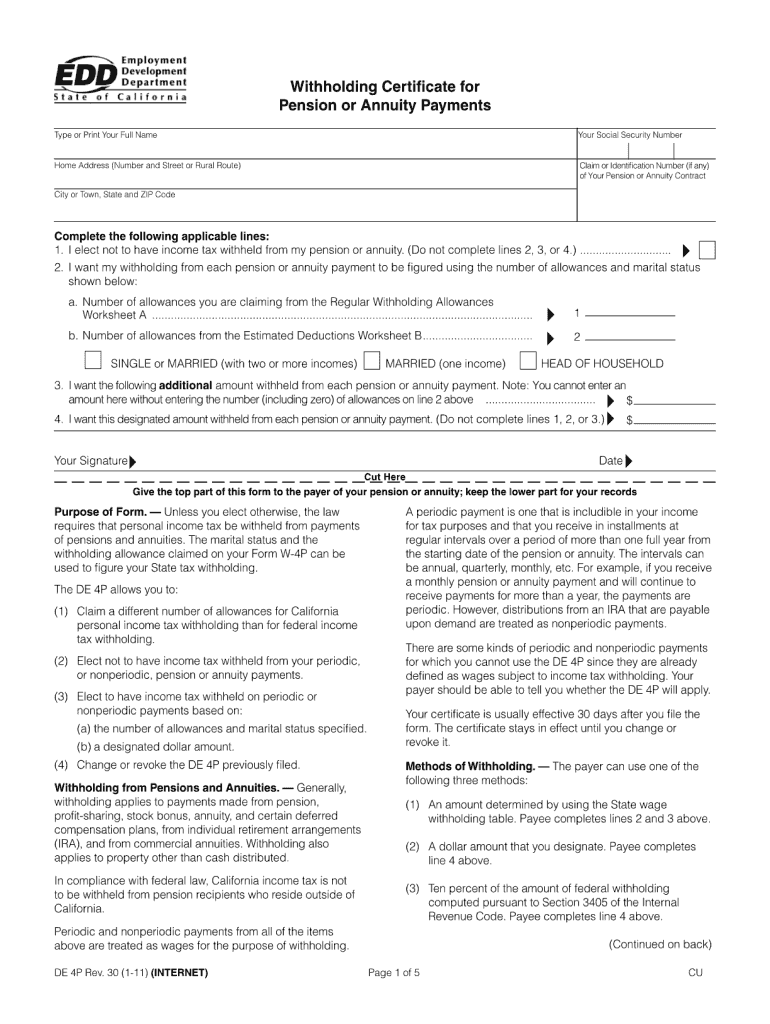

Number of claimed withholding allowances

The W-4 form must be filled out with the number of withholding allowances that you want to claim. This is essential since the tax amount withdrawn from your paychecks will be affected by the you withhold.

A number of factors can determine the amount that you can claim for allowances. Your income level also affects how much allowances you’re qualified to receive. You can apply for a greater allowance if you earn a significant amount of money.

A tax deduction that is suitable for you can aid you in avoiding large tax payments. In addition, you could be eligible for a refund when your annual income tax return is filed. It is essential to choose the right approach.

Just like with any financial decision it is essential to do your homework. To figure out the amount of withholding allowances that need to be claimed, utilize calculators. An alternative is to speak with a specialist.

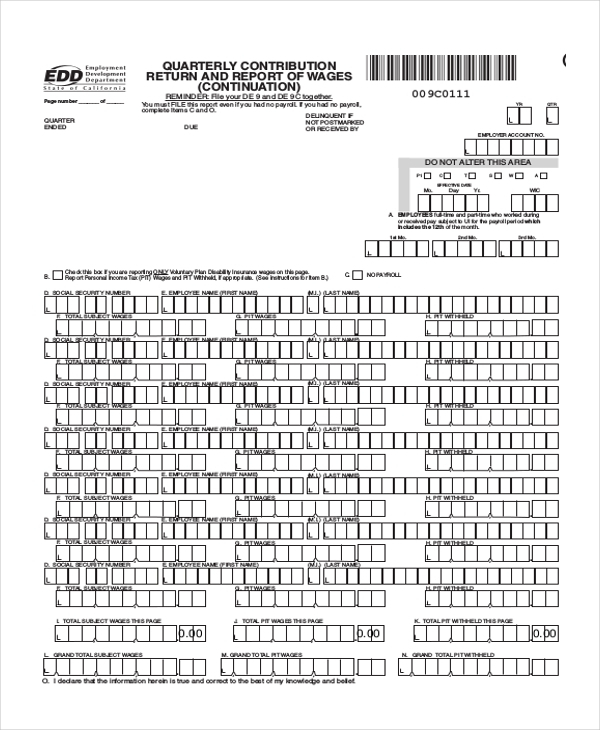

Formulating specifications

Employers must report any withholding tax that is being taken from employees. For some taxes you might need to submit documentation to IRS. A tax reconciliation for withholding and an annual tax return for quarterly filing, or an annual tax return are examples of additional documents you could have to file. Here’s some information about the various tax forms and when they need to be submitted.

The bonuses, salary commissions, other income that you receive from employees might require you to file tax returns withholding. If you make sure that your employees are paid on time, you may be eligible for the reimbursement of taxes withheld. It is crucial to remember that not all of these taxes are local taxes. Additionally, there are unique withholding practices that can be used in certain circumstances.

As per IRS regulations the IRS regulations, electronic filing of forms for withholding are required. Your Federal Employer identification number should be listed when you point at your national tax return. If you don’t, you risk facing consequences.